Market Whales and Their Recent Bets on NEM Options

Market Whales and Their Recent Bets on NEM Options

Financial giants have made a conspicuous bullish move on Newmont. Our analysis of options history for Newmont (NYSE:NEM) revealed 23 unusual trades.

金融巨頭對紐曼礦業採取了引人注目的看漲姿態。我們對紐曼礦業的期權歷史進行分析發現,有23筆飛凡交易。

Delving into the details, we found 47% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $612,695, and 12 were calls, valued at $1,529,913.

深入了解後,我們發現47%的交易者看好,而43%的交易者則顯示出看淡傾向。我們發現的所有交易中,有11張看跌期權,價值爲612,695美元,還有12張看漲期權,價值爲1,529,913美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $57.5 for Newmont over the last 3 months.

考慮到這些合同的成交量和持倉量,似乎鯨魚們在過去3個月裏看好紐曼礦業的目標價區間從35.0美元到57.5美元。

Insights into Volume & Open Interest

成交量和持倉量分析

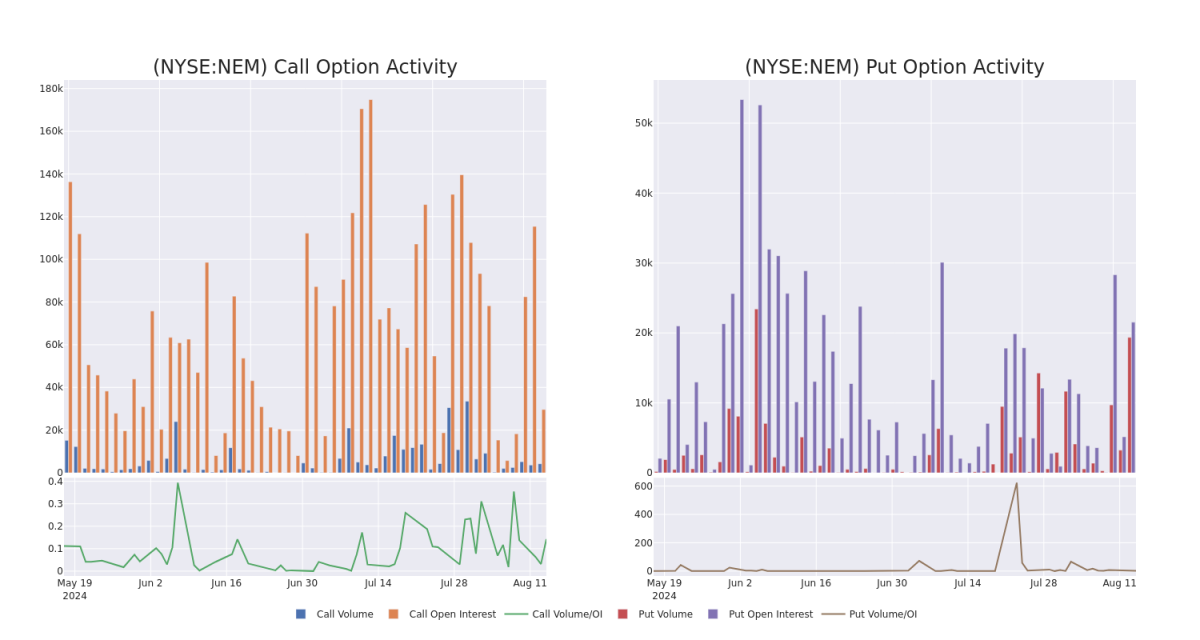

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.

