Shopify's Options Frenzy: What You Need to Know

Shopify's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Shopify (NYSE:SHOP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

深度資金投資者對Shopify(紐交所:SHOP)採取了看好的態度,這是市場參與者不應忽視的事情。我們在Benzinga追蹤的公開期權記錄中揭示了這個重要的舉動。這些投資者的身份仍然是未知的,但是在SHOP中採取這樣的實質性舉動通常意味着即將發生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

今天我們從觀察中得知,Benzinga的期權掃描器突出了13起Shopify非凡的期權交易活動。這種活躍程度是不尋常的。

The general mood among these heavyweight investors is divided, with 53% leaning bullish and 38% bearish. Among these notable options, 4 are puts, totaling $371,912, and 9 are calls, amounting to $792,427.

這些重量級投資者中,53%看好,38%看淡。在這些值得關注的期權交易中,有4個看跌,總額371,912美元,9個看漲,總額792,427美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $57.0 and $120.0 for Shopify, spanning the last three months.

經評估,根據成交量和未平倉合約,Major Market Movers正在關注Shopify的價格區間,即57.0到120.0美元之間,這跨越了過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

In terms of liquidity and interest, the mean open interest for Shopify options trades today is 3441.45 with a total volume of 3,665.00.

就流動性和利潤而言,Shopify期權交易的平均未平倉合約爲3441.45,總成交量爲3,665.00。

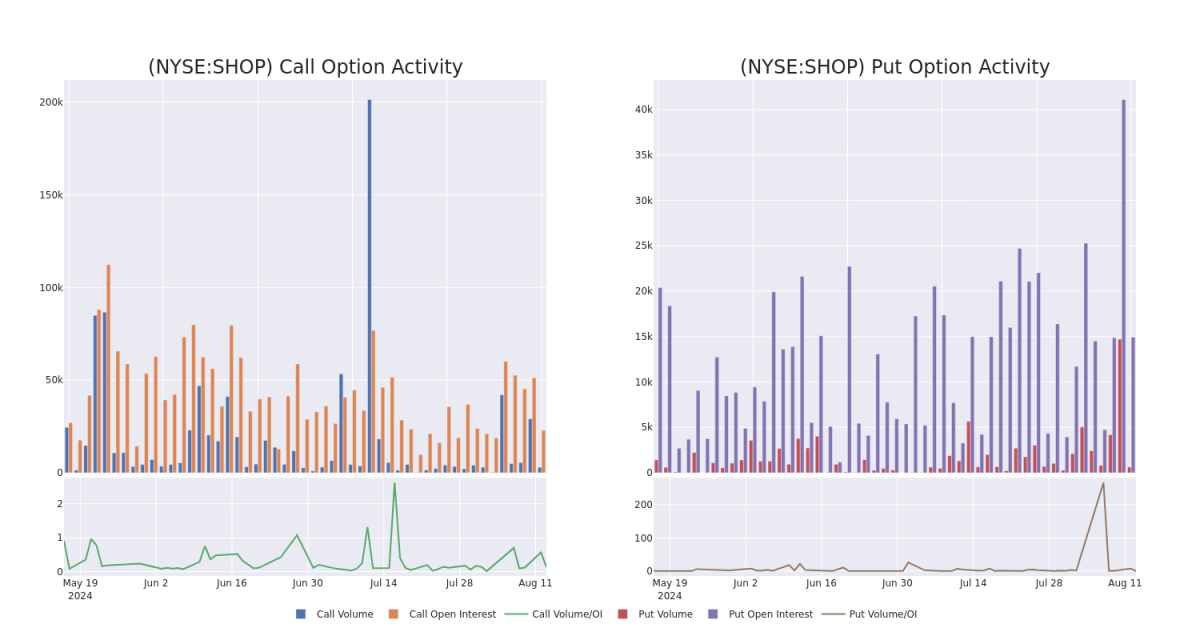

In the following chart, we are able to follow the development of volume and open interest of call and put options for Shopify's big money trades within a strike price range of $57.0 to $120.0 over the last 30 days.

在以下圖表中,我們可以跟蹤Shopify大額期權交易中看漲和看跌期權的成交量和未平倉合約的發展情況,在57.0到120.0美元的執行價格範圍內,持續30天。

Shopify 30-Day Option Volume & Interest Snapshot

Shopify 30天期權成交量和持倉量簡介

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | BULLISH | 03/21/25 | $5.5 | $5.35 | $5.5 | $85.00 | $440.0K | 833 | 800 |

| SHOP | PUT | TRADE | BULLISH | 06/20/25 | $6.45 | $6.3 | $6.35 | $60.00 | $139.0K | 2.0K | 219 |

| SHOP | PUT | TRADE | BEARISH | 06/20/25 | $8.7 | $8.65 | $8.7 | $65.00 | $104.4K | 2.4K | 0 |

| SHOP | PUT | SWEEP | BULLISH | 10/18/24 | $4.25 | $4.15 | $4.2 | $70.00 | $75.1K | 1.5K | 261 |

| SHOP | CALL | SWEEP | BEARISH | 09/06/24 | $13.2 | $13.1 | $13.2 | $57.00 | $66.0K | 197 | 50 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | 看漲 | 交易 | 看好 | 03/21/25 | $5.5 | $5.35 | $5.5 | $85.00 | $440.0K | 833 | 800 |

| SHOP | 看跌 | 交易 | 看好 | 06/20/25 | $6.45 | $6.3 | $ 6.35 | $60.00 | $139.0K | 2.0K | 219 |

| SHOP | 看跌 | 交易 | 看淡 | 06/20/25 | $8.7 | $ 8.65 | $8.7 | $65.00 | $104.4K | 2.4K | 0 |

| SHOP | 看跌 | SWEEP | 看好 | 10/18/24 | $4.25 | $4.15 | $4.2 | 70.00美元 | $75.1K | 1.5K | 261 |

| SHOP | 看漲 | SWEEP | 看淡 | 09/06/24 | $13.2 | $13.1 | $13.2 | 57.00美元 | $66.0K | 197 | 50 |

About Shopify

關於shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify主要爲中小型企業提供電子商務平台。該公司共有兩個部分。訂閱解決方案部分允許Shopify商家在包括該公司網站、實體店、彈出式店鋪、亭子、社交網絡(Facebook)和亞馬遜等各種平台上進行電子商務。商家解決方案部分爲該平台提供了促進電子商務的附加產品,包括Shopify支付、Shopify運送和Shopify資本。

After a thorough review of the options trading surrounding Shopify, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面審查Shopify期權交易之後,我們繼續深入探討該公司。這包括對其當前市場地位和業績的評估。

Current Position of Shopify

Shopify的現狀

- With a volume of 3,474,755, the price of SHOP is up 2.2% at $69.81.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 79 days.

- SHOP的成交量爲3,474,755,價格漲幅爲2.2%,報69.81美元。

- RSI指標暗示該股票可能要超買了。

- 下一個業績預計將在79天內發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Shopify options trades with real-time alerts from Benzinga Pro.

期權交易具有較高的風險和潛在回報。精明的交易員通過不斷學習,調整策略,監控多個因子,並密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,了解最新的Shopify期權交易信息。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $57.0 and $120.0 for Shopify, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $57.0 and $120.0 for Shopify, spanning the last three months.