Walt Disney Unusual Options Activity

Walt Disney Unusual Options Activity

Financial giants have made a conspicuous bearish move on Walt Disney. Our analysis of options history for Walt Disney (NYSE:DIS) revealed 12 unusual trades.

金融巨頭在迪士尼方面採取了顯著的看淡行動。我們對迪士尼(NYSE:DIS)期權歷史的分析顯示,發現了12筆不尋常的交易。

Delving into the details, we found 25% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $200,515, and 7 were calls, valued at $368,284.

深入研究細節後,我們發現25%的交易員看好,而58%的交易員偏向看淡。我們發現的所有交易中,有5個認沽期權,價值爲$200,515,有7個認購期權,價值爲$368,284。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $84.0 to $100.0 for Walt Disney over the recent three months.

根據交易活動來看,相當多的投資者在近3個月中瞄準了迪士尼股價區間,該區間在$84.0至$100.0之間。

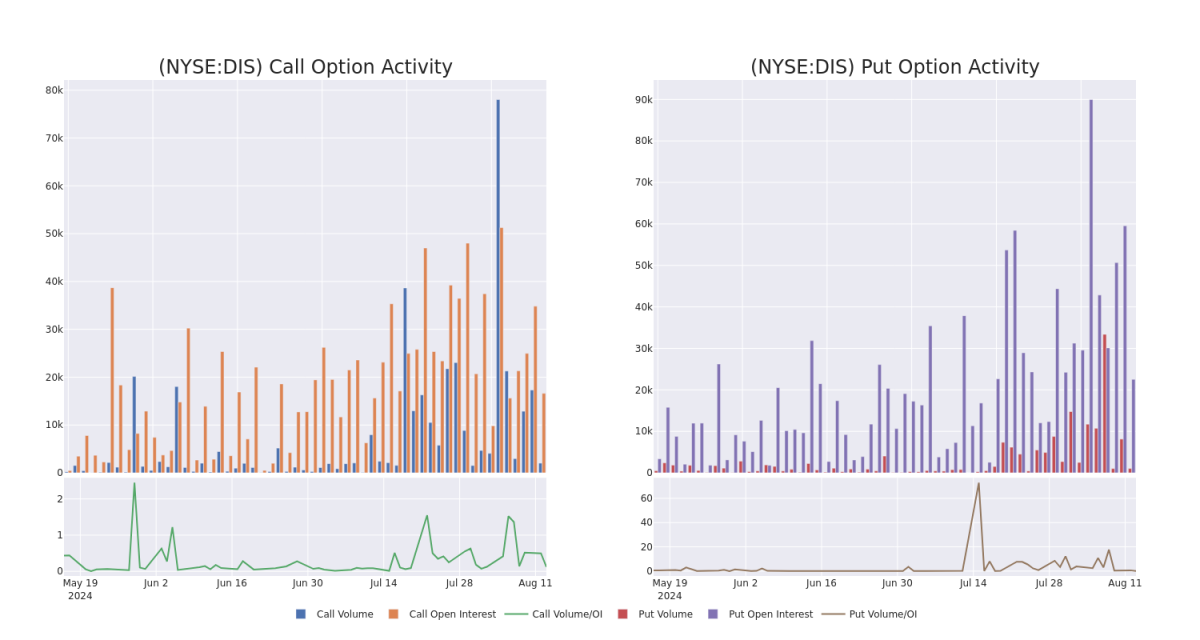

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $84.0 to $100.0 in the last 30 days.

在期權交易中,查看成交量和未平倉合約的強項。這些數據可幫助您追蹤特定行權價格下迪士尼期權的流動性和興趣度。下面,我們可以分別觀察所有迪士尼鯨魚交易中,在$84.0至$100.0的行權價格區間內的認購期權和認沽期權的成交量和未平倉合約隨時間的演變情況。

Walt Disney 30-Day Option Volume & Interest Snapshot

迪士尼30天期權成交量和利益快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | NEUTRAL | 12/18/26 | $11.75 | $11.3 | $11.75 | $100.00 | $117.5K | 844 | 46 |

| DIS | CALL | TRADE | BEARISH | 12/18/26 | $12.0 | $11.75 | $11.75 | $100.00 | $49.3K | 844 | 42 |

| DIS | CALL | TRADE | BEARISH | 09/20/24 | $3.3 | $3.25 | $3.25 | $85.00 | $48.7K | 2.7K | 192 |

| DIS | PUT | SWEEP | NEUTRAL | 09/20/24 | $9.7 | $9.5 | $9.6 | $95.00 | $48.0K | 8.5K | 297 |

| DIS | PUT | TRADE | BEARISH | 09/20/24 | $9.5 | $9.25 | $9.5 | $95.00 | $47.5K | 8.5K | 152 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 項目8.01 | 看漲 | SWEEP | 中立 | 12/18/26 | 11.75美元 | $11.3 | 11.75美元 | $100.00。 | $117.5K | 844 | 46 |

| 項目8.01 | 看漲 | 交易 | 看淡 | 12/18/26 | $12.0 | 11.75美元 | 11.75美元 | $100.00。 | $49.3K | 844 | 42 |

| 項目8.01 | 看漲 | 交易 | 看淡 | 09/20/24 | $3.3 | $3.25 | $3.25 | $85.00 | $48.7K | 2.7K | 192 |

| 項目8.01 | 看跌 | SWEEP | 中立 | 09/20/24 | 9.7 | $9.5 | 9.6 | $ 95.00 | $48.0千 | 8.5千 | 297 |

| 項目8.01 | 看跌 | 交易 | 看淡 | 09/20/24 | $9.5 | 9.25美元 | $9.5 | $ 95.00 | $47.5K | 8.5千 | 152 |

About Walt Disney

關於迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼分爲三個全球業務板塊:娛樂、體育和體驗。娛樂和體驗都受益於公司一世紀以來創造的特許經營權和角色。娛樂包括ABC廣播網絡、幾個有線電視網絡、迪士尼+和Hulu流媒體服務。在這個板塊中,迪士尼還進行電影和電視製作和分銷,將內容授權給電影院、其他內容提供商,或者越來越多地在自己的流媒體平台和電視網絡內使用。體育板塊包括ESPN和ESPN+流媒體服務。體驗包括迪士尼的主題公園和度假勝地,還受益於商品授權。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對迪士尼周邊期權交易進行全面審查後,我們開始對公司進行更詳細的評估。這包括對迪士尼當前市場地位和表現的評估。

Current Position of Walt Disney

華特迪士尼公司的當前位置

- With a trading volume of 1,627,179, the price of DIS is down by -0.56%, reaching $85.47.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 85 days from now.

- 根據成交量和未平倉合約的數據來看,DIS的交易量爲1,627,179股,下跌了-0.56%,達到$85.47。

- 當前RSI指標表明該股可能被超賣。

- 下一份業績將於85天后發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

期權交易存在較高的風險和潛在回報。精明的交易員通過不斷地自我教育、調整策略、監控多個因子、密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報及時了解最新的華特迪士尼期權交易。