Smart Money Is Betting Big In BKNG Options

Smart Money Is Betting Big In BKNG Options

Financial giants have made a conspicuous bearish move on Booking Holdings. Our analysis of options history for Booking Holdings (NASDAQ:BKNG) revealed 34 unusual trades.

Delving into the details, we found 32% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 18 were puts, with a value of $1,101,854, and 16 were calls, valued at $2,072,572.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2310.0 and $5600.0 for Booking Holdings, spanning the last three months.

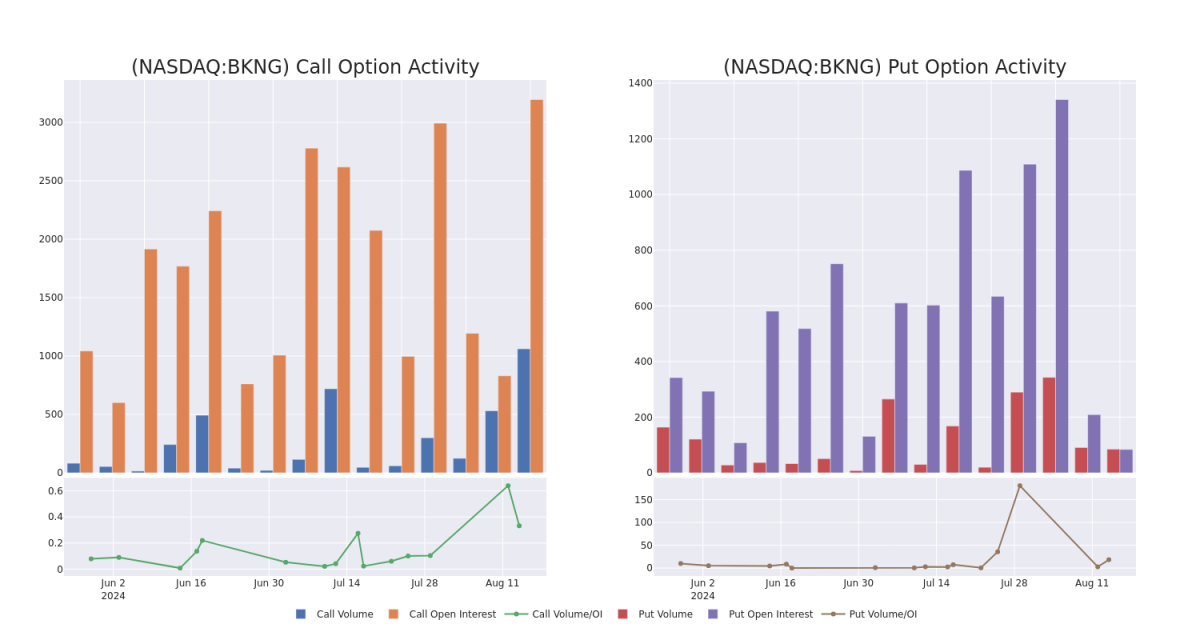

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Booking Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Booking Holdings's significant trades, within a strike price range of $2310.0 to $5600.0, over the past month.

Booking Holdings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | TRADE | BULLISH | 01/17/25 | $1439.4 | $1420.9 | $1432.0 | $2310.00 | $716.0K | 28 | 5 |

| BKNG | CALL | TRADE | BULLISH | 08/30/24 | $63.0 | $50.6 | $62.9 | $3700.00 | $314.5K | 23 | 1 |

| BKNG | PUT | TRADE | NEUTRAL | 09/20/24 | $1904.9 | $1885.0 | $1894.91 | $5600.00 | $189.4K | 0 | 0 |

| BKNG | PUT | TRADE | BEARISH | 08/30/24 | $51.6 | $43.6 | $51.5 | $3670.00 | $154.5K | 2 | 30 |

| BKNG | CALL | TRADE | BEARISH | 08/30/24 | $76.9 | $67.0 | $71.0 | $3670.00 | $142.0K | 25 | 70 |

About Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

In light of the recent options history for Booking Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Booking Holdings Standing Right Now?

- Currently trading with a volume of 40,245, the BKNG's price is down by 0.0%, now at $3702.45.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 71 days.

Professional Analyst Ratings for Booking Holdings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $4023.0.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Booking Holdings with a target price of $4105.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Booking Holdings, targeting a price of $4200.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Booking Holdings, targeting a price of $3860.

- An analyst from B of A Securities has decided to maintain their Neutral rating on Booking Holdings, which currently sits at a price target of $3750.

- An analyst from Oppenheimer persists with their Outperform rating on Booking Holdings, maintaining a target price of $4200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.