Market Mover | Sea Shares Surge 8% After Q2 Earnings Result

Market Mover | Sea Shares Surge 8% After Q2 Earnings Result

August 13, 2024 - $Sea (SE.US)$ shares surged 8.23% to $72.429 on Tuesday. The company today announced its financial results for the second quarter ended June 30, 2024.

2024年8月13日 - $Sea (SE.US)$ 公司股價在週二大漲8.23%,爲72.429美元。目前公司公佈了截至2024年6月30日的第二季度業績。

Q2 Highlights by Segments

Q2業績要點按部門分類

Group

集團

Total GAAP revenue was US$3.8 billion, up 23.0% year-on-year.

Total gross profit was US$1.6 billion, up 9.2% year-on-year.

Total net income was US$79.9 million, as compared to total net income of US$331.0 million for the second quarter of 2023.

Total adjusted EBITDA1 was US$448.5 million, as compared to US$510.0 million for the second quarter of 2023.

As of June 30, 2024, cash, cash equivalents, short-term investments, and other treasury investments2 were US$9.0 billion, representing a net increase of US$364.7 million from March 31, 2024.

總GAAP營業收入爲38億美元,同比增長23.0%。

總毛利潤爲16億美元,同比增長9.2%。

總淨利潤爲7990萬美元,較2023年第二季度的33100萬美元淨利潤有所下降。

總調整後的EBITDA1爲44850萬美元,較2023年第二季度的51000萬美元有所下降。

截至2024年6月30日,現金、現金等價物、短期投資和其他貨幣市場工具2總額爲90億美元,相較於2024年3月31日增加了36470萬美元。

E-commerce

電子商務業務

Gross orders totaled 2.5 billion for the quarter, increasing by 40.3% year-on-year.

GMV was US$23.3 billion for the quarter, increasing by 29.1% year-on-year.

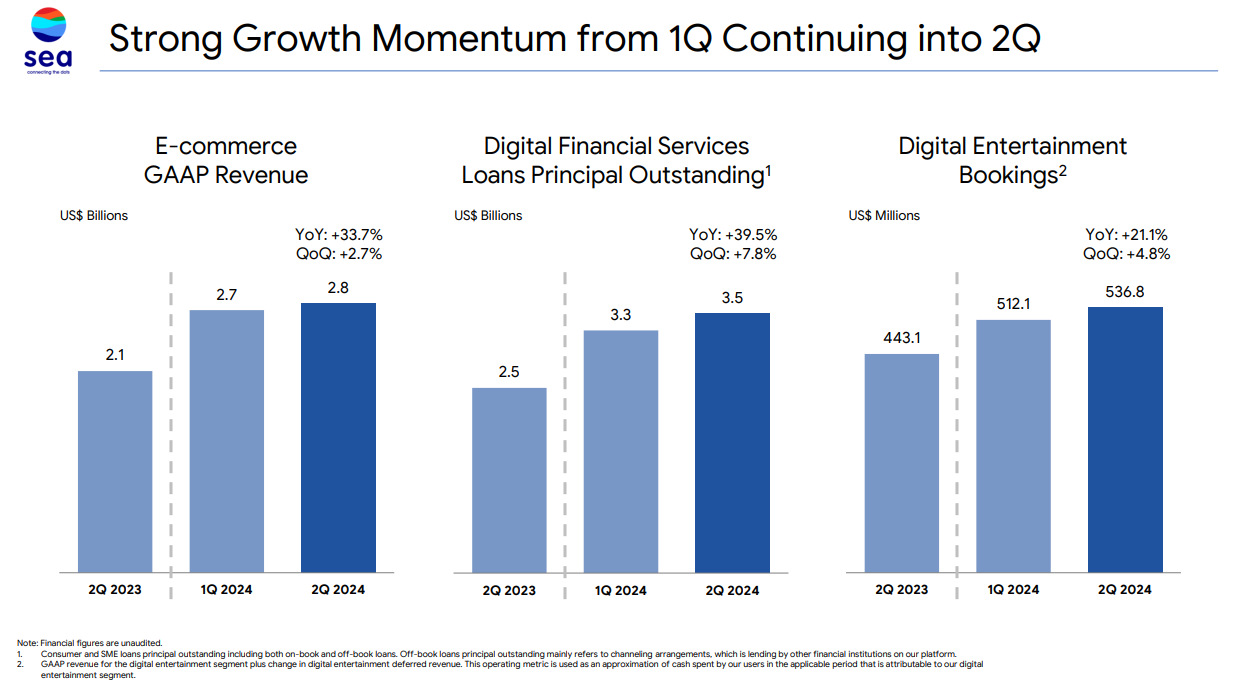

GAAP revenue was US$2.8 billion, up 33.7% year-on-year.

