Does Chewy (NYSE:CHWY) Deserve A Spot On Your Watchlist?

Does Chewy (NYSE:CHWY) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Chewy (NYSE:CHWY). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Chewy with the means to add long-term value to shareholders.

Chewy's Improving Profits

In the last three years Chewy's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Chewy's EPS shot up from US$0.13 to US$0.19; a result that's bound to keep shareholders happy. That's a fantastic gain of 50%.

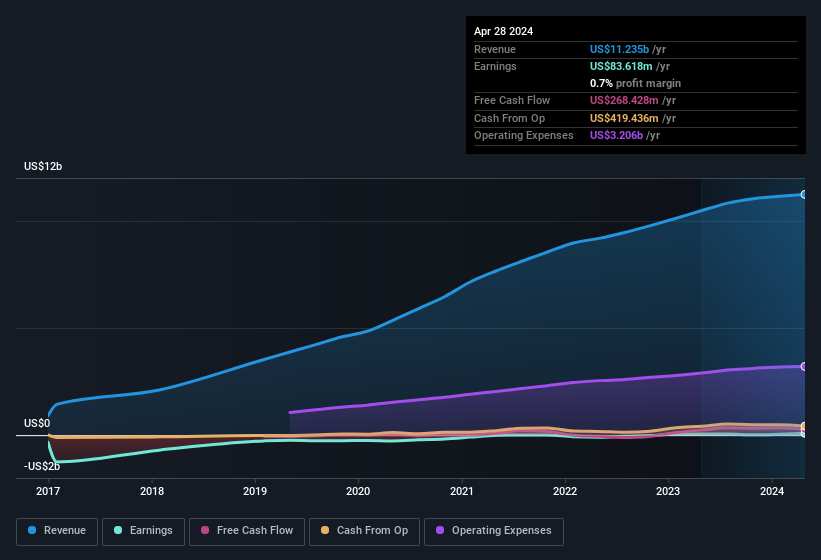

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Chewy achieved similar EBIT margins to last year, revenue grew by a solid 7.3% to US$11b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Chewy.

Are Chewy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Chewy in the last 12 months. Even better, though, is that the Independent Director, James Star, bought a whopping US$551k worth of shares, paying about US$19.95 per share, on average. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, it's good to see that Chewy insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$318m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Does Chewy Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Chewy's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. You still need to take note of risks, for example - Chewy has 2 warning signs we think you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Chewy isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.