This Is What Whales Are Betting On Agnico Eagle Mines

This Is What Whales Are Betting On Agnico Eagle Mines

Financial giants have made a conspicuous bearish move on Agnico Eagle Mines. Our analysis of options history for Agnico Eagle Mines (NYSE:AEM) revealed 11 unusual trades.

金融巨頭們在伊格爾礦業上做出了明顯的看淡動作。我們對伊格爾礦業期權歷史的分析顯示出11項不尋常的交易。

Delving into the details, we found 18% of traders were bullish, while 72% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $417,201, and 8 were calls, valued at $401,088.

具體來說,我們發現18%的交易者看好,而72%的交易者看淡。在我們發現的所有交易中,3次是看跌期權,價值爲417,201美元,8次是看漲期權,價值爲401,088美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $95.0 for Agnico Eagle Mines over the recent three months.

根據交易活動,看來重要的投資者們正瞄準在過去三個月裏,伊格爾礦業的股價區間在65.0到95.0之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

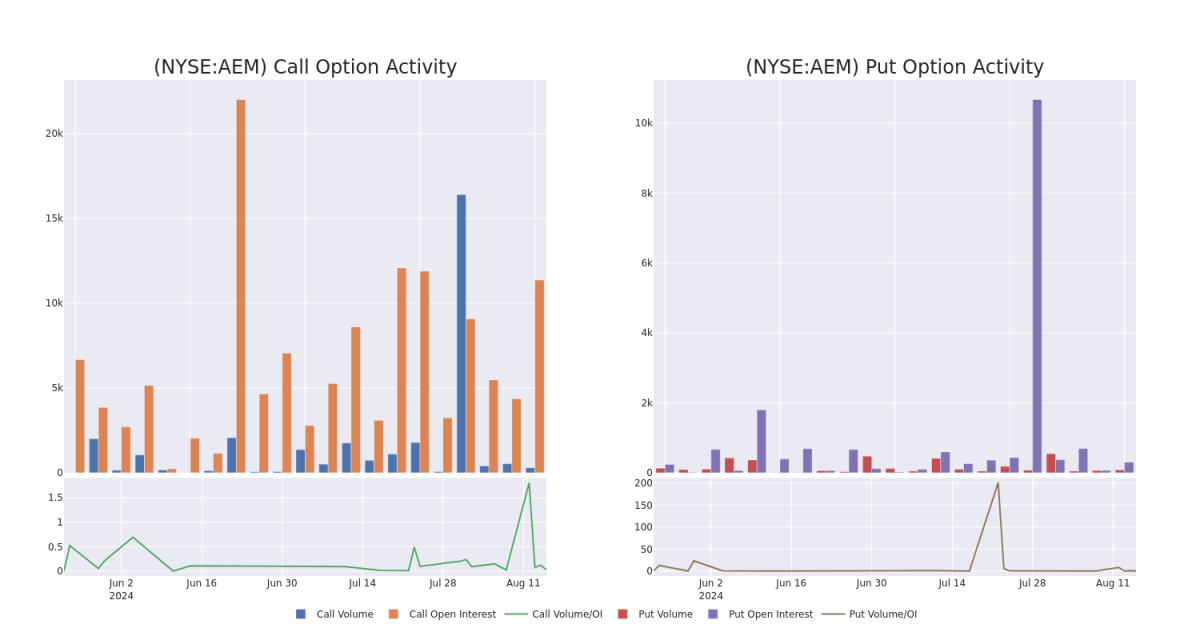

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Agnico Eagle Mines's options for a given strike price.

這份數據可幫助您追蹤某一行權價格下,對於伊格爾礦業的期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Agnico Eagle Mines's whale activity within a strike price range from $65.0 to $95.0 in the last 30 days.