GAAP revenue included US$2.5 billion of GAAP marketplace revenue, which consists of core marketplace revenue and value-added services revenue and increased by 32.7% year-on-year.

Adjusted EBITDA1 was US$(9.2) million, as compared to US$150.3 million for the second quarter of 2023.

本季度總毛訂單數量爲25億,同比增長40.3%。

本季度GMV爲233億美元,同比增長29.1%。

GAAP營業收入爲28億美元,同比增長33.7%。

GAAP營業收入包含25億美元的GAAP市場收入,其中包括核心市場收入和附加值服務收入,同比增長32.7%。

調整後的EBITDA1爲(92萬)美元,較2023年第二季度的15030萬美元有所下降。

Digital Financial Services

數字金融服務業務

GAAP revenue was US$519.3 million, up 21.4% year-on-year.

Adjusted EBITDA1 was US$164.7 million, up 20.2% year-on-year.

Digital financial services revenue and operating income are primarily attributed to the consumer and SME credit business. As of June 30, 2024, consumer and SME loans principal outstanding was US$3.5 billion, up 39.5% year-on-year. This consists of US$2.9 billion on-book and US$0.7 billion off-book loans principal outstanding.

-

Non-performing loans past due by more than 90 days as a percentage of consumer and SME loans principal outstanding, which includes both on-book and off-book loans principal outstanding4 , was 1.3%, a slight improvement quarter-on-quarter.

GAAP營業收入爲51930萬美元,同比增長21.4%。

調整後的EBITDA1爲16470萬美元,同比增長20.2%。

數字金融服務收入和運營收入主要歸因於消費者和中小板信貸業務。截至2024年6月30日,消費者和中小板貸款本金餘額爲35億美元,同比增長39.5%。其中包括29億美元的在帳戶外和7億美元的在帳戶內的貸款本金餘額。

-

逾期超過90天的不良貸款佔消費者和中小板貸款本金餘額的比例(包括在帳戶內和在帳戶外的貸款本金餘額4),爲1.3%,環比略有改善。

Digital Entertainment

數字娛樂業務

Bookings5 were US$536.8 million, up 21.1% year-on-year.

GAAP revenue was US$435.6 million, as compared to US$529.4 million for the second quarter of 2023.

Adjusted EBITDA1 was US$302.8 million, up 26.5% year-on-year.

Adjusted EBITDA represented 56.4% of bookings for the second quarter of 2024, as compared to 54.0% for the second quarter of 2023.

Quarterly active users were 648.0 million, up 19.0% year-on-year. o Quarterly paying users were 52.5 million, up 21.7% year-on-year. Paying user ratio was 8.1%, as compared to 7.9% for the second quarter of 2023.

Average bookings per user were US$0.83, as compared to US$0.81 for the second quarter of 2023.

預訂額達到5.368億美元,同比增長21.1%。

根據GAAP標準,營業收入爲4.356億美元,比2023年第二季度的5.294億美元下降。

調整後的EBITDA1爲3.028億美元,同比增長26.5%。

調整後的EBITDA佔2024年第二季度預訂額的56.4%,而2023年第二季度爲54.0%。

季度活躍用戶數爲6,480萬,同比增長19.0%。季度付費用戶數爲5250萬,同比增長21.7%。付費用戶比率爲8.1%,而2023年第二季度爲7.9%。

每用戶平均預訂額爲0.83美元,而2023年第二季度爲0.81美元。

“I’m happy to report that it has been a solid quarter for us, with our strong momentum from Q1 continuing into Q2. All three of our businesses have shown both strong growth and higher profitability,” said Forrest Li, Sea’s Chairman and Chief Executive Officer.

「我很高興地報告,這對我們來說是一個穩健的季度,我們一季度的強勁勢頭持續到二季度。我們的三個業務都顯示出強勁的增長和更高的盈利能力,」Sea的董事長兼首席執行官Forrest Li說。

On Shopee’s 2024 outlook, he said “With the strong results delivered in the first half and our outlook for the rest of the year, we expect that Shopee will become adjusted EBITDA positive from the third quarter. We are also revising up our guidance for Shopee’s 2024 full year GMV growth to mid-20%.”

關於Shopee的2024年展望,他說:「在上半年取得的強勁成績以及我們對今年餘下時間的展望中,我們預計Shopee將從第三季度開始實現調整後的EBITDA盈利。我們還將調高Shopee 2024年全年GMV增長的指導至中低20%。」

Related Reading: Press Release

相關閱讀:新聞發佈