Behind the Scenes of AppLovin's Latest Options Trends

Behind the Scenes of AppLovin's Latest Options Trends

Financial giants have made a conspicuous bearish move on AppLovin. Our analysis of options history for AppLovin (NASDAQ:APP) revealed 11 unusual trades.

金融巨頭在AppLovin上採取了明顯的看淡策略。我們對AppLovin(納斯達克:APP)期權歷史進行了分析,發現了11筆異常交易。

Delving into the details, we found 18% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $57,200, and 9 were calls, valued at $2,315,850.

深入研究後,我們發現18%的交易員看好,而63%表現出看淡傾向。我們發現的所有交易中,有2筆看跌期權,價值57,200美元,而有9筆看漲期權,價值2,315,850美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $115.0 for AppLovin over the recent three months.

根據交易活動,顯然重要投資者們對AppLovin的價位區間瞄準在65.0美元至115.0美元之間,這種趨勢持續了近三個月。

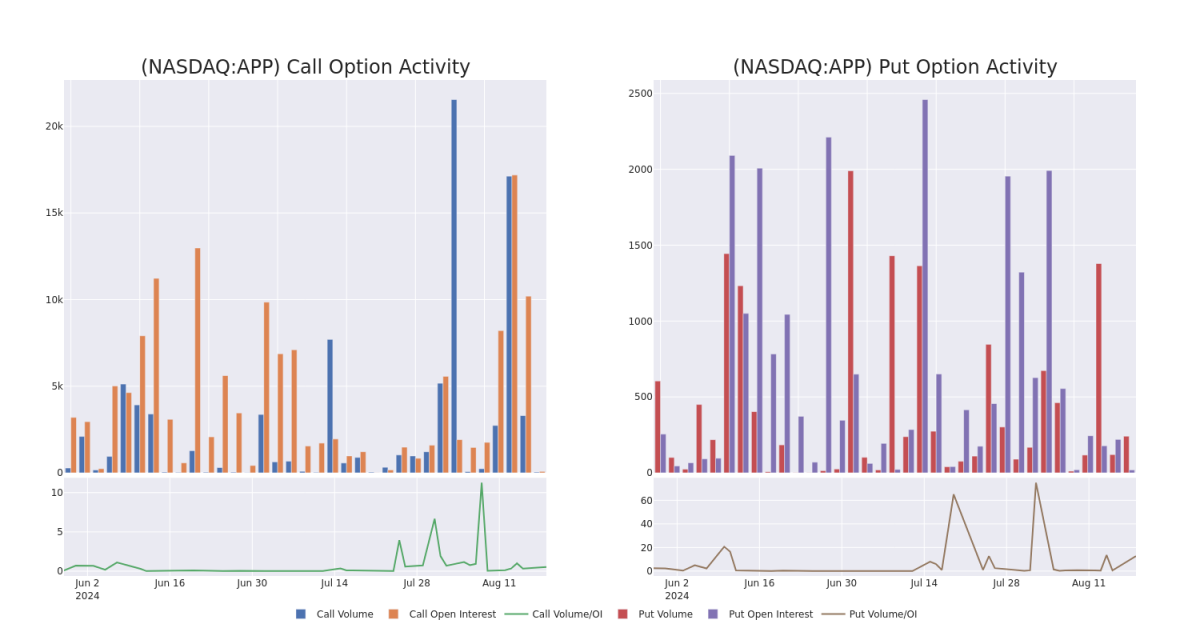

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AppLovin's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AppLovin's significant trades, within a strike price range of $65.0 to $115.0, over the past month.

通過分析成交量和持倉量,可以提供關鍵的股票研究洞察。這些信息對於評估AppLovin在特定行權價格下的期權流動性和利益水平非常重要。以下是AppLovin重要交易的成交量和持倉量趨勢的快照,涵蓋了過去一個月內65.0美元至115.0美元的行權價區間內的看漲期權和看跌期權。

AppLovin Option Volume And Open Interest Over Last 30 Days

AppLovin在過去30天內的期權成交量和未平倉合約數

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | SWEEP | BEARISH | 03/21/25 | $14.6 | $14.1 | $14.1 | $92.50 | $611.9K | 0 | 434 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $14.6 | $14.3 | $14.3 | $90.00 | $607.7K | 78 | 425 |

| APP | CALL | TRADE | BEARISH | 03/21/25 | $7.9 | $7.5 | $7.5 | $110.00 | $562.5K | 0 | 750 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $14.4 | $14.1 | $14.1 | $90.00 | $352.5K | 78 | 675 |

| APP | CALL | TRADE | BEARISH | 09/20/24 | $2.15 | $2.0 | $2.02 | $95.00 | $40.4K | 1.3K | 274 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 應用程序 | 看漲 | SWEEP | 看淡 | 03/21/25 | 14.6美元 | $14.1 | $14.1 | 92.50美元 | $611.9K | 0 | 434 |

| 應用程序 | 看漲 | SWEEP | 看淡 | 02/21/25 | 14.6美元 | $14.3 | $14.3 | $90.00 | Wedbush分析師保持既有立場,對AppLovin持有Outperform評級,並設定價格爲90美元。 | 78 | 425 |

| 應用程序 | 看漲 | 交易 | 看淡 | 03/21/25 | $7.9 | $7.5 | $7.5 | $110.00 | 0 | 750 | |

| 應用程序 | 看漲 | SWEEP | 看淡 | 02/21/25 | 14.4美元 | $14.1 | $14.1 | $90.00 | 78 | 675 | |

| 應用程序 | 看漲 | 交易 | 看淡 | 09/20/24 | $2.15 | $2.0 | $2.02 | $ 95.00 | $40.4K | 1.3K | 274 |

About AppLovin

關於AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

AppLovin Corp是一家移動應用程序技術公司,專注於通過支持移動應用程序開發人員的成功來增長移動應用程序生態系統。該公司的軟件解決方案爲移動應用程序開發人員提供工具,通過自動化和優化其應用程序的營銷和貨幣化來增長他們的業務。

Where Is AppLovin Standing Right Now?

AppLovin現在的狀態如何?

- Currently trading with a volume of 1,980,608, the APP's price is up by 3.32%, now at $89.45.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 77 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預期的收益發布還有77天。

What Analysts Are Saying About AppLovin

3 market experts have recently issued ratings for this stock, with a consensus target price of $98.33333333333333.

3位市場專家最近對這隻股票發表了評級,共識目標價爲98.33333333333333美元。

- An analyst from Oppenheimer downgraded its action to Outperform with a price target of $105.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for AppLovin, targeting a price of $90.

- An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $100.

- Wedbush的一位分析師調低了評級至跑贏大盤,將價格目標設定爲$100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但同時也提供了更高的利潤潛力。精明的交易者通過持續教育,策略性的交易調整,利用各種因子和關注市場動態來減輕這些風險。通過Benzinga Pro獲取AppLovin的最新期權交易,以獲得實時警報。