Decoding TG Therapeutics's Options Activity: What's the Big Picture?

Decoding TG Therapeutics's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on TG Therapeutics.

擁有大量資金的鯨魚對TG Therapeutics持有明顯看好態度。

Looking at options history for TG Therapeutics (NASDAQ:TGTX) we detected 11 trades.

查看TG Therapeutics (納斯達克:TGTX) 期權歷史,我們檢測到11次交易。

If we consider the specifics of each trade, it is accurate to state that 63% of the investors opened trades with bullish expectations and 36% with bearish.

如果我們考慮每次交易的具體情況,準確地說,63%的投資者對看漲持有期權交易,36%的投資者持有看跌期權。

From the overall spotted trades, 2 are puts, for a total amount of $112,780 and 9, calls, for a total amount of $344,146.

從總體交易中,有2個看跌期權,總金額爲112,780美元,9個看漲期權,總金額爲344,146美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $35.0 for TG Therapeutics over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,過去3個月中鯨魚一直在瞄準TG Therapeutics的目標價區間在15.0美元至35.0美元之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

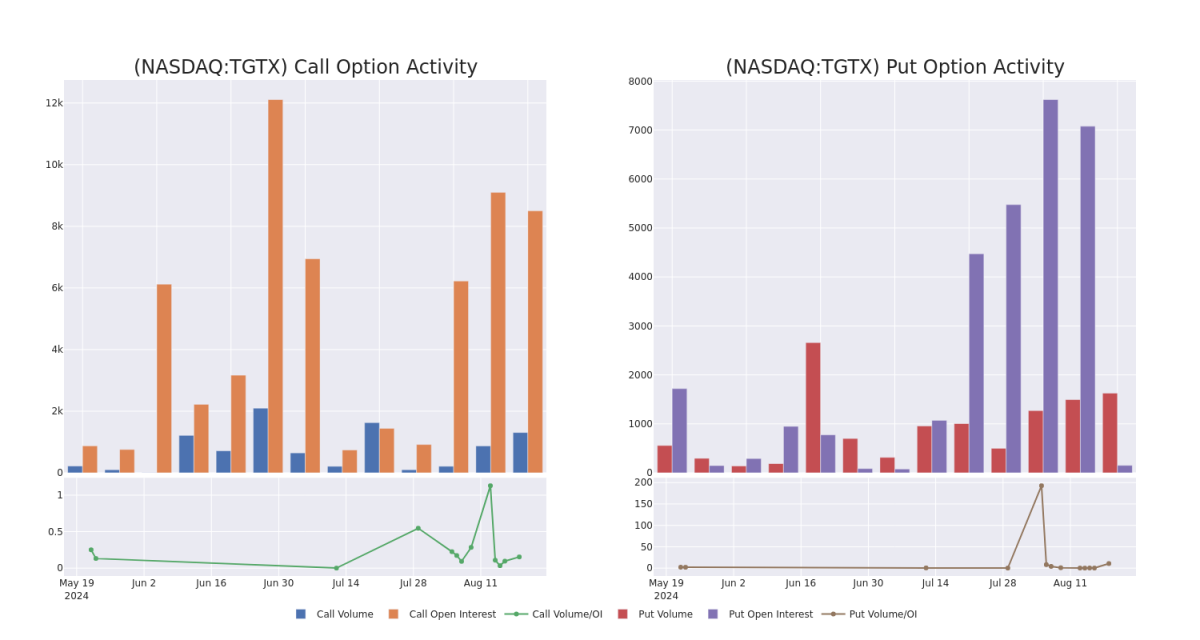

In terms of liquidity and interest, the mean open interest for TG Therapeutics options trades today is 1441.83 with a total volume of 2,936.00.

就流動性和利潤而言,今天TG Therapeutics期權交易的平均未平倉合約量爲1441.83,總成交量爲2,936.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for TG Therapeutics's big money trades within a strike price range of $15.0 to $35.0 over the last 30 days.

