Market Whales and Their Recent Bets on CVX Options

Market Whales and Their Recent Bets on CVX Options

Investors with a lot of money to spend have taken a bearish stance on Chevron (NYSE:CVX).

有大批資金的投資者看淡雪佛龍(紐交所:CVX)。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CVX, it often means somebody knows something is about to happen.

無論這些投資者是機構還是富裕個人,我們都不確定。但當CVX發生這麼大的事情時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 25 uncommon options trades for Chevron.

今天,Benzinga的期權掃描器發現了25個雪佛龍的非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 28% bullish and 48%, bearish.

這些大手交易員的總體情緒在28%看好和48%看淡之間分化。

Out of all of the special options we uncovered, 10 are puts, for a total amount of $1,076,537, and 15 are calls, for a total amount of $707,037.

在我們發現的所有特殊期權中,有10個看跌期權,總金額爲$1,076,537,15個看漲期權,總金額爲$707,037。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $250.0 for Chevron over the last 3 months.

結合這些合同的成交量和未平倉合約量,看起來過去3個月鯨魚一直在將雪佛龍的價格區間定在$75.0到$250.0之間。

Insights into Volume & Open Interest

成交量和持倉量分析

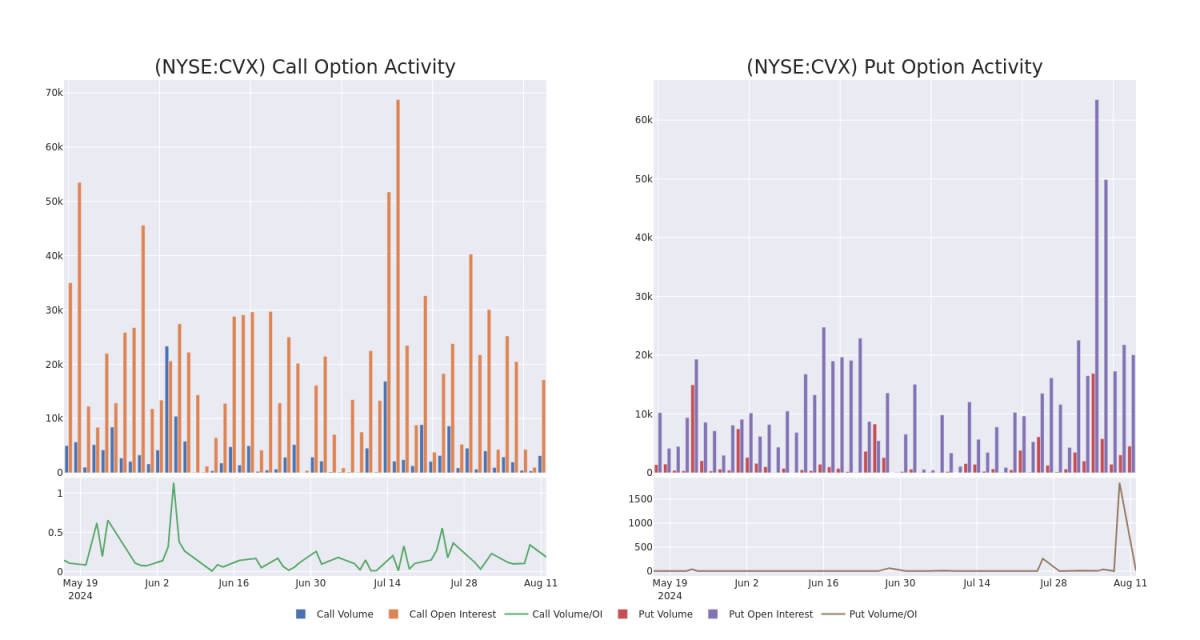

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 2764.0 with a total volume of 9,957.00.

就流動性和利率而言,雪佛龍期權交易的平均未平倉合約量爲2764.0美元,總成交量爲9,957.00美元。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chevron's big money trades within a strike price range of $75.0 to $250.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內針對雪佛龍大手交易的看跌和看漲期權的成交量和未平倉合約量發展情況,這些期權的行權價格區間爲$75.0至$250.0。

Chevron Call and Put Volume: 30-Day Overview

雪佛龍看漲和看跌的成交量:30天概述

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | SWEEP | BULLISH | 01/17/25 | $6.8 | $6.75 | $6.75 | $140.00 | $481.2K | 13.1K | 103 |

| CVX | PUT | SWEEP | BULLISH | 12/20/24 | $8.95 | $8.85 | $8.95 | $145.00 | $161.1K | 3.0K | 195 |

| CVX | PUT | TRADE | BEARISH | 06/20/25 | $5.25 | $5.05 | $5.25 | $125.00 | $129.6K | 2.2K | 264 |

| CVX | CALL | SWEEP | BEARISH | 12/20/24 | $7.15 | $7.0 | $7.05 | $145.00 | $126.9K | 406 | 210 |

| CVX | CALL | TRADE | BULLISH | 01/17/25 | $8.1 | $7.9 | $8.1 | $145.00 | $75.3K | 3.3K | 359 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 雪佛龍 | 看跌 | SWEEP | 看好 | 01/17/25 | $6.8 | 其股票的收盤價格昨天爲$5.75。 | 其股票的收盤價格昨天爲$5.75。 | $140.00 | $481.2K | 13.1K | 103 |

| 雪佛龍 | 看跌 | SWEEP | 看好 | 12/20/24 | $8.95 | $8.85 | $8.95 | $145.00 | $161.1K | 3.0K | 195 |

| 雪佛龍 | 看跌 | 交易 | 看淡 | 06/20/25 | $5.25 | $5.05 | $5.25 | $125.00 | $129.6K | 2.2K | 264 |

| 雪佛龍 | 看漲 | SWEEP | 看淡 | 12/20/24 | $7.15 | $7.0 | $7.05 | $145.00 | $126.9K | 406 | 210 |

| 雪佛龍 | 看漲 | 交易 | 看好 | 01/17/25 | $8.1 | $7.9 | $8.1 | $145.00 | $75.3K | 3.3K | 359 |

About Chevron

關於雪佛龍

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

雪佛龍是一家擁有全球勘探、生產和精煉業務的綜合能源公司。它是美國第二大石油公司,日產量爲310萬桶石油當量,包括每天770萬立方英尺的天然氣和每天180萬桶液體。生產活動在北美、南美、歐洲、非洲、亞洲和澳洲開展。它的煉油廠位於美國和亞洲,總煉油能力爲180萬桶/日。截至2023年年底,已證明儲量爲111億桶石油當量,包括60億桶液體和3.04萬億立方英尺的天然氣。

In light of the recent options history for Chevron, it's now appropriate to focus on the company itself. We aim to explore its current performance.

基於雪佛龍的最近期權歷史,現在適當關注公司本身。我們旨在探索其當前表現。

Where Is Chevron Standing Right Now?

雪佛龍現在處於什麼位置?

- Trading volume stands at 4,828,890, with CVX's price down by -0.56%, positioned at $144.21.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 73 days.

- 交易量爲4,828,890,CVX的價格下跌了-0.56%,位於$144.21。

- RSI指標顯示該股票可能正接近超賣。

- 預計將在73天內發佈收益公告。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Chevron with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因素,並密切關注市場動態來減輕這些風險。通過Benzinga Pro實時警報了解Chevron的最新期權交易內容。