Legendary Hedge Fund Coatue Buys Nvidia Stock Hand Over Fist, Ups Stake Nearly 10x

Legendary Hedge Fund Coatue Buys Nvidia Stock Hand Over Fist, Ups Stake Nearly 10x

In a move that solidifies its bullish stance on Nvidia Corp (NASDAQ:NVDA), legendary hedge fund Coatue Management LLC, led by Philippe Laffont, has dramatically increased its position in the chip giant.

在股票巨頭英偉達公司(納斯達克代碼:NVDA)看漲的立場得到堅實的支持,由菲利普·拉弗特(Philippe Laffont)帶領的傳奇對沖基金Coatue Management LLC大幅增加了在芯片巨頭的持股。

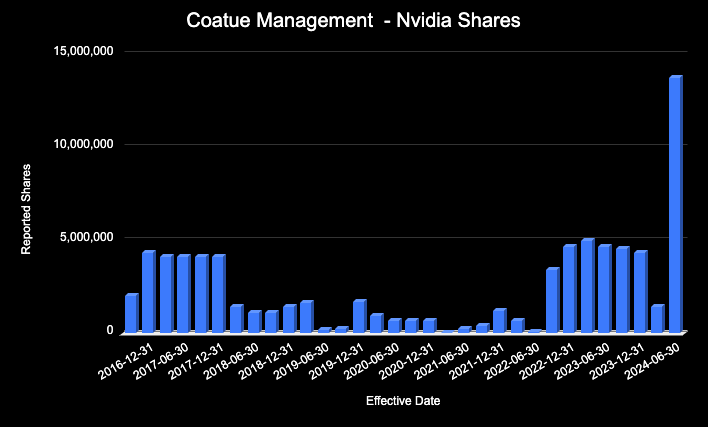

According to the latest 13F filings, Coatue boosted its stake in Nvidia by an eye-popping 893% during the second quarter of 2024. This substantial increase, from 1.39 million shares at the end of Q1 to a whopping 13.75 million shares by the end of Q2, underscores the fund's aggressive confidence in Nvidia's future prospects.

根據最新的13F提交,在2024年第二季度中,Coatue基金將其在英偉達公司的股份增加了驚人的893%。從第一季度末的139萬股到第二季度末的1,375萬股的實質性增加,凸顯了該基金對英偉達未來前景的積極信心。

Chart created by author using data from SEC 13F filings

作者使用SEC 13F提交的數據創建的圖表

Coatue's Mega-Buy: What's Behind The Move?

Coatue的大舉買入:背後的動因是什麼?

Coatue's massive stock purchase comes on the heels of Nvidia's continued dominance in the semiconductor industry, particularly in areas like artificial intelligence and high-performance computing. The firm's decision to nearly tenfold its stake, with an investment now valued at approximately $1.7 billion, is a bold testament to the belief that Nvidia's growth trajectory is far from slowing down.

Coatue基金大舉買入市值巨大的股票,剛好在英偉達在半導體行業,特別是在人工智能和高性能計算等領域繼續佔據主導地位後,這一行動顯示出該公司顯然對英偉達的增長軌跡有着堅定的信心。基金的決定是將其佔股數量將近增加了十倍,現在估值約爲17億美元,這是對英偉達長期增長的信念的大膽證明。

From Doubts To Dominance

從懷疑到佔據主導地位

Interestingly, Coatue had previously reduced its Nvidia holdings in earlier quarters, only to make a stunning reversal this time around. The dramatic shift from holding 1.39 million shares to 13.75 million shares marks one of the most significant strategic pivots for the fund in recent memory. The question now is whether this massive bet will pay off as Nvidia continues to ride the wave of AI and gaming demand.

有趣的是,Coatue此前曾在早期季度削減其英偉達股份,而這次則做出了驚人的反轉。持股從139萬股到1375萬股的巨大變動標誌着該基金近年來最重要的戰略轉型之一。現在問題是,隨着英偉達繼續乘坐人工智能和遊戲需求的浪潮,這筆巨大賭注是否會有回報。

Read Also: Nvidia's Rebound Rally Adds Billions To Market Value, Analysts Eye AI Growth: Report

另外一篇文章:英偉達的反彈行情爲市值增加數十億美元,分析師瞄準人工智能業務增長:報告

A Historic Move For Coatue

Coatue的歷史性舉動

This isn't just any increase; it's a historic one for Coatue. The 893% jump in ownership highlights the hedge fund's aggressive confidence in Nvidia's market leadership. With Nvidia being one of the primary beneficiaries of the AI boom, Coatue's move is clearly driven by expectations of sustained, long-term growth in the sector.

這不僅僅是增持,對於Coatue來說,這是歷史性的一次。持股增長893%突出了對沖基金在英偉達市場領導地位上的強烈信心。隨着英偉達成爲人工智能熱潮中的主要受益者之一,Coatue的舉動顯然是出於對該板塊長期增長的預期。

Nvidia: The Crown Jewel In Coatue's Portfolio?

英偉達:Coatue投資組合中的明珠?

With this move, Nvidia now constitutes a significant portion of Coatue's portfolio, accounting for 6.61% of the fund's total holdings. This is a massive increase from just 4.91% in the previous quarter, showcasing how the chipmaker has become a central piece of Coatue's investment strategy.

此舉後,英偉達現在成爲Coatue投資組合的一個重要組成部分,佔據該基金總持股比例的6.61%。這從之前的4.91%大幅增長,顯示出該芯片製造商已成爲Coatue投資策略的核心。

The Road Ahead

未來之路

While Coatue's bet on Nvidia is certainly bold, it's also calculated. Nvidia's leading position in key growth markets like AI, data centers, and gaming suggests that the stock could see even more upside in the coming months.

儘管Coatue在英偉達上的賭注顯然是大膽的,但也是有計算的。英偉達在人工智能、數據中心和遊戲等關鍵增長市場的領先地位表明,該股票在未來幾個月內還可能看到更多上漲。

For Coatue, this near-tenfold increase in stake might just be the beginning of an even bigger play on the tech giant's future.

對於Coatue來說,這種在持股上近十倍的增加可能只是玩弄科技巨頭未來更大賽局的開始。

- EXCLUSIVE: Which Magnificent 7 Stock Would Investors Put $1,000 In Today? 44% Of Benzinga Readers Pick This Company

- 獨家:投資者今天會將$1,000買進哪個科技七巨頭股票?44%的Benzinga讀者選了這家公司。

Photo: Shutterstock

Photo: shutterstock