GameStop's Options: A Look at What the Big Money Is Thinking

GameStop's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on GameStop.

那些有大把資金的鯨魚已經採取了明顯的看好態度對於遊戲驛站。

Looking at options history for GameStop (NYSE:GME) we detected 11 trades.

查看遊戲驛站(紐交所:GME)期權歷史,我們發現了 11 筆交易。

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 27% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,45% 的投資者看好開倉,27% 的投資者看淡。

From the overall spotted trades, 2 are puts, for a total amount of $103,000 and 9, calls, for a total amount of $408,551.

從整個交易來看,2 筆是看淡期權,總金額爲 103,000 美元,9 筆看好期權,總金額爲 408,551 美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.0 to $40.0 for GameStop over the last 3 months.

考慮成交量和未平倉量這些合約,似乎鯨魚投資者在過去的 3 個月中一直瞄準 GME 的價格區間在 $17.0 ~ $40.0。

Insights into Volume & Open Interest

成交量和持倉量分析

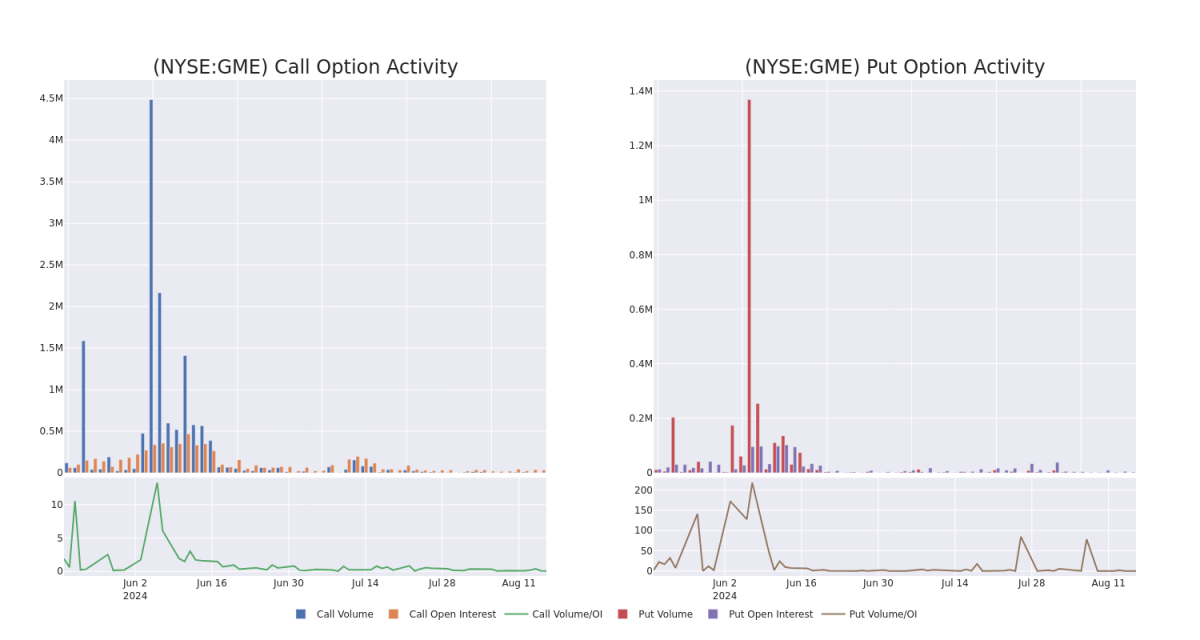

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GameStop's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GameStop's substantial trades, within a strike price spectrum from $17.0 to $40.0 over the preceding 30 days.

評估成交量和未平倉量是期權交易的一項戰略性步驟。 這些指標揭示了遊戲驛站在指定執行價格的看漲和看跌期權的流動性和投資者興趣。 給出的數據可視化了過去 30 天內 $17.0 ~ $40.0 的執行價格範圍內,成交量和未平倉量對看漲和看跌期權的波動情況,相關聯於遊戲驛站的大宗交易。

GameStop Call and Put Volume: 30-Day Overview

GameStop看漲和看跌期權成交量:30天綜合概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BULLISH | 08/16/24 | $2.5 | $2.43 | $2.5 | $20.00 | $81.2K | 7.0K | 449 |

| GME | PUT | TRADE | BULLISH | 01/16/26 | $6.2 | $3.0 | $4.0 | $17.00 | $64.0K | 713 | 0 |

| GME | CALL | TRADE | BEARISH | 01/16/26 | $6.95 | $6.0 | $6.0 | $40.00 | $60.0K | 736 | 100 |

| GME | CALL | SWEEP | BULLISH | 01/17/25 | $4.4 | $4.25 | $4.25 | $25.00 | $51.4K | 5.7K | 133 |

| GME | CALL | SWEEP | BEARISH | 10/18/24 | $4.15 | $4.0 | $4.1 | $20.00 | $46.3K | 7.2K | 288 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看漲 | SWEEP | 看好 | 08/16/24 | $2.5 | $2.43 | $2.5 | $20.00 | $81.2K | 7.0K | 449 |

| GME | 看跌 | 交易 | 看好 | 01/16/26 | $6.2 | $3.0 | $4.0 | $17.00 | $64.0千美元 | 713 | 0 |

| GME | 看漲 | 交易 | 看淡 | 01/16/26 | $6.95 | $6.0 | $6.0 | $40.00 | $60.0K | 736 | 100 |

| GME | 看漲 | SWEEP | 看好 | 01/17/25 | $4.4 | $4.25 | $4.25 | $25.00 | $51.4K | 5.7千 | 133 |

| GME | 看漲 | SWEEP | 看淡 | 10/18/24 | $4.15 | $4.0 | $4.1 | $20.00 | $46.3K | 7,200 | 288 |

About GameStop

關於遊戲驛站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美國的一家多渠道視頻遊戲、消費電子和服務零售商。該公司在歐洲、加拿大、澳洲和美國等地區運營。GameStop主要通過GameStop、Eb Games和Micromania商店以及國際電子商務網站銷售新和二手視頻遊戲硬件、實體和數字視頻遊戲軟件和視頻遊戲配件。銷售收入的大部分來自美國。

Having examined the options trading patterns of GameStop, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了遊戲驛站的期權交易模式後,我們現在把注意力轉向了該公司。這種轉變使我們能夠深入探討它現在的市場地位和業績。

GameStop's Current Market Status

GameStop的當前市場狀態

- With a volume of 1,257,407, the price of GME is down -0.31% at $22.46.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 19 days.

- 成交量爲 1,257,407,GME 的價格爲 22.46 美元,下跌了 -0.31%。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下次業績預計在19天內發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多種指標和密切關注市場動態來管理這些風險。通過Benzinga Pro獲取GameStop期權交易的實時提醒,保持最新動態。

From the overall spotted trades, 2 are puts, for a total amount of $103,000 and 9, calls, for a total amount of $408,551.

From the overall spotted trades, 2 are puts, for a total amount of $103,000 and 9, calls, for a total amount of $408,551.