A Closer Look at TG Therapeutics's Options Market Dynamics

A Closer Look at TG Therapeutics's Options Market Dynamics

Financial giants have made a conspicuous bullish move on TG Therapeutics. Our analysis of options history for TG Therapeutics (NASDAQ:TGTX) revealed 8 unusual trades.

金融巨頭在TG Therapeutics上表現出明顯的看好態勢。我們對TG Therapeutics(NASDAQ:TGTX)期權歷史的分析顯示,有8次不同尋常的交易。

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $72,578, and 6 were calls, valued at $252,764.

具體來說,我們發現62%的交易者看好,25%的交易者持有看淡態度。在我們發現的所有交易中,2次交易是看跌的,價值爲72,578美元,而6次交易是看漲的,價值爲252,764美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $20.0 for TG Therapeutics over the recent three months.

從交易活動來看,重要投資者在過去的三個月中瞄準TG Therapeutics的價格區間爲15.0美元至20.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

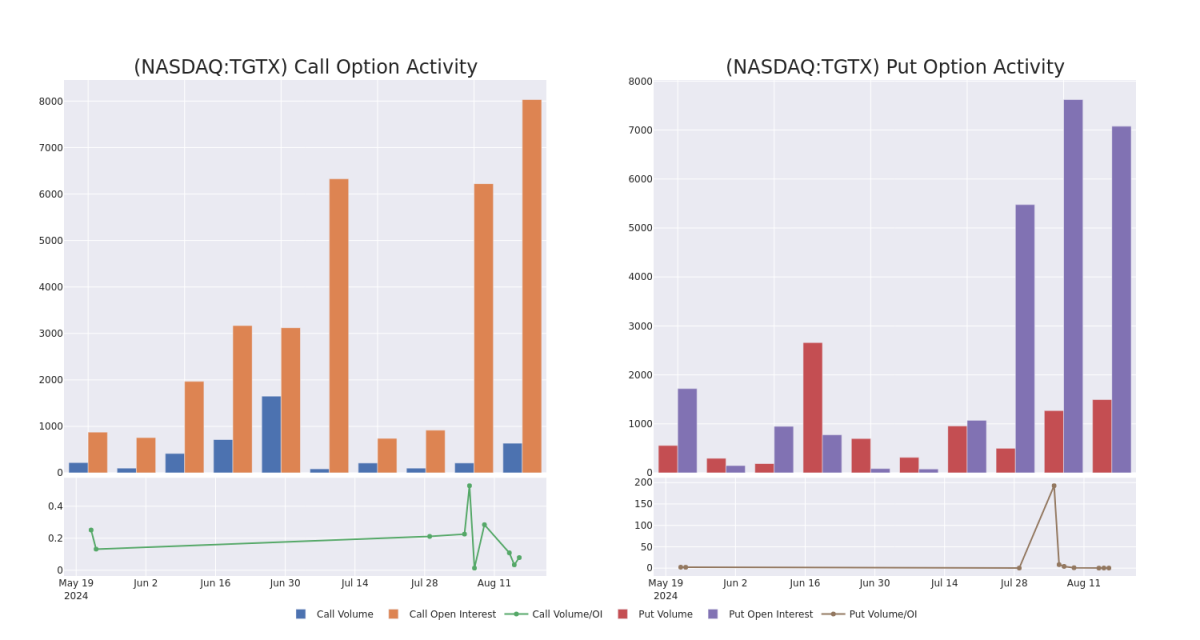

In today's trading context, the average open interest for options of TG Therapeutics stands at 3021.6, with a total volume reaching 2,130.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in TG Therapeutics, situated within the strike price corridor from $15.0 to $20.0, throughout the last 30 days.

