What the Options Market Tells Us About Intuit

What the Options Market Tells Us About Intuit

Investors with significant funds have taken a bullish position in Intuit (NASDAQ:INTU), a development that retail traders should be aware of.

擁有大量資金的投資者對Intuit(納斯達克股票代碼:INTU)持看漲立場,零售交易者應該注意這一事態發展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in INTU usually indicates foreknowledge of upcoming events.

今天,通過對本辛加可公開訪問的期權數據的監控,這引起了我們的注意。這些投資者的確切性質仍然是個謎,但是INTU的如此重大舉動通常表明對即將發生的事件的預感。

Today, Benzinga's options scanner identified 11 options transactions for Intuit. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 45% being bullish and 27% bearish. Of all the options we discovered, 10 are puts, valued at $583,662, and there was a single call, worth $172,500.

今天,Benzinga的期權掃描儀爲Intuit確定了11筆期權交易。這是一種不尋常的事件。這些大型交易者的情緒喜憂參半,45%看漲,27%看跌。在我們發現的所有期權中,有10個是看跌期權,價值583,662美元,還有一個看漲期權,價值172,500美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $600.0 to $670.0 for Intuit during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Intuit在過去一個季度中從600.0美元到670.0美元的價格窗口。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

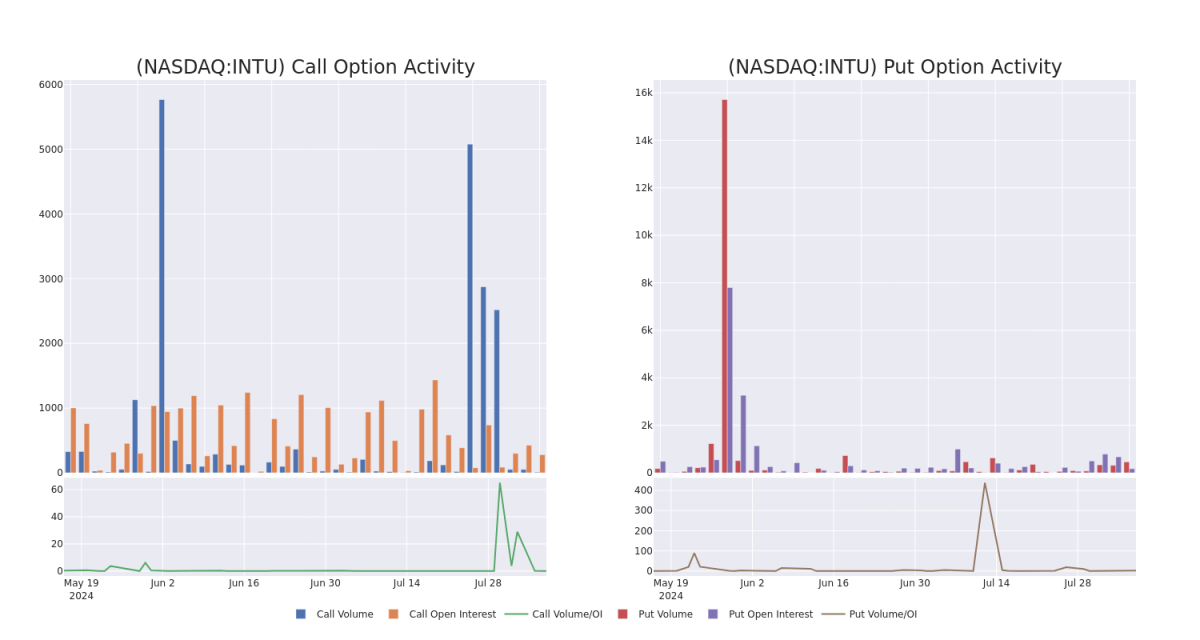

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intuit's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intuit's significant trades, within a strike price range of $600.0 to $670.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Intuit期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月Intuit重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲600.0美元至670.0美元。

Intuit Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Intuit 期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | TRADE | BULLISH | 09/20/24 | $57.5 | $56.7 | $57.5 | $600.00 | $172.5K | 293 | 0 |

| INTU | PUT | SWEEP | BEARISH | 12/20/24 | $51.1 | $50.6 | $50.8 | $650.00 | $81.2K | 45 | 17 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $51.1 | $50.5 | $50.8 | $650.00 | $71.1K | 45 | 126 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $50.7 | $50.0 | $50.4 | $650.00 | $70.5K | 45 | 98 |

| INTU | PUT | TRADE | BEARISH | 12/20/24 | $50.4 | $49.9 | $50.2 | $650.00 | $70.2K | 45 | 140 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | 打電話 | 貿易 | 看漲 | 09/20/24 | 57.5 美元 | 56.7 美元 | 57.5 美元 | 600.00 美元 | 172.5 萬美元 | 293 | 0 |

| INTU | 放 | 掃 | 粗魯的 | 12/20/24 | 51.1 美元 | 50.6 美元 | 50.8 美元 | 650.00 美元 | 81.2 萬美元 | 45 | 17 |

| INTU | 放 | 貿易 | 中立 | 12/20/24 | 51.1 美元 | 50.5 美元 | 50.8 美元 | 650.00 美元 | 71.1 萬美元 | 45 | 126 |

| INTU | 放 | 貿易 | 中立 | 12/20/24 | 50.7 美元 | 50.0 美元 | 50.4 美元 | 650.00 美元 | 70.5 萬美元 | 45 | 98 |

| INTU | 放 | 貿易 | 粗魯的 | 12/20/24 | 50.4 美元 | 49.9 美元 | 50.2 美元 | 650.00 美元 | 70.2 萬美元 | 45 | 140 |

About Intuit

關於 Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Intuit是小型企業會計軟件(QuickBooks)、個人稅務解決方案(TurboTax)和專業稅收服務(Lacerte)的提供商。Intuit 成立於 20 世紀 80 年代中期,控制着美國小型企業會計和自己動手報稅軟件的大部分市場份額。

Following our analysis of the options activities associated with Intuit, we pivot to a closer look at the company's own performance.

在分析了與Intuit相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Present Market Standing of Intuit

Intuit 目前的市場地位

- With a trading volume of 306,872, the price of INTU is up by 2.25%, reaching $641.51.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 9 days from now.

- INTU的交易量爲306,872美元,上漲了2.25%,達到641.51美元。

- 當前的RSI值表明,該股目前在超買和超賣之間處於中立狀態。

- 下一份收益報告定於9天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。