Unpacking the Latest Options Trading Trends in UnitedHealth Group

Unpacking the Latest Options Trading Trends in UnitedHealth Group

Investors with a lot of money to spend have taken a bullish stance on UnitedHealth Group (NYSE:UNH).

資金雄厚的投資者看好聯合健康集團(紐交所:UNH)。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.

無論是機構投資者還是富裕個人投資者,我們並不清楚。但是當UNH發生如此大的變動時,通常意味着有人知道即將發生什麼。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for UnitedHealth Group.

今天,財經新聞網站Benzinga的期權掃描器發現聯合健康集團的8筆非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

這些大資金交易者的總體情緒在62%看好和37%看淡之間。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $199,354, and 4 are calls, for a total amount of $471,004.

在我們發現的所有特殊期權中,有4個爲看跌期權,總金額爲199,354美元,有4個爲看漲期權,總金額爲471,004美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $505.0 to $590.0 for UnitedHealth Group over the last 3 months.

考慮到這些合約的成交量和持倉量,似乎在過去3個月中,大戶一直以505.0到590.0美元的價格區間爲目標。

Insights into Volume & Open Interest

成交量和持倉量分析

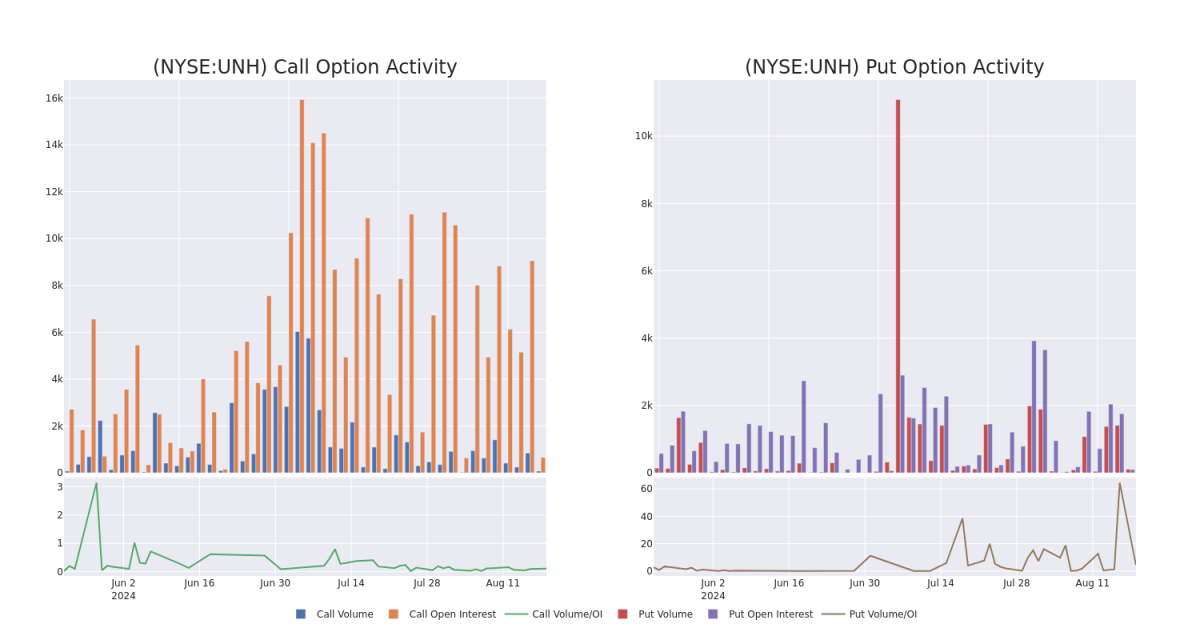

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale trades within a strike price range from $505.0 to $590.0 in the last 30 days.

查看期權的成交量和持倉量是一個有力的操作。這些數據可以幫助您追蹤聯合健康集團某一行權價格的期權流動性和興趣。下面,我們可以觀察在最近30天內,所有處於505.0到590.0美元行權價格區間的聯合健康集團的大戶交易中,看漲期權和看跌期權的成交量和持倉量的變化。

UnitedHealth Group 30-Day Option Volume & Interest Snapshot

聯合健康集團30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | SWEEP | BEARISH | 08/30/24 | $77.55 | $75.45 | $76.0 | $505.00 | $182.4K | 50 | 40 |

| UNH | CALL | SWEEP | BULLISH | 06/20/25 | $76.0 | $73.95 | $76.0 | $550.00 | $129.0K | 603 | 5 |

| UNH | CALL | SWEEP | BEARISH | 08/30/24 | $77.45 | $74.35 | $76.0 | $505.00 | $121.5K | 50 | 40 |

| UNH | PUT | SWEEP | BULLISH | 11/15/24 | $32.8 | $31.0 | $31.69 | $590.00 | $57.0K | 23 | 51 |

| UNH | PUT | TRADE | BULLISH | 11/15/24 | $33.2 | $30.9 | $31.66 | $590.00 | $56.9K | 23 | 33 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯合健康 | 看漲 | SWEEP | 看淡 | 08/30/2024 | $77.55 | $75.45 | $76.0 | $505.00應翻譯爲$505.00 | $182.4K | 50 | 40 |

| 聯合健康 | 看漲 | SWEEP | 看好 | 06/20/25 | $76.0 | $73.95 | $76.0 | $550.00 | $129.0K | 603 | 5 |

| 聯合健康 | 看漲 | SWEEP | 看淡 | 08/30/2024 | $77.45 | $74.35 | $76.0 | $505.00應翻譯爲$505.00 | $121.5K | 50 | 40 |

| 聯合健康 | 看跌 | SWEEP | 看好 | 11/15/24 | $32.8 | $31.0 | $31.69 | 590.00美元 | $57.0K | 23 | 51 |

| 聯合健康 | 看跌 | 交易 | 看好 | 11/15/24 | $33.2 | $30.9 | $31.66 | 590.00美元 | $56.9K | 23 | 33 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

聯合健康集團是全球最大的私人醫療保險提供商之一,爲包括2024年6月外美國的約5000萬會員提供醫療保障。作爲僱主贊助、自主選擇和政府支持的保險計劃的領導者,聯合健康在託管護理方面獲得了大規模的規模。除了其保險資產外,聯合健康繼續投資於其Optum公司,創造了一個醫療保健服務巨頭,涵蓋從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析。

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

根據聯合健康的最近期權歷史,現在適合關注公司本身。我們旨在探究它的當前表現。

Current Position of UnitedHealth Group

聯合健康集團的現狀

- With a trading volume of 104,421, the price of UNH is up by 0.35%, reaching $579.68.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 53 days from now.

- UNH的交易量爲104,421股,價格上漲0.35%,達到579.68美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次收益報告將在53天后發佈。

What Analysts Are Saying About UnitedHealth Group

關於聯合健康集團,分析師們都在說些什麼?

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $591.0.

過去30天中,共有1位專業分析師對該股票進行了評估,設定了平均目標價爲591.0美元。

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $591.

- Cantor Fitzgerald分析師將其行動下調爲超重,目標價爲591美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.