Smart Money Is Betting Big In MRNA Options

Smart Money Is Betting Big In MRNA Options

Financial giants have made a conspicuous bearish move on Moderna. Our analysis of options history for Moderna (NASDAQ:MRNA) revealed 13 unusual trades.

金融巨頭在Moderna上做空了,我們分析了Moderna(NASDAQ:MRNA)的期權歷史,發現了13筆異常交易。

Delving into the details, we found 7% of traders were bullish, while 76% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $385,463, and 8 were calls, valued at $299,598.

具體來看,我們發現7%的交易者看多,而76%的交易者看空。在所有我們發現的交易中,有5筆爲看跌期權,總價值383,463美元,有8筆爲看漲期權,總價值299,598美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $200.0 for Moderna, spanning the last three months.

經過對成交量和未平倉合約的評估,很明顯主要的市場動向集中在65.0美元至200.0美元之間的價格區間內,涵蓋了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

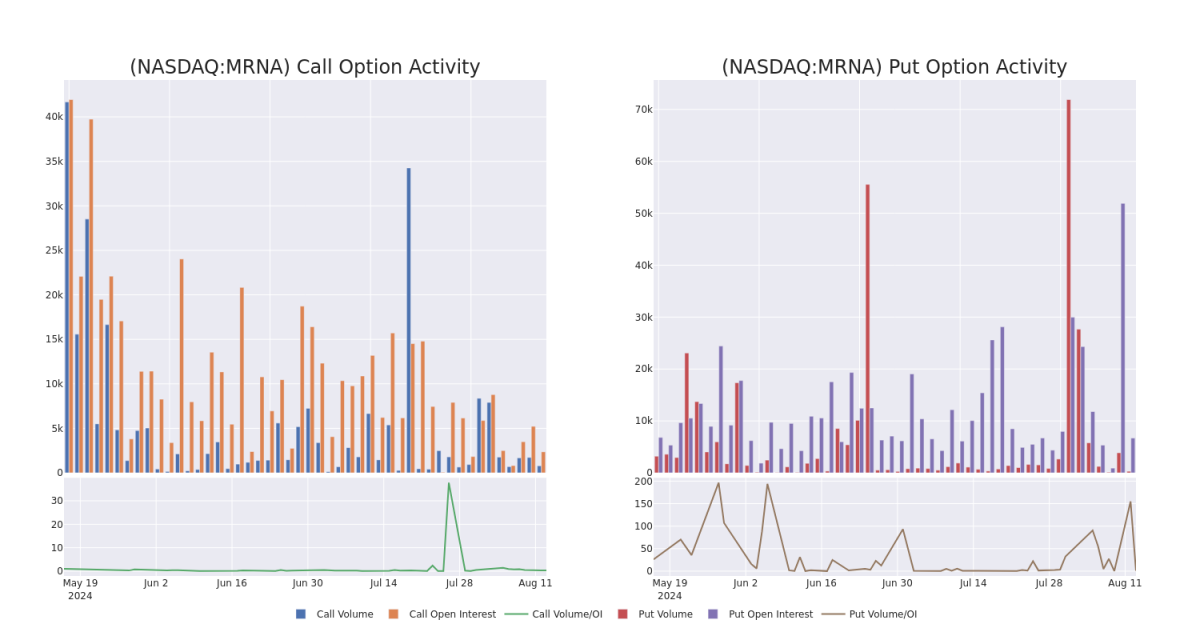

In terms of liquidity and interest, the mean open interest for Moderna options trades today is 822.27 with a total volume of 1,051.00.

就流動性和利益而言,今天Moderna期權交易的平均未平倉合約爲822.27,總成交量爲1,051.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Moderna's big money trades within a strike price range of $65.0 to $200.0 over the last 30 days.

