Tapestry Analysts Slash Their Forecasts After Q4 Results

Tapestry Analysts Slash Their Forecasts After Q4 Results

Tapestry (NYSE:TPR) reported better-than-expected fourth-quarter financial results on Thursday.

Tapestry(紐交所:TPR)週四發佈了超預期的第四季度財務業績報告。

The company reported fourth-quarter adjusted earnings per share of 92 cents, beating the analyst consensus of 88 cents. Quarterly sales of $1.59 billion (down 2%) beat the $1.58 billion estimate.

公司第四季度調整後每股收益爲92美分,超過分析師88美分的共識。季度銷售額爲15.9億美元(下降2%),超過15.8億美元的預期。

In fiscal 2025, Tapestry said it expects to maintain its annual dividend rate of $1.40 per common share. The company declared a quarterly cash dividend of 35 cents per common share, payable on September 23.

在2025財年,Tapestry表示預計維持每股普通股的年度股利率爲1.40美元。公司宣佈每股普通股的季度現金股利爲35美分,將於9月23日支付。

Tapestry anticipates FY25 revenue of around $6.7 billion, slightly below the $6.8 billion estimate, and expects EPS between $4.45 and $4.50, compared to the $4.49 estimate.

Tapestry預計2025財年營業收入約爲67億美元,略低於68億美元的預期,並預計每股收益爲4.45美元至4.50美元,而預測爲4.49美元。

oanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, "Our fourth quarter results exceeded expectations, capping a successful year. This is a testament to our passionate global teams whose creativity and exceptional execution continue to fuel our brands and business. Importantly, through an unwavering focus on powering innovation and consumer connections, we meaningfully advanced our strategic agenda in fiscal year 2024, delivering strong financial results against a dynamic backdrop. From this position of strength, we have a bold vision for the future and a steadfast commitment to drive growth and shareholder value for years to come."

Tapestry首席執行官Joanne Crevoiserat表示:「我們的第四季度業績超出預期,爲我們成功的一年畫上了完美句號。這證明了我們充滿激情的全球團隊,他們的創意和傑出執行能力繼續推動我們的品牌和業務發展。重要的是,通過始終專注於推動創新和消費者聯繫,我們在2024財年實現了戰略議程的實質性推進,面對不斷變化的背景取得了強勁的財務業績。在這個強大的基礎上,我們有一個大膽的願景,堅定地致力於未來數年的增長和股東價值推動。」

Tapestry shares gained 0.3% to trade at $39.31 on Friday.

Tapestry股價週五上漲0.3%,報39.31美元。

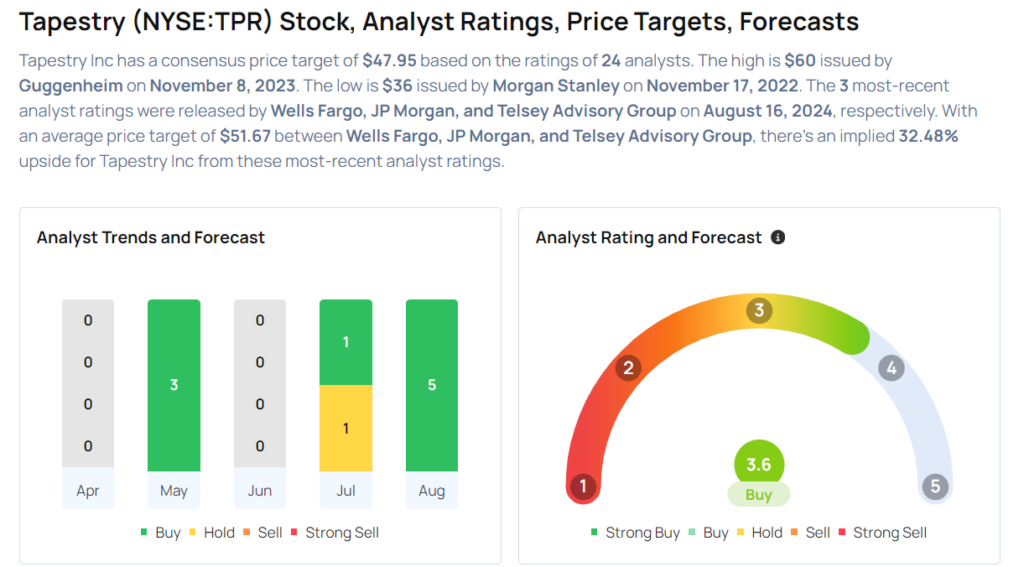

These analysts made changes to their price targets on Tapestry following earnings announcement.

這些分析師在業績公佈後對Tapestry的目標價進行了更改。

- Wells Fargo analyst Ike Boruchow maintained Tapestry with an Overweight and lowered the price target from $52 to $50.

- JP Morgan analyst Matthew Boss maintained the stock with an Overweight and cut the price target from $54 to $51.

- Telsey Advisory Group analyst Dana Telsey maintained Tapestry with an Outperform and maintained a $54 price target.

- 富國銀行分析師Ike Boruchow維持Tapestry爲超配並將目標價從52美元降至50美元。

- JP Morgan分析師Matthew Boss維持該股票爲超配並將目標價從54美元降至51美元。

- Telsey Advisory Group分析師Dana Telsey維持該股票爲跑贏市場表現並將目標價維持在54美元。

Considering buying TPR stock? Here's what analysts think:

考慮購買TPR股票嗎?以下是分析師的看法:

Read More:

閱讀更多:

- More Than $30M Bet On This Stock? Check Out These 3 Stocks Insiders Are Buying

- 這支股票有超過3000萬的投注?看看這3只股票內部人士正在購買

Tapestry anticipates FY25 revenue of around $6.7 billion, slightly below the $6.8 billion estimate, and expects EPS between $4.45 and $4.50, compared to the $4.49 estimate.

Tapestry anticipates FY25 revenue of around $6.7 billion, slightly below the $6.8 billion estimate, and expects EPS between $4.45 and $4.50, compared to the $4.49 estimate.