在今天的交易環境中,紐曼礦業期權的平均持倉量爲5687.0,總成交量爲23,592.00。附帶的圖表描述了紐曼礦業高價值交易中看漲和看跌期權的成交量和持倉量在過去30天內的走勢,這些期權的行權價格區間爲35.0美元到57.5美元。

Newmont Call and Put Volume: 30-Day Overview

紐曼礦業看漲和看跌期權成交量:30天總覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | SWEEP | NEUTRAL | 09/20/24 | $9.2 | $8.65 | $9.0 | $40.00 | $270.0K | 12.1K | 307 |

| NEM | CALL | SWEEP | BULLISH | 09/20/24 | $9.0 | $8.95 | $9.0 | $40.00 | $245.7K | 12.1K | 809 |

| NEM | CALL | SWEEP | NEUTRAL | 09/20/24 | $9.05 | $9.0 | $9.0 | $40.00 | $202.5K | 12.1K | 507 |

| NEM | CALL | SWEEP | BULLISH | 03/21/25 | $7.45 | $7.35 | $7.45 | $45.00 | $145.2K | 44 | 1 |

| NEM | CALL | SWEEP | BULLISH | 06/20/25 | $9.75 | $9.65 | $9.75 | $42.50 | $122.8K | 1.5K | 127 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 紐曼礦業 | 看漲 | SWEEP | 中立 | 09/20/24 | $9.2 | $ 8.65 | 9.0美元 | $40.00 | $270.0K | 12.1K | 307 |

| 紐曼礦業 | 看漲 | SWEEP | 看好 | 09/20/24 | 9.0美元 | $8.95 | 9.0美元 | $40.00 | $245.7K | 12.1K | 809 |

| 紐曼礦業 | 看漲 | SWEEP | 中立 | 09/20/24 | $9.05 | 9.0美元 | 9.0美元 | $40.00 | $202.5K | 12.1K | 507 |

| 紐曼礦業 | 看漲 | SWEEP | 看好 | 03/21/25 | $7.45 | $7.35 | $7.45 | $45.00 | $145.2K | 44 | 1 |

| 紐曼礦業 | 看漲 | SWEEP | 看好 | 06/20/25 | $9.75 | $9.65 | $9.75 | $42.50 | $122.8K | 1.5K | 127 |

About Newmont

關於紐曼礦業

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

紐曼礦業是世界上最大的黃金生產商。它在2019年收購了Goldcorp,在同年晚些時候與競爭對手Barrick公司合作組建了內華達州的一家合資企業,並於2023年11月收購了競爭對手Newcrest。其投資組合包括在美洲、非洲、澳大利亞和巴布亞新幾內亞擁有全部或絕大多數權益的17個礦山和兩個合資企業。預計該公司在2024年生產約690萬盎司黃金。然而,在收購Newcrest之後,紐曼礦業可能會出售佔2024年預測銷售額20%的成本較高、規模較小的礦山。紐曼礦業還生產大量的銅、白銀、鋅和鉛副產品。今年12月底,黃金儲備和副產品儲備還有約20年的時間。

Having examined the options trading patterns of Newmont, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查紐曼礦業的期權交易模式後,我們現在轉向公司本身。這種轉變使我們能夠深入探討其當前的市場地位和表現。

Where Is Newmont Standing Right Now?

紐曼礦業目前的地位如何?

- With a volume of 2,022,990, the price of NEM is down -0.73% at $48.66.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 71 days.

- 成交量爲2,022,990,NEM的價格下跌了-0.73%,爲48.66美元。

- RSI指標暗示該股票可能要超買了。

- 下次業績預計在71天內發佈。

Expert Opinions on Newmont

關於紐曼礦業的專家意見

In the last month, 1 experts released ratings on this stock with an average target price of $57.0.

在過去一個月中,有1位專家對這隻股票進行了評級,平均目標價爲57.0美元。

- An analyst from BMO Capital persists with their Outperform rating on Newmont, maintaining a target price of $57.

- BMO Capital的一位分析師堅持其對紐曼礦業的跑贏市場評級,維持目標價爲57美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Newmont with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供了更高的獲利潛力。 懂得識別並控制風險的交易者通過持續的教育、策略性交易調整、利用各種因子,以及了解市場動態來降低風險。使用Benzinga Pro即可及時獲得紐曼礦業的最新期權交易警報。

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.