Tesla Powers Up, But Clean Energy Stocks Are Stuck In Death Cross Rut

Tesla Powers Up, But Clean Energy Stocks Are Stuck In Death Cross Rut

Tesla Inc. (NASDAQ:TSLA) has been riding a wave of mixed fortunes in 2024. The electric vehicle giant is down more than 19% year-to-date, but recent gains of about 3% over the last month have offered some respite.

特斯拉公司(NASDAQ:TSLA)在2024年一直經歷起伏。這家電動汽車巨頭的股票今年已經下跌超過19%,但過去一個月的漲幅約爲3%,爲其帶來了一些喘息之機。

The company's second-quarter earnings report on July 23 brought a glimmer of hope. Revenue hovered at around $25.5 billion — a modest 2% increase year-over-year — beating Wall Street's expectations of $24.73 billion, according to Benzinga Pro.

7月23日,公司發佈了第二季度業績,帶來了一線希望。營業收入維持在大約255億美元左右——同比增長2%,超過了華爾街預期的247.3億美元,據Benzinga Pro稱。

However, Tesla's earnings per share (EPS) told a different story, falling 43% year-over-year to 52 cents. They missed the Street's consensus estimate of 62 cents. Despite the earnings miss, the stock found a technical lifeline, forming a Golden Cross on July 29.

然而,特斯拉每股收益(EPS)講述了一個不同的故事,同比下降43%至52美分。它們低於華爾街的共識估計值62美分。儘管收益未能達到預期,股票還是找到了一個技術生命線,在7月29日形成了一個金十字。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

A Golden Cross occurs when the 50-day moving average crosses above the 200-day moving average, signaling a potential bullish trend. This pattern has sparked optimism among investors, suggesting Tesla could be poised for a rebound.

金十字發生在50日移動平均線上穿過200日移動平均線的時候,預示着潛在的看好趨勢。這個模式激起了投資者的樂觀情緒,暗示特斯拉可能準備反彈。

While Tesla is basking in the glow of its Golden Cross, the broader clean energy sector isn't faring as well.

雖然特斯拉在其金十字的光輝中沉醉,但整個清潔能源板塊的表現並不好。

Read Also: Tesla FSD Test Drive Terrifies Analyst's Son: 'Third Time Not The Charm'

還閱讀:特斯拉FSD試駕驚嚇了分析師的兒子:「第三次還不夠」

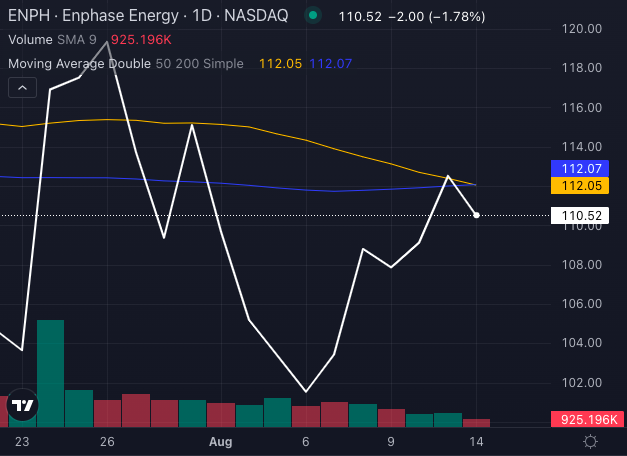

Enphase Energy Inc. (NASDAQ:ENPH), a leader in energy management technology, is down 15.69% YTD and teetering on the brink of a Death Cross.

能源管理技術領域的領導者Enphase Energy Inc.(NASDAQ:ENPH)今年以來下跌了15.69%,處於金叉死叉的邊緣。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

This bearish signal, where the 50-day moving average falls below the 200-day moving average, indicates potential further declines.

這個看淡信號表明,50日移動平均線下穿200日移動平均線,可能暗示着可能會進一步下跌。

Blink Charging Co. (NASDAQ:BLNK), another key player in the EV space, is also struggling.

在電動汽車行業的另一位重要參與者Blink Charging Co.(NASDAQ:BLNK)也在苦苦掙扎。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

With its stock down 35.49% YTD, Blink is rapidly approaching a Death Cross, casting a shadow over its short-term prospects.

由於股票今年以來下跌了35.49%,Blink正在迅速接近金叉死叉,這給其短期前景蒙上了陰影。

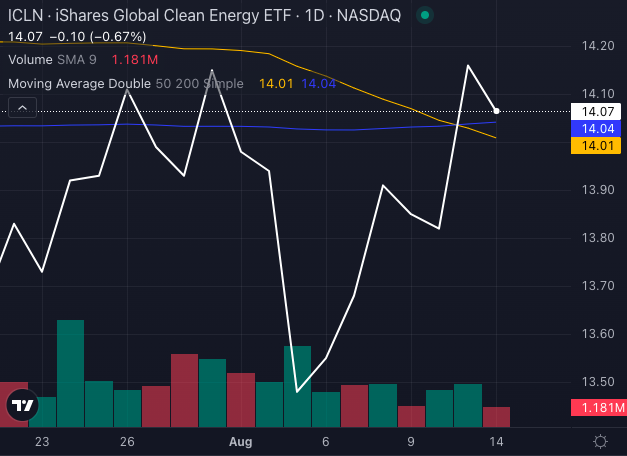

The iShares Global Clean Energy ETF (NASDAQ:ICLN), which tracks the performance of clean energy companies worldwide, has already succumbed to a Death Cross, reflecting the sector's broader struggles.

追蹤全球清潔能源公司表現的環球清潔能源etf-ishares(NASDAQ:ICLN)已經給金叉死叉所擊垮,反映了該行業面臨的更廣泛的挑戰。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

The ETF is down 8.54% YTD, signaling that clean energy stocks face an uphill battle despite Tesla's technical rebound.

該ETF今年已下跌8.54%,表明儘管特斯拉有技術反彈,清潔能源股票仍面臨艱難的鬥爭。

As Tesla powers up with its Golden Cross, clean energy stocks remain stuck in a Death Cross rut, highlighting the sector's contrasting fortunes.

隨着特斯拉的金十字的助力,清潔能源股票仍然陷入了死叉的困境中,凸顯了該行業截然不同的命運。

- Clean Tech Titans: Can Enovix, ChargePoint, Archer, Joby Defy The Doubters?

- 清潔技術巨頭:Enovix、ChargePoint、Archer、Joby能否打破懷疑者的質疑?