Intel Unusual Options Activity For August 15

Intel Unusual Options Activity For August 15

Financial giants have made a conspicuous bearish move on Intel. Our analysis of options history for Intel (NASDAQ:INTC) revealed 14 unusual trades.

金融巨頭們對英特爾做出了明顯的看淡動作。我們對英特爾(納斯達克股票:INTC)期權歷史進行分析後發現,有14筆非常規的交易。

Delving into the details, we found 14% of traders were bullish, while 64% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $422,977, and 8 were calls, valued at $358,061.

深入了解後,我們發現有14%的交易者看好市場,而64%的交易者表現出看淡的傾向。我們發現的所有交易中,有6筆看跌期權交易,總價值爲422,977美元,還有8筆看漲期權交易,總價值爲358,061美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $16.0 and $24.0 for Intel, spanning the last three months.

通過對成交量和持倉量的評估,我們可以看出主要市場操盤者都在關注英特爾的價格區間,該區間爲16.0美元至24.0美元,時間爲過去三個月。

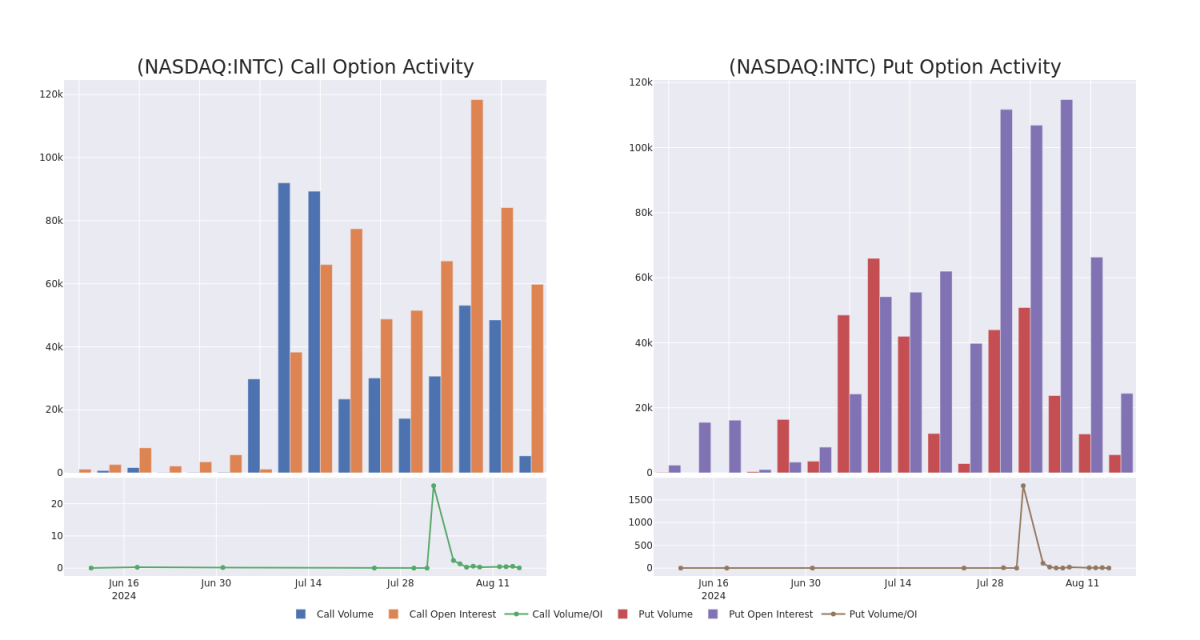

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Intel's options for a given strike price.

這些數據可以幫助您跟蹤給定行權價下的英特爾期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intel's whale activity within a strike price range from $16.0 to $24.0 in the last 30 days.

下面我們可以看到,在過去30天內,在16.0美元至24.0美元的行權價格區間內,針對英特爾所有龐大的活動所進行的看漲和看跌期權的成交量和持倉量的變化。

Intel Option Activity Analysis: Last 30 Days

英特爾期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | SWEEP | BEARISH | 06/20/25 | $4.5 | $4.4 | $4.5 | $23.00 | $126.4K | 12.8K | 282 |

| INTC | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.1 | $4.05 | $4.1 | $23.00 | $99.1K | 2.9K | 1.2K |

| INTC | CALL | SWEEP | BEARISH | 10/18/24 | $2.97 | $2.9 | $2.9 | $18.00 | $81.2K | 614 | 280 |

| INTC | PUT | SWEEP | BEARISH | 10/18/24 | $1.55 | $1.54 | $1.55 | $21.00 | $55.0K | 3.0K | 422 |

| INTC | PUT | SWEEP | BEARISH | 06/20/25 | $4.5 | $4.45 | $4.5 | $23.00 | $49.5K | 12.8K | 403 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 英特爾 | 看跌 | SWEEP | 看淡 | 06/20/25 | $4.5 | $4.4 | $4.5 | $23.00 | 126.4千美元 | 12.8K | 282 |

| 英特爾 | 看跌 | SWEEP | 中立 | 03/21/25 | $4.1 | $4.05 | $4.1 | $23.00 | $99.1K | 2.9K | 1.2K |

| 英特爾 | 看漲 | SWEEP | 看淡 | 10/18/24 | $2.97 | $2.9 | $2.9 | $18.00 | $81.2K | 614 | 280 |

| 英特爾 | 看跌 | SWEEP | 看淡 | 10/18/24 | $1.55 | $1.54 | $1.55 | 21.00美元 | $55.0K | 3.0K | 422 |

| 英特爾 | 看跌 | SWEEP | 看淡 | 06/20/25 | $4.5 | $4.45 | $4.5 | $23.00 | $49.5K | 12.8K | 403 |

About Intel

關於英特爾

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特爾是一家領先的數字芯片製造商,專注於爲全球個人電腦和數據中心市場設計和製造微處理器。英特爾率先提出了微處理器的x86架構,並是Moore's law在半導體制造方面的主要支持者。英特爾在PC和服務器終端市場的中央處理單元方面保持市場份額領先地位。英特爾還擴展到了新的附加領域,如通信基礎設施、汽車和物聯網。此外,英特爾希望利用其芯片製造能力進入外包晶圓廠模式,在此模式下爲他人構建芯片。

Having examined the options trading patterns of Intel, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了英特爾的期權交易模式之後,我們的注意力現在直接轉向公司。這個轉變讓我們可以深入探討它目前的市場地位和業績。

Present Market Standing of Intel

英特爾現在的市場地位

- With a volume of 17,975,565, the price of INTC is up 2.33% at $20.39.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 70 days.

- 英特爾的成交量爲17,975,565股,價格上漲了2.33%,報價爲20.39美元。

- RSI指標表明該基礎股票可能被超賣。

- 下一輪的業績預計將在70天內發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。