These Analysts Increase Their Forecasts On Dycom Industries After Upbeat Q2 Earnings

These Analysts Increase Their Forecasts On Dycom Industries After Upbeat Q2 Earnings

Dycom Industries, Inc. (NYSE:DY) reported better-than-expected second quarter FY25 results on Wednesday.

戴康工業(NYSE:DY)週三公佈了2025財年第二季度超出預期的業績。

Contract revenue increased 15.5% Y/Y to $1.203 billion, beating the consensus of $1.196 billion. Adjusted EBITDA increased to $158.3 million from $130.8 million a year ago. Adjusted EPS of $2.46 surpassed the street view of $2.26.

合同營業收入同比增長15.5%,達到1203億元,超過1196億元的共識。調整後的EBITDA從去年的1.308億元增加到1.583億元。每股調整後的EPS爲2.46美元,超過了2.26美元的預期。

For the third quarter, Dycom anticipates a mid- to high single-digit percentage increase in total contract revenues, which included the company expectation of around $75 million of acquired contract revenues for the quarter.

對於第三季度,戴康預計合同總收入將增長中高個位數百分比,其中包括公司預計該季度將獲得7500萬美元的收購合同收入。

In a separate release, Dycom revealed the acquisition of Black & Veatch's public carrier wireless telecom infrastructure business, expanding its reach into nine states and boosting its capabilities in wireless network modernization.

另外,Dycom披露了收購Black & Veatch的公共載波無線電信基礎設施業務,擴展到九個州,增強其無線網絡現代化能力。

Dycom shares fell 2.4% to trade at $175.20 on Thursday.

戴康的股價在週四下跌2.4%,報175.20美元交易。

These analysts made changes to their price targets on Dycom following earnings announcement.

這些分析師在盈利公告後對戴康的價格目標進行了調整。

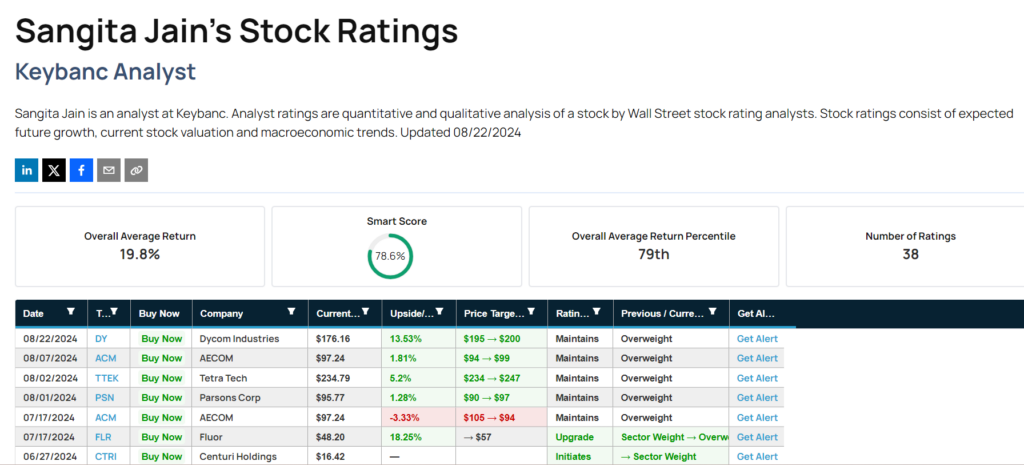

Keybanc analyst Sangita Jain maintained Dycom Industries with an Overweight and raised the price target from $195 to $200.

Keybanc分析師Sangita Jain維持對戴康工業的超重評級,並將價格目標從195美元上調至200美元。

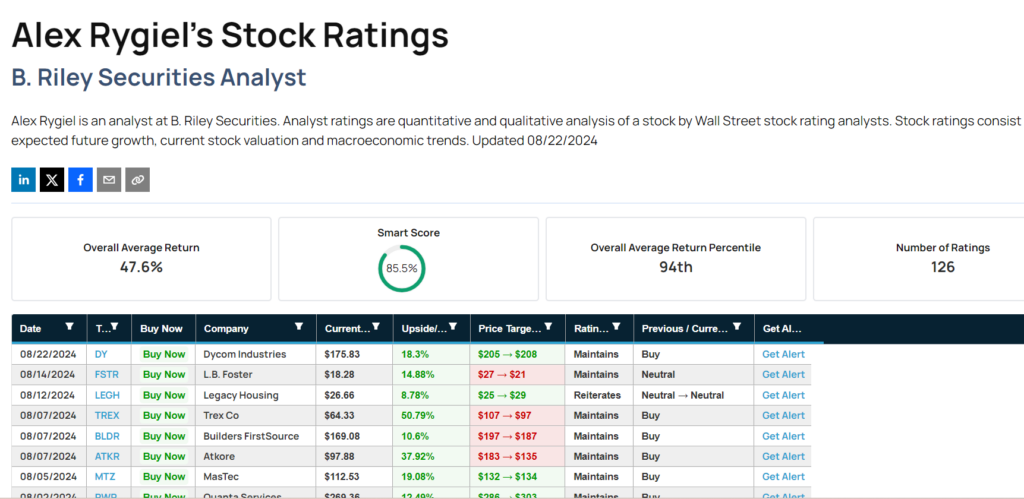

B. Riley Securities analyst Alex Rygiel maintained Dycom with a Buy and raised the price target from $205 to $208.

b. Riley Securities分析師Alex Rygiel維持對Dycom的買入評級,並將目標價從205美元提高至208美元。

Read More:

更多閱讀:

- Toll Brothers To Rally Around 19%? Here Are 10 Top Analyst Forecasts For Thursday

- 托爾兄弟將會上漲約19%?以下是週四的10位頂級分析師預測。

In a separate release, Dycom revealed the acquisition of Black & Veatch's public carrier wireless telecom infrastructure business, expanding its reach into nine states and boosting its capabilities in wireless network modernization.

In a separate release, Dycom revealed the acquisition of Black & Veatch's public carrier wireless telecom infrastructure business, expanding its reach into nine states and boosting its capabilities in wireless network modernization.