What's Going On With Super Micro Computer Stock On Thursday?

What's Going On With Super Micro Computer Stock On Thursday?

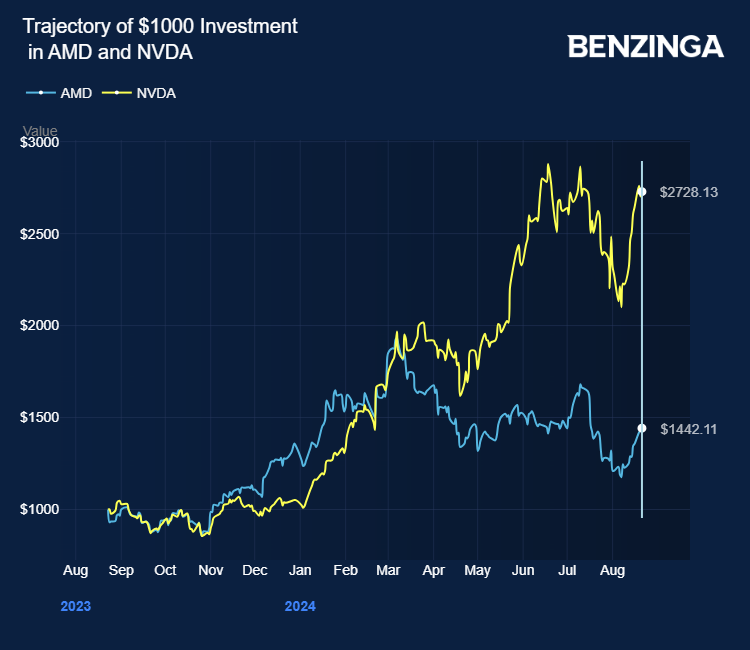

Artificial intelligence server company Super Micro Computer, Inc (NASDAQ:SMCI) stock is trading lower Thursday in sympathy with the broader semiconductor selloff led by its clients, including Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD).

人工智能服務器公司超級微電腦公司(納斯達克股票代碼:SMCI)股價週四走低,這與包括英偉達公司(納斯達克股票代碼:NVDA)和先進微設備公司(納斯達克股票代碼:AMD)在內的客戶主導的更廣泛的半導體拋售表示同情。

Despite the selloff, analysts continue to hail Nvidia as the critical AI play, implying the continued potential for the AI frenzy. The selloff has rendered the valuation of the semiconductor companies as more attractive entry points.

儘管出現拋售,但分析師繼續稱讚Nvidia是關鍵的人工智能企業,這意味着人工智能狂潮的持續潛力。拋售使半導體公司的估值成爲更具吸引力的切入點。

Super Micro Computer stock has increased 136% in the last 12 months and is currently trading at a price-to-earnings multiple of 13.73x. Nvidia, up 176%, is currently trading at a 33.16 PE multiple.

超級微電腦的股票在過去12個月中上漲了136%,目前的市盈倍數爲13.73倍。英偉達上漲176%,目前的市盈率爲33.16倍。

Recently, Taiwanese rail kit supplier Nan Juen International Co, a Super Micro Computer partner, inked a deal with Nvidia to ramp up rail kit production for GB200 AI servers.

最近,超級微電腦合作伙伴臺灣軌道套件供應商南俊國際公司與英偉達簽署了一項協議,以提高 GB200 人工智能服務器的軌道套件產量。

The market value of AI servers has the potential to surpass $187 billion in 2024, implying a growth rate of 69% driven by the demand for advanced AI servers from major CSPs and brand clients, as per TrendForce.

根據TrendForce的數據,到2024年,人工智能服務器的市值有可能超過1870億美元,這意味着69%的增長率是由主要通信服務提供商和品牌客戶對高級人工智能服務器的需求推動的。

The market potential for AI servers backed by demand from Big Tech giants, including Nvidia, AMD, Amazon.Com Inc (NASDAQ:AMZN), Amazon Web Services, and Meta Platforms Inc (NASDAQ:META) explains Super Micro Computer's stock price trajectory.

在包括英偉達、AMD、亞馬遜公司(納斯達克股票代碼:AMZN)、亞馬遜網絡服務和Meta Platforms Inc(納斯達克股票代碼:META)在內的大型科技巨頭需求的支持下,人工智能服務器的市場潛力解釋了超級微電腦的股價走勢。

Super Micro Computer reported a topline growth of 144% in the fourth quarter. Analysts expected the AI server company's margin weakness to recover by fiscal 2025, easing the competitive pricing environment.

超級微電腦報告稱,第四季度的收入增長了144%。分析師預計,到2025財年,這家人工智能服務器公司的利潤疲軟將恢復,從而緩解競爭激烈的定價環境。

Investors can gain exposure to Super Micro Computer through Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), and SPDR S&P 500 (NYSE:SPY).

投資者可以通過景順QQ信託、第一系列(納斯達克股票代碼:QQQ)和SPDR標準普爾500指數(紐約證券交易所代碼:SPY)獲得超級微電腦的投資機會。

Price Action: SMCI shares traded lower by 2.77% at $606.50 at the last check on Thursday.

價格走勢:在週四的最後一次支票中,SMCI股價下跌2.77%,至606.50美元。

Photo via Company

照片來自公司