Smart Money Is Betting Big In ETSY Options

Smart Money Is Betting Big In ETSY Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Etsy.

有很多錢要花的鯨魚在Etsy上表現出顯著的看好態勢。

Looking at options history for Etsy (NASDAQ:ETSY) we detected 36 trades.

查看Etsy(NASDAQ:ETSY)的期權歷史,我們發現了36筆交易。

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 38% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,55%的投資者持看好預期開倉,38%的投資者持看淡預期開倉。

From the overall spotted trades, 3 are puts, for a total amount of $629,980 and 33, calls, for a total amount of $4,967,429.

從總體市場交易來看,有3個看跌期權合約,總金額爲629,980美元,33個看漲期權合約,總金額爲4,967,429美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $70.0 for Etsy during the past quarter.

分析這些合約的成交量和持倉量,大型投資者似乎已經關注了Etsy在過去一個季度的40.0到70.0美元的價格區間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

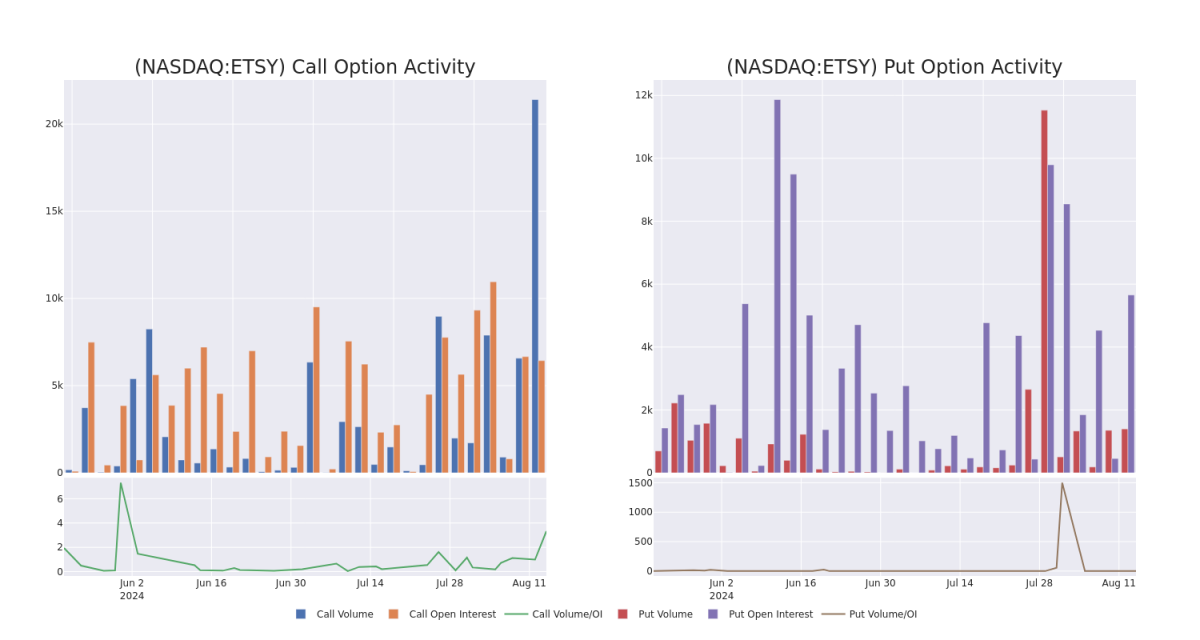

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Etsy's options for a given strike price.

這些數據可以幫助您追蹤Etsy的期權給定行權價的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Etsy's whale activity within a strike price range from $40.0 to $70.0 in the last 30 days.

下面,我們可以觀察過去30天內Etsy所有鯨魚活動在40.0到70.0美元行權價範圍內看漲期權和看跌期權的成交量和持倉量的變化。

Etsy Option Activity Analysis: Last 30 Days

Etsy期權交易分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | CALL | SWEEP | NEUTRAL | 01/16/26 | $10.55 | $10.05 | $10.15 | $60.00 | $504.4K | 499 | 497 |

| ETSY | PUT | TRADE | BULLISH | 06/20/25 | $9.5 | $9.2 | $9.2 | $55.00 | $482.0K | 755 | 524 |

| ETSY | CALL | TRADE | BEARISH | 06/20/25 | $7.4 | $7.3 | $7.3 | $60.00 | $473.7K | 894 | 650 |

| ETSY | CALL | TRADE | BULLISH | 01/17/25 | $8.4 | $8.2 | $8.35 | $50.00 | $417.5K | 665 | 500 |

| ETSY | CALL | TRADE | BULLISH | 01/16/26 | $11.8 | $11.65 | $11.8 | $55.00 | $309.1K | 226 | 375 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | 看漲 | SWEEP | 中立 | 01/16/26 | $10.55 | $10.05 | $10.15 | $60.00 | $504.4K | 499 | 497 |

| ETSY | 看跌 | 交易 | 看好 | 06/20/25 | $9.5 | $9.2 | $9.2 | $55.00 | $482.0K | 755 | 524 |

| ETSY | 看漲 | 交易 | 看淡 | 06/20/25 | $7.4 | $7.3 | $7.3 | $60.00 | $473.7K | 894 | 650 |

| ETSY | 看漲 | 交易 | 看好 | 01/17/25 | $8.4 | $8.2 | $8.35 | $50.00 | $417.5K | 665 | 500 |

| ETSY | 看漲 | 交易 | 看好 | 01/16/26 | $11.8 | $11.65 | $11.8 | $55.00 | $309.1K | 226 | 375 |

About Etsy

關於Etsy

Etsy operates a top-10 e-commerce marketplace operator in the us and the UK, with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods. With $13.2 billion in 2023 consolidated gross merchandise volume, Etsy has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels. As of the end of 2023, the firm connected more than 96 million buyers and 9 million sellers on its marketplace properties: Etsy, Reverb (musical equipment), and Depop (clothing resale).

Etsy在美國和英國經營着排名前十的電子商務市場運營商,並在德國、法國、澳大利亞和加拿大擁有相當規模的業務。該公司在連接買家和賣家的利基市場上佔據着重要地位,通過其在線市場交換古董和手工藝品。作爲一家2023年營業收入爲132億美元的公司,Etsy已經成爲快速增長領域中最大的參與者之一,在上架費、銷售物品提成、廣告服務、支付處理和運費標籤等方面產生收入。截至2023年底,該公司在其市場營銷中連接了超過9600萬買家和900萬賣家:Etsy、Reverb(音樂設備)和Depop(服裝轉售)。

Having examined the options trading patterns of Etsy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

研究了Etsy的期權交易模式之後,我們現在直接轉向公司。這種轉變使我們可以深入挖掘其目前的市場地位和業績。

Current Position of Etsy

Etsy目前的位置爲:

- With a volume of 1,373,485, the price of ETSY is down -3.15% at $52.36.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 77 days.

- ETSY的成交量爲1,373,485,價格下跌了-3.15%,爲52.36美元。

- RSI指標表明該基礎股票可能被超賣。

- 下一次盈利預計在77天內發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Etsy options trades with real-time alerts from Benzinga Pro.

期權交易提供了更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子以及密切關注市場動態來管理這些風險。通過Benzinga Pro實時警報保持對最新的Etsy期權交易的了解。