Decoding PayPal Holdings's Options Activity: What's the Big Picture?

Decoding PayPal Holdings's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on PayPal Holdings (NASDAQ:PYPL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PYPL often signals that someone has privileged information.

高額投資者已將自己定位爲看好PayPal Holdings(納斯達克股票代碼:PYPL),散戶交易者注意這一點很重要。\ 這項活動今天通過Benzinga對公開期權數據的追蹤引起了我們的注意。這些投資者的身份尚不確定,但是PYPL的如此重大舉措通常表明有人擁有特權信息。

Today, Benzinga's options scanner spotted 12 options trades for PayPal Holdings. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現了PayPal Holdings的12筆期權交易。這不是典型的模式。

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $27,250, and 11 calls, totaling $6,988,218.

這些主要交易者的情緒分歧,50%看漲,50%看跌。在我們確定的所有期權中,有一個看跌期權,金額爲27,250美元,還有11個看漲期權,總額爲6,988,218美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $62.5 and $80.0 for PayPal Holdings, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月的PayPal Holdings62.5美元至80.0美元之間的價格區間。

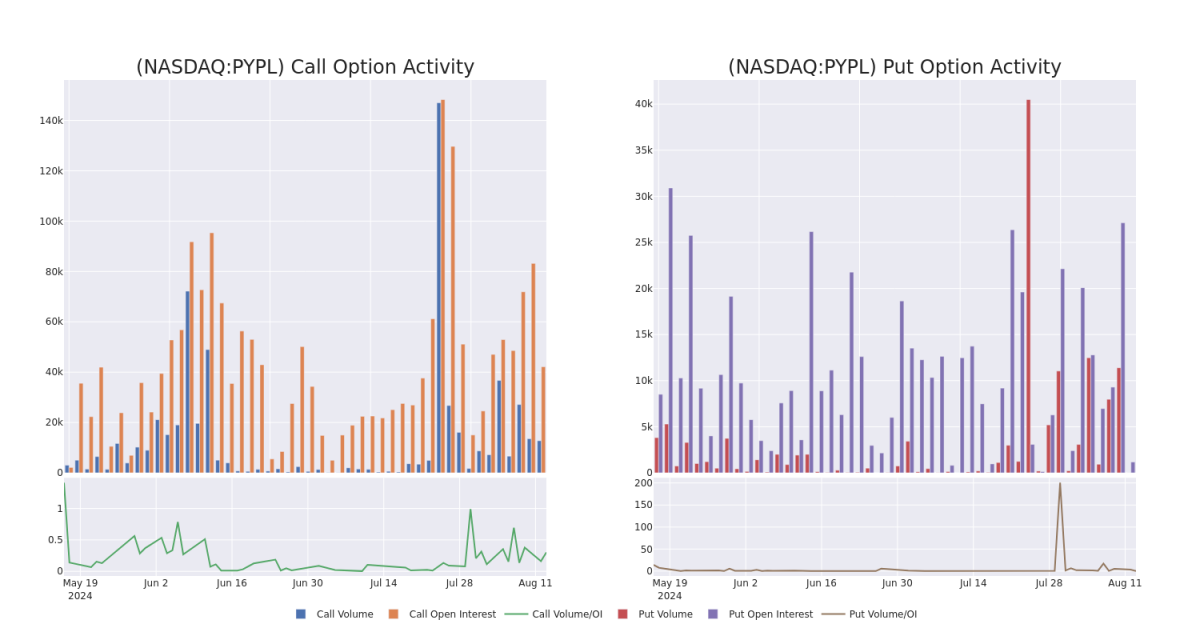

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PayPal Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PayPal Holdings's substantial trades, within a strike price spectrum from $62.5 to $80.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了PayPal Holdings期權在指定行使價下的流動性和投資者對該期權的興趣。即將發佈的數據可視化了與PayPal Holdings的大量交易相關的看漲期權和未平倉合約的交易量和未平倉合約的波動,在過去30天內,行使價範圍從62.5美元到80.0美元不等。

