These Analysts Boost Their Forecasts On Walmart After Upbeat Earnings

These Analysts Boost Their Forecasts On Walmart After Upbeat Earnings

Walmart Inc (NYSE:WMT) announced strong second-quarter results and raised full-year guidance on Thursday.

沃爾瑪公司 (紐交所:WMT) 週四公佈了強勁的第二季度業績並上調了全年指引。

The retailer reported adjusted EPS of 67 cents (+9.8% Y/Y), beating the consensus of 64 cents. Sales were $169.34 billion, up 4.8% year over year or 5.0% (at constant currency), beating the consensus of $168.57 billion.

該零售商報告調整後的每股收益爲67美分(同比增長9.8%),超過了64美分的共識預期。銷售額爲1693.4億美元,同比增長4.8%或按固定匯率計算的5.0%,超出了1685.7億美元的共識預期。

Walmart expects third-quarter adjusted EPS of $0.51 to $0.52 versus a consensus of $0.55, and its sales outlook is $164.58 billion-$166.17 billion vs. $167.11 billion estimate.

沃爾瑪預計第三季度調整後的每股收益爲0.51美元至0.52美元,而共識預期爲0.55美元,銷售預期爲1645.8億美元至1661.7億美元,而1671.1億美元是共識預期。

For FY25, the big box retailer raised its adjusted EPS outlook to $2.35-$2.43 (from $2.23-$2.37), vs. the consensus of $2.43. Walmart boosted FY25 net sales (at constant currency) growth guidance to 3.75%-4.75% from 3.0%- 4.0%.

對於FY25,這家大型零售商將其調整後的EPS展望上調至2.35美元至2.43美元(之前爲2.23美元至2.37美元),而共識預期爲2.43美元。沃爾瑪將FY25淨銷售額(按固定匯率計算)增長預期從3.0%-4.0%上調至3.75%-4.75%。

Walmart shares gained 6.6% to close at $73.18 on Thursday.

沃爾瑪股票在週四收盤時上漲6.6%,報73.18美元。

These analysts made changes to their price targets on Walmart following earnings announcement.

這些分析師在沃爾瑪公佈業績後對其股價目標進行了調整。

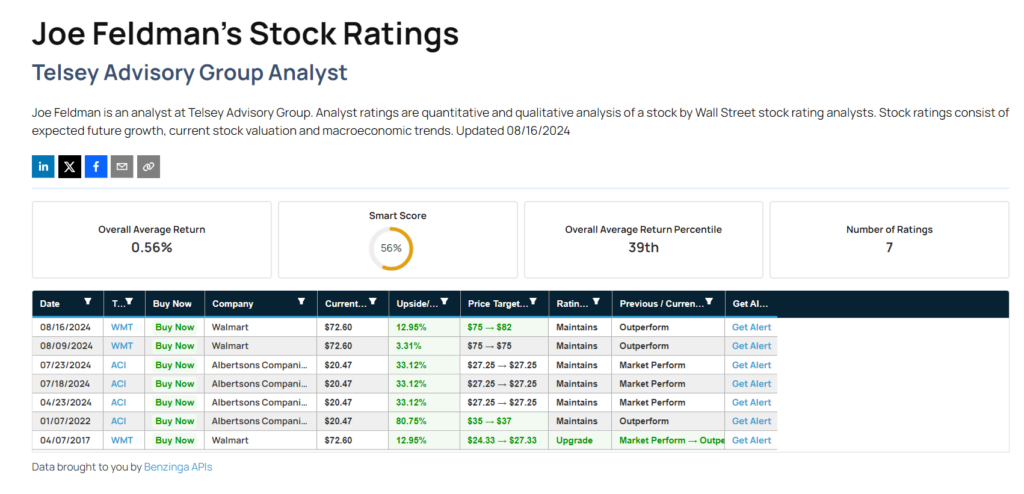

Telsey Advisory Group analyst Joe Feldman maintained Walmart with an Outperform and raised the price target from $75 to $82.

Telsey Advisory Group 的分析師喬·費爾德曼維持沃爾瑪股票的跑贏大盤評級,並將其股價目標從75美元上調至82美元。

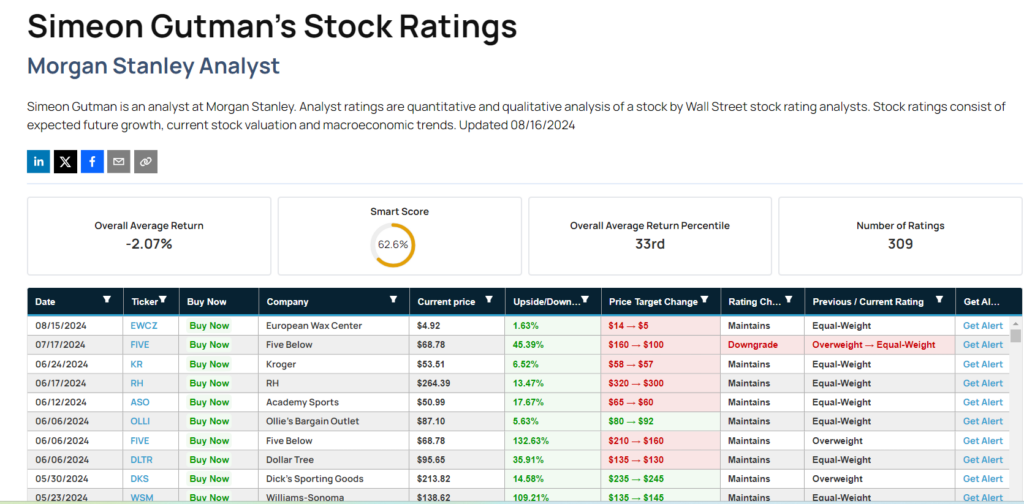

Morgan Stanley analyst Simeon Gutman maintained Walmart with an Overweight and boosted the price target from $75 to $82.

摩根士丹利的分析師Simeon Gutman維持沃爾瑪股票的增持評級,並將其股價目標從75美元上調至82美元。

Read More:

閱讀更多:

- Jim Cramer Recommends Buying Clorox: 'CEO Has Done Remarkable Job'

- 吉姆·克萊默推薦購買高樂氏:'CEO表現出色'