下面,我們可以觀察到,在過去30天裏,針對伊格爾礦業某一行權價區間內所有的巨鯨活動中,看跌和看漲期權的成交量和未平倉量的演變。

Agnico Eagle Mines Option Activity Analysis: Last 30 Days

伊格爾礦業期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | PUT | SWEEP | BEARISH | 01/17/25 | $17.3 | $17.2 | $17.3 | $95.00 | $205.8K | 0 | 120 |

| AEM | PUT | SWEEP | BEARISH | 11/15/24 | $16.8 | $16.6 | $16.8 | $95.00 | $107.5K | 0 | 65 |

| AEM | PUT | SWEEP | BEARISH | 01/17/25 | $17.3 | $17.1 | $17.3 | $95.00 | $103.8K | 0 | 121 |

| AEM | CALL | TRADE | NEUTRAL | 08/16/24 | $4.6 | $4.4 | $4.5 | $75.00 | $103.5K | 2.6K | 501 |

| AEM | CALL | TRADE | BEARISH | 09/20/24 | $2.7 | $2.65 | $2.66 | $80.00 | $61.1K | 5.8K | 774 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | 看跌 | SWEEP | 看淡 | 01/17/25 | $17.3 | $17.2 | $17.3 | $ 95.00 | $205.8K | 0 | 120 |

| AEM | 看跌 | SWEEP | 看淡 | 11/15/24 | $16.8 | $16.6 | $16.8 | $ 95.00 | $107.5K | 0 | 65 |

| AEM | 看跌 | SWEEP | 看淡 | 01/17/25 | $17.3 | $17.1 | $17.3 | $ 95.00 | $103.8千美元 | 0 | 121 |

| AEM | 看漲 | 交易 | 中立 | 08/16/24 | $4.6 | $4.4 | $4.5 | $75.00 | $103.5千美元 | 2.6K | 501 |

| AEM | 看漲 | 交易 | 看淡 | 09/20/24 | $2.7 | $2.65 | $2.66 | $80.00 | $61.1K | 5.8K | 774 |

About Agnico Eagle Mines

關於伊格爾礦業

Agnico Eagle is a gold miner with mines in Canada, Mexico, Finland, and Australia. Agnico operated just one mine, LaRonde, as recently as 2008 before bringing its other mines online in rapid succession in the following years. It merged with Kirkland Lake Gold in 2022, acquiring the Detour Lake and Macassa mines in Canada along with the high-grade, low-cost Fosterville mine in Australia. It produced more than 3.4 million gold ounces in 2023 and had about 15 years of gold reserves at end 2023. Agnico Eagle is focused on increasing gold production in lower-risk jurisdictions and bought the remaining 50% of its Canadian Malartic mine along with the Wasamac project and other assets from Yamana Gold in 2023.

伊格爾礦業是一家擁有在加拿大、墨西哥、芬蘭和澳大利亞開採金礦的公司。自2008年以來,伊格爾礦業僅經營一座礦山LaRonde,隨後在接下來的幾年裏快速增加了其他礦山的開採。它於2022年與Kirkland Lake Gold合併,收購了加拿大Detour Lake和Macassa礦山以及澳大利亞高品位、低成本的Fosterville礦山。它在2023年生產超過340萬盎司黃金,並擁有約15年的黃金儲備。伊格爾礦業專注於在低風險的司法管轄區增加黃金產量,並在2023年從Yamana Gold收購了加拿大Malartic礦的剩餘50%,以及Wasamac項目和其他資產。

Following our analysis of the options activities associated with Agnico Eagle Mines, we pivot to a closer look at the company's own performance.

在分析了與伊格爾礦業相關的期權活動之後,我們轉而更近地關注公司自身的表現。

Where Is Agnico Eagle Mines Standing Right Now?

伊格爾礦業現在處於什麼位置?

- Currently trading with a volume of 1,347,450, the AEM's price is up by 1.97%, now at $79.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 68 days.

- 目前交易量爲1,347,450,伊格爾礦業的股價上漲了1.97%,現爲79.62美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計發佈收益數據還有68天。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Agnico Eagle Mines with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供更高的潛在利潤。精明的交易者通過持續教育、策略性的交易調整、利用各種因子以及關注市場動態來減輕這些風險。通過Benzinga Pro獲取伊格爾礦業最新的期權交易實時提醒。