Constellation Energy's Options: A Look at What the Big Money Is Thinking

Constellation Energy's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Constellation Energy.

有大量資金可投入的鯨魚對Constellation Energy持着明顯看淡的態度。

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 12 trades.

查看Constellation Energy (納斯達克: CEG) 的期權交易歷史,我們發現了12次交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 75% with bearish.

如果考慮每個交易的具體情況,可以準確地說,有25%的投資者以看好期望來開倉,75%以看淡爲主。

From the overall spotted trades, 3 are puts, for a total amount of $304,050 and 9, calls, for a total amount of $719,478.

從總體來看,我們發現了3次看跌期權交易,總金額爲304,050美元,以及9次看漲期權交易,總金額爲719,478美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $175.0 and $240.0 for Constellation Energy, spanning the last three months.

經過成交量和持倉量的分析,明顯發現主要的市場操縱者將目光聚焦於Constellation Energy的價格區間在175.0美元到240.0美元之間,該價格區間歷時三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Constellation Energy's options for a given strike price.

這些數據可以幫助您跟蹤星座能源期權在給定行權價下的流動性和利益。

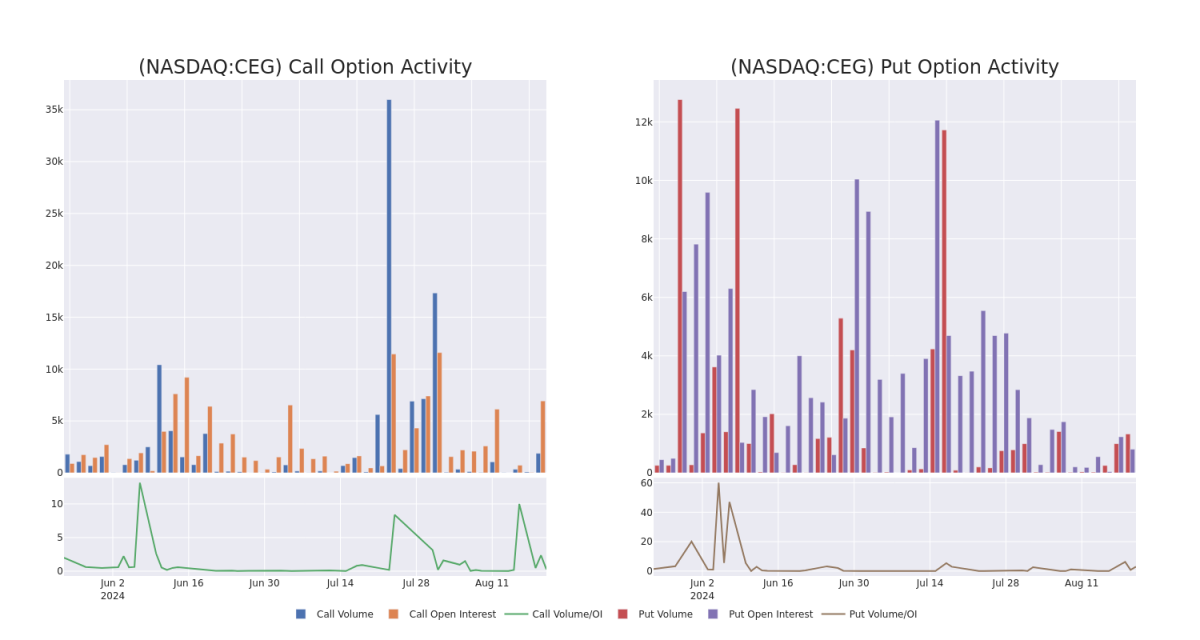

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Constellation Energy's whale activity within a strike price range from $175.0 to $240.0 in the last 30 days.

下面,我們可以觀察星座能源所有鯨魚活動中,看漲和看跌期權的成交量和未平倉量的變化,其行權價範圍爲$175.0到$240.0,在過去30天內。

Constellation Energy Option Volume And Open Interest Over Last 30 Days

Constellation Energy在過去30天中的期權成交量和持倉量。

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 01/16/26 | $28.7 | $27.7 | $27.8 | $240.00 | $278.0K | 38 | 100 |

| CEG | PUT | SWEEP | BULLISH | 11/15/24 | $12.7 | $12.5 | $12.5 | $190.00 | $187.5K | 338 | 152 |

| CEG | CALL | TRADE | BEARISH | 11/15/24 | $12.2 | $11.7 | $11.8 | $210.00 | $142.7K | 3.0K | 238 |

| CEG | CALL | SWEEP | BEARISH | 11/15/24 | $12.4 | $11.9 | $11.9 | $210.00 | $103.5K | 3.0K | 117 |

| CEG | PUT | SWEEP | BEARISH | 09/20/24 | $1.75 | $1.6 | $1.75 | $175.00 | $76.8K | 468 | 474 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看漲 | 交易 | 看淡 | 01/16/26 | $28.7 | $27.7 | $27.8 | $240.00 | $278.0K | 38 | 100 |

| CEG | 看跌 | SWEEP | 看好 | 11/15/24 | $12.7 | $12.5 | $12.5 | $190.00 | $187.5K | 338 | 152 |

| CEG | 看漲 | 交易 | 看淡 | 11/15/24 | $12.2 | $11.7 | $11.8 | 目標股價爲$210.00。 | $142.7K | 3.0K | 238 |

| CEG | 看漲 | SWEEP | 看淡 | 11/15/24 | $12.4 | $11.9 | $11.9 | 目標股價爲$210.00。 | $103.5千美元 | 3.0K | 117 |

| CEG | 看跌 | SWEEP | 看淡 | 09/20/24 | $1.75 | $1.6 | $1.75 | $175.00 | $76.8K | 468 | 474 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Constellation Energy Corp提供能源解決方案。它爲家庭、企業、公共部門、社區集合體和各種批發客戶(如市政當局、合作社和其他戰略客戶)提供清潔能源和可持續解決方案。公司爲各種規模的企業提供綜合能源解決方案和各種定價選項,包括電力、天然氣和可再生能源產品。

Current Position of Constellation Energy

Constellation Energy的當前位置

- With a volume of 864,106, the price of CEG is up 2.88% at $196.21.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

- RSI指標暗示該股票可能要超買了。

- 下次盈利預計在75天內公佈。

What Analysts Are Saying About Constellation Energy

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.5.

- An analyst from Barclays has revised its rating downward to Overweight, adjusting the price target to $211.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $212.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Constellation Energy, targeting a price of $189.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Constellation Energy, targeting a price of $230.

- 艾佛裏公司的一位分析師繼續持有對Constellation Energy的跑贏大盤評級,目標價爲212美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易員通過不斷教育自己,調整策略,監控多個指標,並密切關注市場變動來管理這些風險。通過Benzinga Pro及時獲得Constellation Energy期權交易的最新信息。