Analyzing Palantir Technologies In Comparison To Competitors In Software Industry

Analyzing Palantir Technologies In Comparison To Competitors In Software Industry

In today's rapidly changing and fiercely competitive business landscape, it is vital for investors and industry enthusiasts to carefully evaluate companies. In this article, we will perform a comprehensive industry comparison, evaluating Palantir Technologies (NYSE:PLTR) against its key competitors in the Software industry. By analyzing important financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company's performance within the industry.

在今天快速變化和競爭激烈的商業環境中,對投資者和行業愛好者來說,仔細評估公司是至關重要的。在本文中,我們將對Palantir Technologies進行綜合行業比較,評估其在軟件行業中的關鍵競爭對手。通過分析重要的財務指標、市場地位和增長前景,我們旨在爲投資者提供有價值的見解,同時揭示公司在行業中的表現。

Palantir Technologies Background

palantir科技簡介

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir是一家專注於利用數據創造客戶組織效率的分析軟件公司,該公司通過其Foundry和Gotham平台爲商業和政府客戶提供服務。總部位於丹佛的該公司成立於2003年,並於2020年上市。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Palantir Technologies Inc | 191.18 | 17.97 | 31.14 | 3.43% | $0.11 | $0.55 | 27.15% |

| Salesforce Inc | 47.73 | 4.31 | 7.30 | 2.57% | $2.6 | $6.97 | 10.74% |

| SAP SE | 91.94 | 5.56 | 7.17 | 2.1% | $1.94 | $6.02 | 9.72% |

| Adobe Inc | 50.69 | 16.82 | 12.58 | 10.38% | $2.19 | $4.71 | 10.24% |

| Intuit Inc | 61.30 | 9.89 | 11.90 | 13.4% | $3.34 | $5.67 | 11.95% |

| Synopsys Inc | 60.87 | 11.96 | 13.75 | 4.23% | $0.41 | $1.15 | 15.2% |

| Cadence Design Systems Inc | 73.05 | 18.12 | 18.50 | 5.86% | $0.38 | $0.92 | 8.61% |

| Workday Inc | 41.47 | 7.56 | 8.23 | 1.32% | $0.23 | $1.5 | 18.17% |

| Roper Technologies Inc | 41.10 | 3.25 | 9.01 | 1.88% | $0.69 | $1.19 | 12.12% |

| Autodesk Inc | 54.59 | 25.04 | 9.62 | 12.55% | $0.34 | $1.28 | 11.66% |

| Datadog Inc | 249.38 | 16.42 | 18.03 | 1.9% | $0.06 | $0.52 | 26.66% |

| AppLovin Corp | 36.67 | 35.20 | 7.60 | 39.35% | $0.51 | $0.8 | 43.98% |

| Ansys Inc | 57.76 | 5.11 | 12.32 | 2.37% | $0.2 | $0.52 | 19.64% |

| Tyler Technologies Inc | 120 | 7.90 | 12.30 | 2.2% | $0.12 | $0.24 | 7.28% |

| PTC Inc | 71.98 | 7.03 | 9.58 | 2.32% | $0.13 | $0.41 | -4.37% |

| Zoom Video Communications Inc | 22.07 | 2.23 | 4.08 | 2.65% | $0.23 | $0.87 | 3.25% |

| Manhattan Associates Inc | 79.19 | 66.11 | 16.28 | 21.98% | $0.07 | $0.15 | 14.85% |

| Bentley Systems Inc | 43.72 | 15.44 | 13.04 | 7.52% | $0.1 | $0.27 | 11.32% |

| Dynatrace Inc | 96.02 | 7.19 | 10.02 | 1.89% | $0.06 | $0.32 | 19.93% |

| Average | 72.2 | 14.73 | 11.18 | 7.58% | $0.76 | $1.86 | 13.94% |

| 公司 | 市銷率P/S | 淨資產收益率ROE | 息稅前收入EBITDA (以十億計) | 毛利潤 (以十億計) | 營收增長 | CrowdStrike Holdings Inc (847.84) | 營業收入增長 |