在下面的圖表中,我們能夠跟蹤過去30天TG Therapeutics大額期權交易中看漲期權和看跌期權的成交量和未平倉合約量在15.0美元至35.0美元的行權價格範圍內的發展情況。

TG Therapeutics Option Volume And Open Interest Over Last 30 Days

TG Therapeutics過去30天的期權成交量和未平倉合約量

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGTX | PUT | SWEEP | BEARISH | 09/20/24 | $2.15 | $1.25 | $1.25 | $21.00 | $70.0K | 152 | 628 |

| TGTX | CALL | TRADE | BULLISH | 01/17/25 | $7.5 | $7.3 | $7.5 | $20.00 | $52.5K | 5.6K | 171 |

| TGTX | CALL | SWEEP | BEARISH | 01/17/25 | $7.8 | $7.5 | $7.56 | $20.00 | $46.9K | 5.6K | 101 |

| TGTX | CALL | TRADE | BULLISH | 01/17/25 | $7.2 | $7.0 | $7.2 | $20.00 | $46.8K | 5.6K | 236 |

| TGTX | CALL | TRADE | BULLISH | 01/17/25 | $7.4 | $7.2 | $7.4 | $20.00 | $44.4K | 5.6K | 296 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGTX | 看跌 | SWEEP | 看淡 | 09/20/24 | $2.15 | $1.25 | $1.25 | 21.00美元 | $70.0K | 152 | 628 |

| TGTX | 看漲 | 交易 | 看好 | 01/17/25 | $7.5 | $7.3 | $7.5 | $20.00 | $52.5K | 5.6K | 171 |

| TGTX | 看漲 | SWEEP | 看淡 | 01/17/25 | $7.8 | $7.5 | $7.56 | $20.00 | $46.9K | 5.6K | 101 |

| TGTX | 看漲 | 交易 | 看好 | 01/17/25 | $7.2 | $7.0 | $7.2 | $20.00 | $46.8K | 5.6K | 236 |

| TGTX | 看漲 | 交易 | 看好 | 01/17/25 | $7.4 | $7.2 | $7.4 | $20.00 | $44.4千美元 | 5.6K | 296 |

About TG Therapeutics

關於TG Therapeutics

TG Therapeutics Inc is a fully integrated, commercial-stage, biopharmaceutical company focused on the acquisition, development, and commercialization of novel treatments for B-cell diseases. The company has received approval from the U.S. Food and Drug Administration (FDA) for BRIUMVI (ublituximab-xiiy) for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS). and the company is developing TG-1701 (BTK inhibitor) and TG-1801 (anti-CD47/CD19 bispecific mAb) for B-cell disorders which are under Phase 1 trial.

TG Therapeutics Inc是一家完全整合的商業化階段生物製藥公司,專注於收購、開發和商業化治療B細胞疾病的新療法。該公司已獲得美國食品和藥物管理局(FDA)批准,用於治療成人複發性多發性硬化症(RMS)的BRIUMVI(ublituximab-xiiy)。同時,該公司正在開發TG-1701(BTk抑制劑)和TG-1801(抗CD47/CD19的雙特異性mAb)用於治療B細胞疾病,目前處於一期臨床試驗。

Present Market Standing of TG Therapeutics

TG Therapeutics目前市場地位

- With a volume of 1,798,459, the price of TGTX is up 13.68% at $25.1.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 72 days.

- TGTX交易量爲1,798,459美元,價格上漲了13.68%,目前爲25.1美元。

- RSI指標暗示該股票可能要超買了。

- 下一次收益預期將在72天內發佈。

What The Experts Say On TG Therapeutics

關於TG Therapeutics的專家意見

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $34.333333333333336.

在過去的一個月中,有3位行業分析師分享了他們對這支股票的看法,並提出了一個平均目標價爲34.333333333333336美元。

- An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $49.

- Consistent in their evaluation, an analyst from B. Riley Securities keeps a Buy rating on TG Therapeutics with a target price of $34.

- An analyst from Goldman Sachs persists with their Neutral rating on TG Therapeutics, maintaining a target price of $20.

- HC Wainwright & Co.的一位分析師將其看漲評級下調爲買入,目標價爲49美元。

- 一位Riley Securities的分析師持續給TG Therapeutics買入評級,目標價爲34美元。

- 高盛的一名分析師繼續維持對TG Therapeutics的中立評級,維持價格目標爲20美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest TG Therapeutics options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在收益。精明的交易者通過不斷學習、改進策略、監控多種因子並密切關注市場動向來管理這些風險。通過Benzinga Pro了解TG Therapeutics期權實時交易提醒。

From the overall spotted trades, 2 are puts, for a total amount of $112,780 and 9, calls, for a total amount of $344,146.

From the overall spotted trades, 2 are puts, for a total amount of $112,780 and 9, calls, for a total amount of $344,146.