PayPal Holdings Option Activity Analysis: Last 30 Days

PayPal Holdings 期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $18.25 | $17.6 | $18.0 | $65.00 | $5.3M | 13.0K | 40 |

| PYPL | CALL | TRADE | BULLISH | 11/15/24 | $3.35 | $3.25 | $3.31 | $70.00 | $1.1M | 1.3K | 3.5K |

| PYPL | CALL | SWEEP | BEARISH | 09/20/24 | $1.59 | $1.58 | $1.59 | $67.50 | $187.7K | 8.5K | 3.4K |

| PYPL | CALL | SWEEP | BEARISH | 09/06/24 | $0.5 | $0.49 | $0.49 | $70.00 | $81.4K | 449 | 1.6K |

| PYPL | CALL | SWEEP | BEARISH | 12/19/25 | $8.25 | $7.0 | $8.2 | $77.50 | $58.2K | 239 | 72 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 打電話 | 貿易 | 看漲 | 12/18/26 | 18.25 美元 | 17.6 美元 | 18.0 美元 | 65.00 美元 | 530 萬美元 | 13.0K | 40 |

| PYPL | 打電話 | 貿易 | 看漲 | 11/15/24 | 3.35 美元 | 3.25 | 3.31 | 70.00 美元 | 110 萬美元 | 1.3K | 3.5K |

| PYPL | 打電話 | 掃 | 粗魯的 | 09/20/24 | 1.59 | 1.58 美元 | 1.59 | 67.50 美元 | 187.7 萬美元 | 8.5K | 3.4K |

| PYPL | 打電話 | 掃 | 粗魯的 | 09/06/24 | 0.5 美元 | 0.49 美元 | 0.49 美元 | 70.00 美元 | 81.4 萬美元 | 449 | 1.6K |

| PYPL | 打電話 | 掃 | 粗魯的 | 12/19/25 | 8.25 美元 | 7.0 美元 | 8.2 美元 | 77.50 美元 | 58.2 萬美元 | 239 | 72 |

About PayPal Holdings

關於 PayPal 控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal於2015年從eBay分拆出來,爲商家和消費者提供電子支付解決方案,重點是在線交易。截至2023年底,該公司擁有4.26億個活躍帳戶。該公司還擁有人對人支付平台Venmo。

In light of the recent options history for PayPal Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於PayPal Holdings最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Current Position of PayPal Holdings

PayPal控股公司目前的狀況

- Trading volume stands at 2,760,693, with PYPL's price up by 2.71%, positioned at $65.18.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 78 days.

- 交易量爲2760,693美元,其中PYPL的價格上漲了2.71%,爲65.18美元。

- RSI指標顯示該股可能接近超買。

- 預計將在78天后公佈業績。

Professional Analyst Ratings for PayPal Holdings

PayPal控股的專業分析師評級

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $78.6.

在過去的30天中,共有5位專業分析師對該股發表了看法,將平均目標股價設定爲78.6美元。

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on PayPal Holdings with a target price of $85.

- An analyst from Baird persists with their Outperform rating on PayPal Holdings, maintaining a target price of $80.

- An analyst from Canaccord Genuity has decided to maintain their Buy rating on PayPal Holdings, which currently sits at a price target of $80.

- In a positive move, an analyst from Bernstein has upgraded their rating to Outperform and adjusted the price target to $78.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Hold rating for PayPal Holdings, targeting a price of $70.

- 巴克萊銀行的一位分析師在評估中保持對PayPal Holdings的增持評級,目標價爲85美元。

- 貝爾德的一位分析師堅持對PayPal Holdings的跑贏大盤評級,將目標價維持在80美元。

- Canaccord Genuity的一位分析師已決定維持對PayPal Holdings的買入評級,該評級目前的目標股價爲80美元。

- 伯恩斯坦的一位分析師將其評級上調至跑贏大盤,並將目標股價調整至78美元,這是一個積極的舉動。

- 道明考恩的一位分析師堅持自己的立場,繼續維持PayPal控股的持有評級,目標價格爲70美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。