High-rolling investors have positioned themselves bullish on Novo Nordisk (NYSE:NVO), and it's important for retail traders to take note.This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in NVO often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Novo Nordisk. This is not a typical pattern.

The sentiment among these major traders is split, with 66% bullish and 11% bearish. Among all the options we identified, there was one put, amounting to $26,390, and 8 calls, totaling $868,304.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $145.0 for Novo Nordisk, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $145.0 for Novo Nordisk, spanning the last three months.

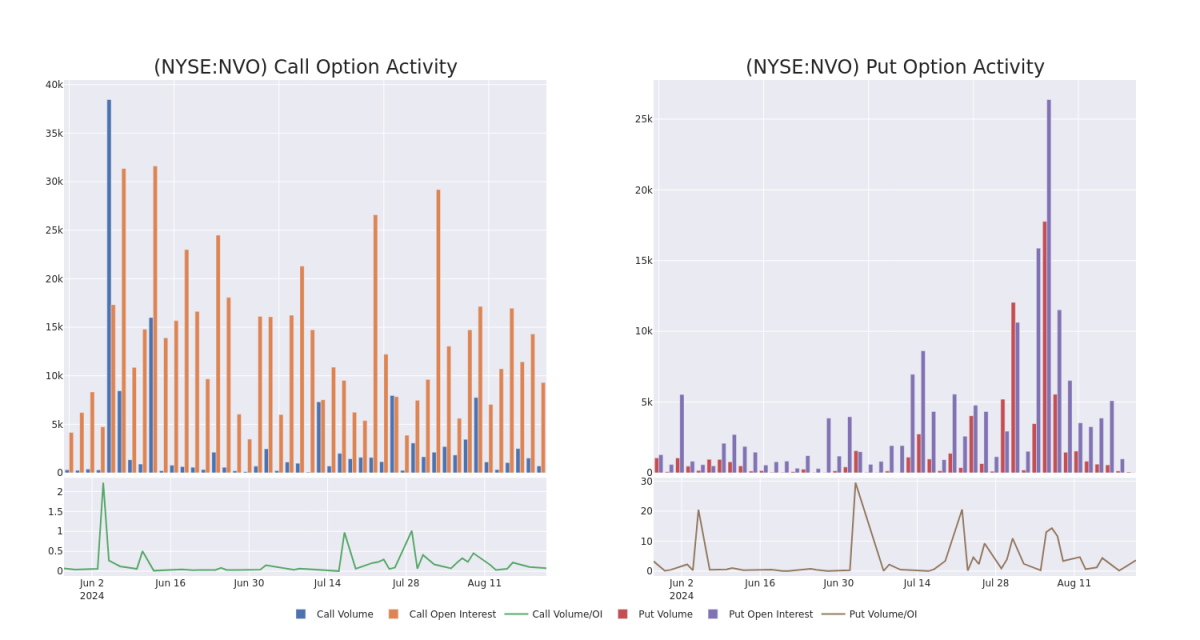

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Novo Nordisk's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Novo Nordisk's significant trades, within a strike price range of $100.0 to $145.0, over the past month.

Novo Nordisk Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| NVO | CALL | TRADE | BULLISH | 09/27/24 | $4.9 | $4.0 | $4.7 | $140.00 | $493.5K | 103 | 2 |

| NVO | CALL | TRADE | BULLISH | 03/21/25 | $33.85 | $33.65 | $33.85 | $110.00 | $101.5K | 187 | 31 |

| NVO | CALL | SWEEP | BULLISH | 09/13/24 | $3.95 | $3.75 | $3.95 | $138.00 | $99.9K | 694 | 302 |

| NVO | CALL | SWEEP | BULLISH | 09/20/24 | $2.11 | $2.09 | $2.1 | $145.00 | $41.8K | 7.9K | 208 |

| NVO | CALL | TRADE | NEUTRAL | 11/15/24 | $40.65 | $38.65 | $39.56 | $100.00 | $39.5K | 6 | 10 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

After a thorough review of the options trading surrounding Novo Nordisk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Novo Nordisk

- Currently trading with a volume of 1,216,126, the NVO's price is up by 1.77%, now at $137.34.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

Expert Opinions on Novo Nordisk

3 market experts have recently issued ratings for this stock, with a consensus target price of $160.0.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Novo Nordisk with a target price of $160.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $160.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $160.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Novo Nordisk options trades with real-time alerts from Benzinga Pro.

高額投資者已將自己定位爲看好諾和諾德(紐約證券交易所代碼:NVO),散戶交易者注意這一點很重要。\ 這項活動今天通過Benzinga對公開期權數據的追蹤引起了我們的注意。這些投資者的身份尚不確定,但是NVO的如此重大舉措通常表明有人擁有特權信息。

今天,Benzinga的期權掃描儀發現了Novo Nordisk的9筆期權交易。這不是典型的模式。

這些主要交易者的情緒分歧,66%看漲,11%看跌。在我們確定的所有期權中,有一個看跌期權,金額爲26,390美元,還有8個看漲期權,總額爲868,304美元。

預期的價格走勢

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月諾和諾德在100.0美元至145.0美元之間的價格區間。

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月諾和諾德在100.0美元至145.0美元之間的價格區間。

分析交易量和未平倉合約

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Novo Nordisk期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月諾和諾德重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲100.0美元至145.0美元。

諾和諾德期權活動分析:過去 30 天

發現的最大選擇:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

NVO | CALL | TRADE | BULLISH | 09/27/24 | $4.9 | $4.0 | $4.7 | $140.00 | $493.5K | 103 | 2 |

NVO | CALL | TRADE | BULLISH | 03/21/25 | $33.85 | $33.65 | $33.85 | $110.00 | $101.5K | 187 | 31 |

NVO | CALL | SWEEP | BULLISH | 09/13/24 | $3.95 | $3.75 | $3.95 | $138.00 | $99.9K | 694 | 302 |

NVO | CALL | SWEEP | BULLISH | 09/20/24 | $2.11 | $2.09 | $2.1 | $145.00 | $41.8K | 7.9K | 208 |

NVO | CALL | TRADE | NEUTRAL | 11/15/24 | $40.65 | $38.65 | $39.56 | $100.00 | $39.5K | | |

關於 Novo Nordisk

諾和諾德擁有全球品牌糖尿病治療市場約三分之一的份額,是全球領先的糖尿病護理產品提供商。該公司總部位於丹麥,生產和銷售各種人用和現代胰島素、注射型糖尿病治療藥物(如 GLP-1 療法)、口服抗糖尿病藥物和肥胖療法。Novo還有一個生物製藥板塊(約佔收入的10%),專門研究血友病和其他疾病的蛋白質療法。

在對圍繞Novo Nordisk的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

諾和諾德的當前位置

關於諾和諾德的專家意見

3位市場專家最近發佈了該股的評級,共識目標價爲160.0美元。

BMO Capital的一位分析師在評估中保持了對諾和諾德跑贏大盤的評級,目標價爲160美元。

坎託·菲茨傑拉德的一位分析師將其評級下調至增持,新的目標股價爲160美元,這反映了人們的擔憂。

坎託·菲茨傑拉德的一位分析師謹慎地將其評級下調至增持,將目標股價定爲160美元。

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解Novo Nordisk的最新期權交易。

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月諾和諾德在100.0美元至145.0美元之間的價格區間。

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月諾和諾德在100.0美元至145.0美元之間的價格區間。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $145.0 for Novo Nordisk, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $145.0 for Novo Nordisk, spanning the last three months.