Check Out What Whales Are Doing With WBA

Check Out What Whales Are Doing With WBA

Benzinga's options scanner just detected over 11 options trades for Walgreens Boots Alliance (NASDAQ:WBA) summing a total amount of $612,543.

Benzinga的期權掃描器剛剛檢測到了11個沃爾格林-聯合博姿(納斯達克:WBA)期權交易,總金額爲612,543美元。

At the same time, our algo caught 3 for a total amount of 145,588.

同時,我們的量化工具捕捉到了3個交易,總金額爲145,588美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $15.0 for Walgreens Boots Alliance over the recent three months.

根據交易活動,顯然重要的投資者瞄準沃爾格林-聯合博姿的價格區間從2.5美元到15.0美元,在最近三個月內。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

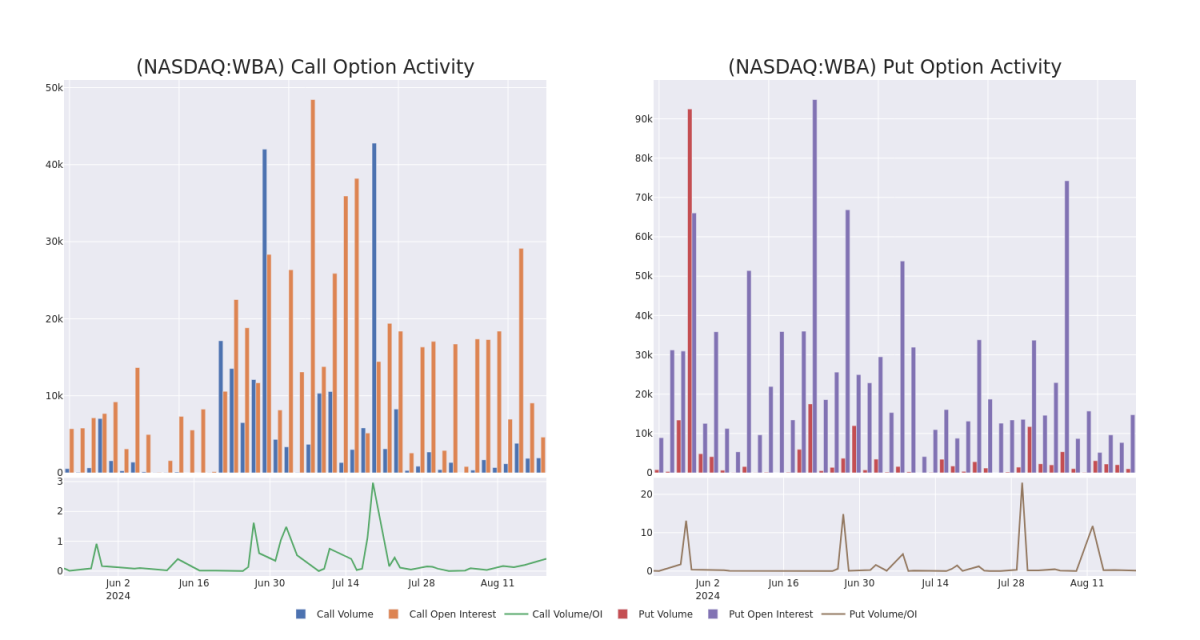

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walgreens Boots Alliance's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walgreens Boots Alliance's significant trades, within a strike price range of $2.5 to $15.0, over the past month.

