D.R. Horton Unusual Options Activity For August 21

D.R. Horton Unusual Options Activity For August 21

High-rolling investors have positioned themselves bullish on D.R. Horton (NYSE:DHI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DHI often signals that someone has privileged information.

高風險投資者看好霍頓房屋(紐交所:DHI),散戶交易者需要關注。通過親測 BZD 掌握的公開期權數據,我們今天了解到這一活動。這些投資者的身份尚不確定,但對 DHI 的如此重大交易通常意味着有人擁有內部信息。

Today, Benzinga's options scanner spotted 17 options trades for D.R. Horton. This is not a typical pattern.

今天,BZD 的期權掃描工具發現了 17 筆霍頓房屋的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 52% bullish and 35% bearish. Among all the options we identified, there was one put, amounting to $47,600, and 16 calls, totaling $1,056,708.

這些主要交易者的情緒分歧,看漲佔 52%,看淡佔 35%。我們發現了所有期權中的一個看跌,金額爲 $47,600,和 16 筆看漲,總計 $1,056,708。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for D.R. Horton, spanning the last three months.

經過對成交量和未平倉合約的評估,明顯可見,主要市場動能關注霍頓房屋的價格區間在$135.0和$190.0之間,涵蓋了過去三個月的時間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

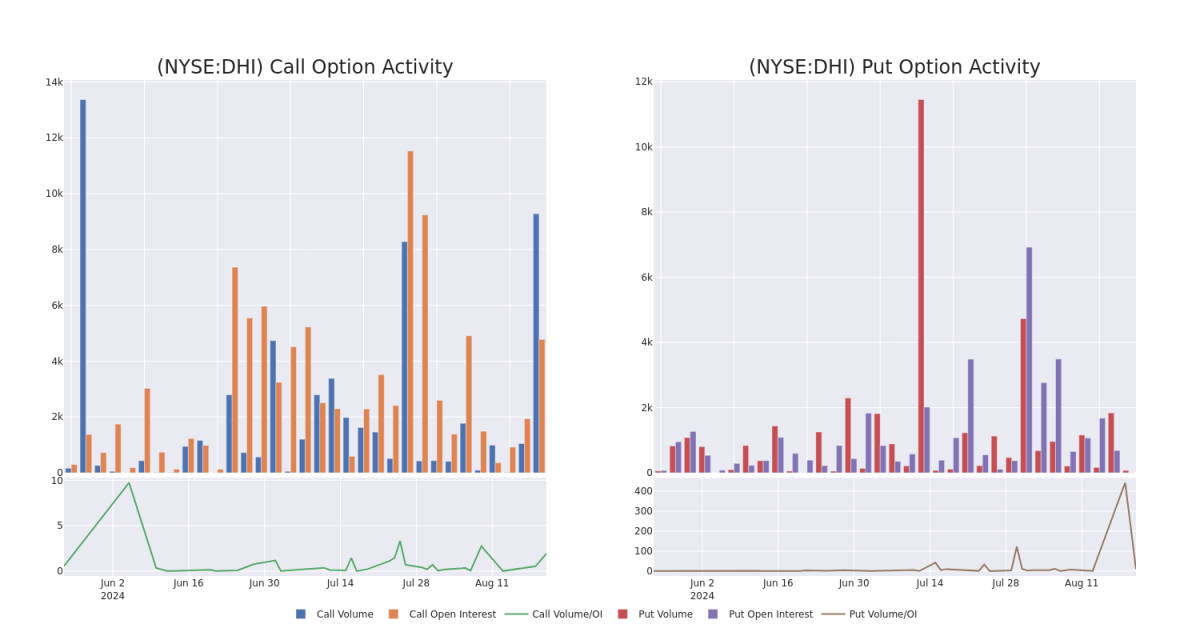

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for D.R. Horton's options for a given strike price.

這些數據可以幫助您追蹤給定行權價下霍頓房屋期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of D.R. Horton's whale activity within a strike price range from $135.0 to $190.0 in the last 30 days.

下面我們可以觀察到過去30天內霍頓房屋所有看漲和看跌期權的成交量和持倉量的變化,其行權價格範圍從$135.0到$190.0。

D.R. Horton Option Activity Analysis: Last 30 Days

霍頓房屋期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHI | CALL | SWEEP | BULLISH | 08/23/24 | $6.6 | $6.5 | $6.6 | $180.00 | $310.2K | 780 | 542 |

| DHI | CALL | SWEEP | BULLISH | 08/30/24 | $4.0 | $3.7 | $3.9 | $185.00 | $116.5K | 282 | 1.7K |

| DHI | CALL | SWEEP | BULLISH | 08/30/24 | $3.7 | $3.4 | $3.51 | $185.00 | $109.2K | 282 | 1.2K |

| DHI | CALL | SWEEP | BEARISH | 08/30/24 | $3.4 | $3.2 | $3.4 | $185.00 | $76.7K | 282 | 424 |

| DHI | CALL | SWEEP | BULLISH | 09/20/24 | $4.0 | $3.7 | $4.0 | $190.00 | $60.0K | 1.5K | 156 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHI | 看漲 | SWEEP | 看好 | 08/23/24 | 6.6 | $6.5 | 6.6 | 180.00美元 | $60.0K | 780 | 542 |

| DHI | 看漲 | SWEEP | 看好 | 08/30/2024 | $4.0 | $3.7 | $3.9 | $185.00 | 保持立場,Keefe, Bruyette & Woods的分析師繼續持有霍頓房屋的強於大市的評級,目標價爲208美元。 | 282 | 1.7K |

| DHI | 看漲 | SWEEP | 看好 | 08/30/2024 | $3.7 | $3.4 | $3.51 | $185.00 | $109.2K | 282 | 1.2K |

| DHI | 看漲 | SWEEP | 看淡 | 08/30/2024 | $3.4 | $3.2 | $3.4 | $185.00 | $76.7K | 282 | 424 |

| DHI | 看漲 | SWEEP | 看好 | 09/20/24 | $4.0 | $3.7 | $4.0 | $190.00 | $60.0K | 1.5K | 156 |

About D.R. Horton

關於D.R. Horton

D.R. Horton is a leading homebuilder in the United States with operations in 118 markets across 33 states. D.R. Horton mainly builds single-family detached homes (over 90% of home sales revenue) and offers products to entry-level, move-up, luxury buyers, and active adults. The company offers homebuyers mortgage financing and title agency services through its financial services segment. D.R. Horton's headquarters are in Arlington, Texas, and it manages six regional segments across the United States.

After a thorough review of the options trading surrounding D.R. Horton, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of D.R. Horton

D.R. Horton的當前位置

- With a trading volume of 1,187,179, the price of DHI is up by 3.38%, reaching $185.68.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 76 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個業績發佈時間爲76天后。

Expert Opinions on D.R. Horton

D.R. Horton的專家意見

2 market experts have recently issued ratings for this stock, with a consensus target price of $194.0.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Outperform rating for D.R. Horton, targeting a price of $208.

- An analyst from JP Morgan persists with their Neutral rating on D.R. Horton, maintaining a target price of $180.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for D.R. Horton, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for D.R. Horton, spanning the last three months.