在當今的交易環境中,TG Therapeutics期權的平均未平倉量爲3021.6,總成交量達到2,130.00。附圖描繪了TG Therapeutics高價值交易的看漲期權和看跌期權成交量和未平倉量,這些交易位於15.0美元至20.0美元的行權價通道中,持續30天。

TG Therapeutics Option Activity Analysis: Last 30 Days

TG Therapeutics期權交易分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGTX | CALL | SWEEP | BULLISH | 01/16/26 | $10.9 | $10.4 | $10.9 | $15.00 | $81.7K | 651 | 77 |

| TGTX | PUT | SWEEP | BEARISH | 09/20/24 | $1.15 | $0.95 | $1.15 | $19.00 | $44.1K | 7.0K | 618 |

| TGTX | CALL | SWEEP | BULLISH | 08/16/24 | $6.0 | $5.9 | $6.0 | $15.00 | $42.6K | 835 | 122 |

| TGTX | CALL | TRADE | BULLISH | 01/17/25 | $5.3 | $4.9 | $5.27 | $20.00 | $38.9K | 5.6K | 114 |

| TGTX | CALL | TRADE | NEUTRAL | 08/16/24 | $6.4 | $6.2 | $6.3 | $15.00 | $31.5K | 835 | 172 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGTX | 看漲 | SWEEP | 看好 | 01/16/26 | $10.9 | $10.4 | $10.9 | 15.00美元 | $81.7K | 651 | 77 |

| TGTX | 看跌 | SWEEP | 看淡 | 09/20/24 | $1.15 | 0.95美元 | $1.15 | 19.00美元 | $44.1K | 7.0K | 618 |

| TGTX | 看漲 | SWEEP | 看好 | 08/16/24 | $6.0 | $5.9 | $6.0 | 15.00美元 | $42.6K | 835 | 122 |

| TGTX | 看漲 | 交易 | 看好 | 01/17/25 | $5.3 | $4.9 | 5.27美元 | $20.00 | $38.9K | 5.6K | 114 |

| TGTX | 看漲 | 交易 | 中立 | 08/16/24 | 6.4美元 | $6.2 | $6.3 | 15.00美元 | $31.5千美元 | 835 | 172 |

About TG Therapeutics

關於TG Therapeutics

TG Therapeutics Inc is a fully integrated, commercial-stage, biopharmaceutical company focused on the acquisition, development, and commercialization of novel treatments for B-cell diseases. The company has received approval from the U.S. Food and Drug Administration (FDA) for BRIUMVI (ublituximab-xiiy) for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS). and the company is developing TG-1701 (BTK inhibitor) and TG-1801 (anti-CD47/CD19 bispecific mAb) for B-cell disorders which are under Phase 1 trial.

TG Therapeutics Inc是一家完全整合的商業化階段生物製藥公司,專注於收購、開發和商業化治療B細胞疾病的新療法。該公司已獲得美國食品和藥物管理局(FDA)批准,用於治療成人複發性多發性硬化症(RMS)的BRIUMVI(ublituximab-xiiy)。同時,該公司正在開發TG-1701(BTk抑制劑)和TG-1801(抗CD47/CD19的雙特異性mAb)用於治療B細胞疾病,目前處於一期臨床試驗。

Having examined the options trading patterns of TG Therapeutics, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對TG Therapeutics期權交易模式的研究,我們現在的注意力直接轉向了該公司。這爲我們深入了解其當前的市場地位和表現打下了基礎。

Where Is TG Therapeutics Standing Right Now?

TG Therapeutics現在的狀況如何?

- Trading volume stands at 2,245,178, with TGTX's price up by 5.23%, positioned at $22.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 75 days.

- TGTX的交易量爲2,245,178,價格上漲了5.23%,目前爲22.04美元。

- RSI指標顯示該股票可能接近超買。

- 盈利聲明將在75天內公佈。

Expert Opinions on TG Therapeutics

關於TG Therapeutics的專家意見

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $34.333333333333336.

在過去的30天中,共有3名專業分析師對該股票發表了看法,給出了平均的價格目標爲34.333333333333336美元。

- An analyst from B. Riley Securities has decided to maintain their Buy rating on TG Therapeutics, which currently sits at a price target of $34.

- An analyst from Goldman Sachs persists with their Neutral rating on TG Therapeutics, maintaining a target price of $20.

- An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $49.

- b. Riley Securities的一名分析師決定維持對TG Therapeutics的買入評級,目前的價目標爲34美元。

- 高盛的一名分析師繼續維持對TG Therapeutics的中立評級,維持價格目標爲20美元。

- HC Wainwright & Co.的一名分析師已將其評級下調至買入,調整價格目標至49美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。