|---|---|---|---|---|---|---|---|

| palantir科技公司 | $191.18 | 17.97 | 31.14 | 3.43% | $0.11 | $0.55 | 27.15% |

| Salesforce 公司 | 91.94 | 4.31 | 7.30 | 2.57% | $2.6 | $6.97 | 10.74% |

| sap se | 50.69 | 5.56 | 7.17 | 2.1% | $1.94每股 | $6.02 | 9.72% |

| adobe 公司 | 16.82 | 12.58 | 10.38% | $2.19 | $4.71 | 10.24% | |

| Intuit 公司 | 61.30 | 9.89 | 11.90 | 13.4% | 3.34美元 | $5.67 | 11.95% |

| Synopsys 公司 | 60.87 | 11.96 | 13.75 | 4.23% | $0.41 | $1.15 | 15.2% |

| 鏗騰電子股份有限公司 | 249.38 | 18.12 | 18.50 | 5.86% | $0.38 | 0.92美元 | 8.61% |

| Workday公司 | 41.47 | 7.56 | 8.23 | 1.32% | $0.23 | $1.5 | 18.17% |

| 儒博實業股份有限公司 | 71.98 | 3.25 | 9.01 | 1.88% | $0.69 | $1.19 | 12.12% |

| 歐特克公司 | 79.19 | 25.04 | 9.62 | 12.55% | $0.34 | $1.28 | 11.66% |

| datadog | 16.42 | 18.03 | 1.9% | 0.06美元 | 0.52美元 | 26.66% | |

| AppLovin公司 | 36.67 | 35.20 | 7.60 | 39.35% | $0.51 | $0.8 | 43.98% |

| 安澤斯公司 | 5.11 | 12.32 | 2.37% | $0.2 | 0.52美元 | 19.64% | |

| Tyler Technologies公司 | 120 | 7.90 | 12.30 | 2.2% | $0.12 | 0.24美元 | 7.28% |

| PTC公司 | 第七條 其他協議 | 9.58 | 2.32% | 0.13元 | $0.41 | -4.37% | |

| zoom視頻通訊公司 | 22.07 | 2.23 | 4.08 | 2.65% | $0.23 | $0.87 | 3.25% |

| Manhattan Associates公司 | 79.19 | 16.28 | 21.98% | 0.07美元 | 0.15美元 | 14.85% | |

| Bentley Systems公司 | 15.44 | 13.04 | 7.52% | 0.1美元 | $0.27 | 11.32% | |

| dynatrace公司 | 96.02 | 7.19 | 10.02 | 1.89% | 0.06美元 | 0.32美元 | 19.93% |

| 平均值 | 6,652,787 | 14.73 | 11.18 | 7.58% | $0.76 | $1.86 | 13.94% |

After a detailed analysis of Palantir Technologies, the following trends become apparent:

Notably, the current Price to Earnings ratio for this stock, 191.18, is 2.65x above the industry norm, reflecting a higher valuation relative to the industry.

The elevated Price to Book ratio of 17.97 relative to the industry average by 1.22x suggests company might be overvalued based on its book value.

The stock's relatively high Price to Sales ratio of 31.14, surpassing the industry average by 2.79x, may indicate an aspect of overvaluation in terms of sales performance.

The Return on Equity (ROE) of 3.43% is 4.15% below the industry average, suggesting potential inefficiency in utilizing equity to generate profits.

Compared to its industry, the company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $110 Million, which is 0.14x below the industry average, potentially indicating lower profitability or financial challenges.

The gross profit of $550 Million is 0.3x below that of its industry, suggesting potential lower revenue after accounting for production costs.

The company is experiencing remarkable revenue growth, with a rate of 27.15%, outperforming the industry average of 13.94%.

Debt To Equity Ratio

債務權益比率

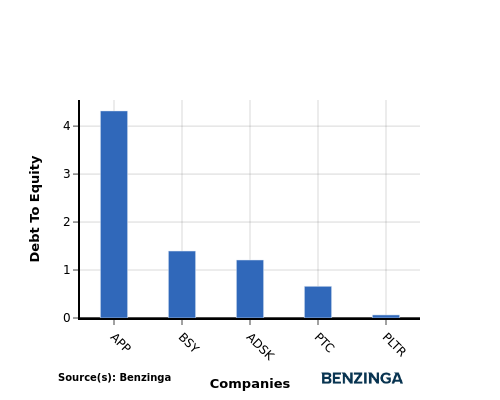

The debt-to-equity (D/E) ratio helps evaluate the capital structure and financial leverage of a company.

債務權益比率有助於評估公司的資本結構和財務槓桿。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行業比較中考慮債務權益比率可以簡明地評估公司的財務狀況和風險特徵,有助於投資者做出明智的決策。

When examining Palantir Technologies in comparison to its top 4 peers with respect to the Debt-to-Equity ratio, the following information becomes apparent:

Compared to its top 4 peers, Palantir Technologies has a stronger financial position indicated by its lower debt-to-equity ratio of 0.06.

This suggests that the company relies less on debt financing and has a more favorable balance between debt and equity, which can be seen as a positive attribute by investors.

與其前四大同行相比,Palantir Technologies的財務狀況更強,體現在其較低的0.06的債務-權益比。

這表明公司對債務融資的依賴較少,債務和股本之間的平衡更爲有利,這可視爲投資者的正面屬性。

Key Takeaways

要點

For Palantir Technologies, the PE, PB, and PS ratios are all high compared to its peers in the Software industry, indicating potentially overvalued stock. On the other hand, the low ROE, EBITDA, and gross profit suggest lower profitability levels compared to industry peers. However, the high revenue growth rate may indicate potential for future growth and market expansion.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。