Market Mover | S P Setia Shares Fall Over 10% After Releasing Its Quarterly Financial Results

Market Mover | S P Setia Shares Fall Over 10% After Releasing Its Quarterly Financial Results

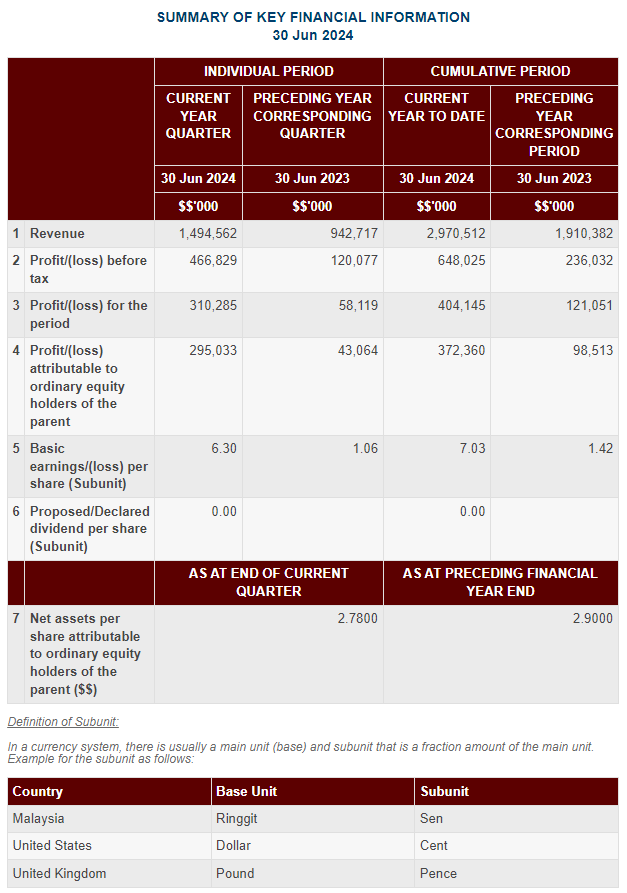

August 15, 2024 - $SPSETIA (8664.MY)$ shares fell 10.53% to RM1.36 on Thursday. The company released its 24Q2 financial results, reporting a net profit of RM310 million for the second quarter ended Jun 30, 2024.

2024年8月15日 - $SPSETIA (8664.MY)$ 公司發佈了2024年第二季度業績,報告淨利潤爲3,100萬馬來西亞令吉,截至2024年6月30日。

Key Highlights

主要亮點

Profit increased: Net profit after tax has increased to RM404 million in YTD Q2 2024 compared to RM121 million in the same period last year, benefitting from successful strategic land deals in Johor and Klang Valley, as well as completion of S P Setia’s 50% equity stake disposal in Taman Ikan Emas, Cheras partnership redevelopment project.

利潤增加:截至2024年第二季度,稅後淨利潤比去年同期增加到4,040萬馬來西亞令吉,受益於在柔佛和吉隆坡謀劃成功的戰略用地買賣,以及S P Setia在武吉加里曼丹Taman Ikan Emas項目的50%股權出售完成。

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.

完成了2024財年銷售目標的52%,中央地區強勁工業部門的表現和南部地區良好的需求狀況推動了23億馬來西亞令吉的銷售,其餘的推出階段將在今年剩下的時間內逐步推出。

Successful De-gearing strategies: From RM10.1 billion borrowings in Q4 2023, it has declined significantly by RM700 million within 6 months to RM9.4 billion as of Q2 2024. Net gearing ratio has consistently strengthened over the past few quarters to 0.41x per Q2 2024, compared to 0.49x in Q4 2023 due to the effectiveness of the Group’s debt management and capital allocation strategies.

成功減槓桿的策略:從2023年第四季度的101億馬來西亞令吉借款,到2024年第二季度已經顯著下降了7000萬馬來西亞令吉,降至94億馬來西亞令吉。由於集團的債務管理和資本分配策略的有效性,淨負債比率在過去幾個季度持續加強,截至2024年第二季度爲0.41倍,而2023年第四季度爲0.49倍。

Steady progress of inventories clearance: Achieved RM244 million reduction of stocks compared to Q4 2023 level, representing ~15% clearance progressively taking place through a concerted effort throughout the Group.

存貨清理穩步進展:與2023年第四季度相比,存貨已經減少了2,440萬馬來西亞令吉,約佔集團總存貨的15%,通過集團的協調努力逐步清理。

Setia Brand refresh – “Shaping Spaces That Shape Us All": In its 50th year, in honouring decades of excellence, S P Setia celebrates its enduring legacy and unwavering commitment to quality and innovation in real estate development with new marketing campaigns aimed to enhance future sales.

Setia品牌更新 - 「打造改變我們所有人空間」:在其50週年之際,S P Setia通過新的營銷活動來慶祝其悠久的歷史和對房地產開發質量和創新的恒久承諾,旨在增強未來的銷售。

Related Links: Q2FY2024 Financial Results

相關鏈接:2024年第二季度財務結果

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.