在下面的圖表中,我們可以追蹤過去30天內Moderna大手交易看跌和看漲期權的成交量和未平倉合約的發展情況,在65.0美元至200.0美元的行權價格範圍內。

Moderna Option Activity Analysis: Last 30 Days

Moderna期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | BEARISH | 11/15/24 | $11.15 | $11.1 | $11.1 | $85.00 | $152.1K | 237 | 139 |

| MRNA | PUT | TRADE | BULLISH | 01/17/25 | $58.6 | $58.2 | $58.2 | $140.00 | $110.5K | 899 | 30 |

| MRNA | CALL | TRADE | BEARISH | 06/20/25 | $9.45 | $9.2 | $9.2 | $110.00 | $61.6K | 220 | 67 |

| MRNA | PUT | SWEEP | BEARISH | 09/20/24 | $10.35 | $10.0 | $10.35 | $90.00 | $53.8K | 2.4K | 52 |

| MRNA | CALL | TRADE | BEARISH | 12/18/26 | $18.15 | $15.4 | $15.4 | $130.00 | $46.2K | 353 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Moderna | 看跌 | SWEEP | 看淡 | 11/15/24 | $11.15 | 11.1美元 | 11.1美元 | $85.00 | $152.1K | 237 | 139 |

| Moderna | 看跌 | 交易 | 看好 | 01/17/25 | 58.6美元 | $58.2 | $58.2 | $140.00 | 110.5K | 899 | 30 |

| Moderna | 看漲 | 交易 | 看淡 | 06/20/25 | 9.45 | $9.2 | $9.2 | $110.00 | $61.6K | 220 | 67 |

| Moderna | 看跌 | SWEEP | 看淡 | 09/20/24 | $10.35 | $10.0 | $10.35 | $90.00 | $53.8K | 2.4K | 52 |

| Moderna | 看漲 | 交易 | 看淡 | 12/18/26 | $18.15 | $15.4 | $15.4 | $130.00 | $46.2千 | 353 | 30 |

About Moderna

關於現代

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Moderna是一家成立於2010年並於2018年12月進行首次公開發行的商業化生物技術公司。該公司的mRNA技術得到了驗證,其COVID-19疫苗在2020年12月獲得美國授權。截至2023年中期,Moderna共有39個mRNA開發候選藥物處於臨床試驗中。這些項目涉及多個治療領域,包括傳染病、腫瘤、心血管疾病和罕見遺傳疾病。

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Moderna的期權交易模式之後,我們現在將注意力直接轉向該公司。這個轉變使我們能夠深入了解它的現在市場地位和表現。

Moderna's Current Market Status

Moderna的當前市場地位

- With a trading volume of 996,645, the price of MRNA is up by 0.59%, reaching $81.77.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 79 days from now.

- MRNA的交易量爲996,645美元,價格上漲了0.59%,達到81.77美元。

- 當前RSI指標表明該股可能被超賣。

- 下一份財務報告將於79天后公佈。

Professional Analyst Ratings for Moderna

Moderna的專業分析師評級

In the last month, 5 experts released ratings on this stock with an average target price of $126.0.

在過去的一個月中,有5位專家發佈了對該股票的評級,平均目標價爲126.0美元。

- An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $90.

- An analyst from Piper Sandler downgraded its action to Overweight with a price target of $157.

- An analyst from RBC Capital persists with their Outperform rating on Moderna, maintaining a target price of $125.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Moderna with a target price of $178.

- Showing optimism, an analyst from Deutsche Bank upgrades its rating to Hold with a revised price target of $80.

- RBC Capital的分析師將其行動下調至板塊持有,目標價爲90美元。

- Piper Sandler的分析師將其行動下調至看漲,目標價爲157美元。

- RBC Capital的分析師仍然堅持對Moderna的跑贏大盤評級,目標價爲125美元。

- 高盛(Goldman Sachs)分析師一致對Moderna給予買入評級,目標價爲178美元。

- 德意志銀行(Deutsche Bank)的分析師看好,將評級升級爲持有,目標價修訂爲80美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Moderna options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。精明的交易者通過不斷自我教育,調整策略,監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro獲得有關最新Moderna期權交易的實時警報,以保持及時了解。