研究成交量和持倉量爲股票研究提供至關重要的見解。這些信息對於評估沃爾格林-聯合博姿在某些行使價格上期權的流動性和利益水平至關重要。下面,我們介紹了過去一個月內(行使價格區間從2.5美元到15.0美元),沃爾格林-聯合博姿的期權認購和認沽的成交量和持倉量趨勢的快照。

Walgreens Boots Alliance Call and Put Volume: 30-Day Overview

沃爾格林-聯合博姿看漲期權和看跌期權成交量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBA | CALL | SWEEP | BULLISH | 04/17/25 | $3.7 | $3.6 | $3.7 | $7.50 | $110.6K | 10 | 778 |

| WBA | CALL | SWEEP | BULLISH | 04/17/25 | $3.65 | $3.6 | $3.65 | $7.50 | $108.4K | 10 | 302 |

| WBA | CALL | SWEEP | BULLISH | 06/20/25 | $3.8 | $3.7 | $3.8 | $7.50 | $106.4K | 3.8K | 127 |

| WBA | PUT | SWEEP | BULLISH | 01/16/26 | $2.0 | $1.93 | $1.93 | $10.00 | $86.4K | 7.8K | 730 |

| WBA | CALL | TRADE | BEARISH | 01/17/25 | $5.75 | $5.7 | $5.6 | $5.00 | $56.0K | 95 | 100 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 沃爾格林-聯合博姿 | 看漲 | SWEEP | 看好 | 04/17/25 | $3.7 | $3.6 | $3.7 | $7.50 | $110.6K | 10 | 778 |

| 沃爾格林-聯合博姿 | 看漲 | SWEEP | 看好 | 04/17/25 | $3.65 | $3.6 | $3.65 | $7.50 | $108.4K | 10 | 302 |

| 沃爾格林-聯合博姿 | 看漲 | SWEEP | 看好 | 06/20/25 | $3.8 | $3.7 | $3.8 | $7.50 | $106.4K | 3.8K | 127 |

| 沃爾格林-聯合博姿 | 看跌 | SWEEP | 看好 | 01/16/26 | $2.0 | $1.93 | $1.93 | $10.00 | $86.4K | 7.8千 | 730 |

| 沃爾格林-聯合博姿 | 看漲 | 交易 | 看淡 | 01/17/25 | $5.75 | $5.7 | $5.6 | $5.00。 | $56.0K | 95 | 100 |

About Walgreens Boots Alliance

關於沃爾格林-聯合博姿

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the US, with over 8,500 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the US. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider.

沃爾格林-聯合博姿是美國最大的零售藥店之一,擁有超過8,500個門店。接近三分之一的美國人住在距離Walgreens門店5英里以內的地方。大約三分之二的營收來自處方藥銷售;Walgreens在美國總處方藥收入中佔20%。Walgreens還從零售產品(一般的健康消費品和其自有品牌商品)、歐洲藥品批發和醫療保健中獲得銷售額。隨着更多門店增加額外服務,例如健康角和村莊醫療,沃爾格林爲患者創造了全渠道的體驗,定位自己爲一站式醫療保健服務提供商。

Having examined the options trading patterns of Walgreens Boots Alliance, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了沃爾格林-聯合博姿的期權交易模式後,我們的關注點現在直接轉向了該公司。這種轉變使我們能夠深入探討其現有的市場地位和業績。

Current Position of Walgreens Boots Alliance

沃爾格林-聯合博姿的當前位置

- Currently trading with a volume of 5,279,385, the WBA's price is down by -1.34%, now at $10.71.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 51 days.

- WBA的成交量爲5,279,385,價格下跌了-1.34%,目前爲10.71美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計業績發佈還有51天。

What Analysts Are Saying About Walgreens Boots Alliance

關於沃爾格林-聯合博姿的分析師觀點

In the last month, 1 experts released ratings on this stock with an average target price of $7.0.

上個月,有1位專家發佈了對這隻股票的評級,平均目標價爲7.0美元。

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Walgreens Boots Alliance, targeting a price of $7.

- 巴克萊銀行的分析師仍然持有沃爾格林-聯合博姿的「輕倉」評級,目標價格爲7美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walgreens Boots Alliance with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子並密切關注市場動態來減輕這些風險。使用Benzinga Pro進行實時警報,了解沃爾格林-聯合博姿的最新期權交易。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walgreens Boots Alliance's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walgreens Boots Alliance's options at certain strike prices. Below, we present a snapshot of the