Behind the Scenes of Vertiv Hldgs's Latest Options Trends

Behind the Scenes of Vertiv Hldgs's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Vertiv Hldgs.

具有大量資金的鯨魚在Vertiv Hldgs上採取了明顯的看淡態度。

Looking at options history for Vertiv Hldgs (NYSE:VRT) we detected 11 trades.

審視Vertiv Hldgs(紐交所:VRT)的期權歷史,我們發現了11筆交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 54% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地表示,36%的投資者以看漲爲期望,而54%則以看淡爲期望。

From the overall spotted trades, 2 are puts, for a total amount of $122,803 and 9, calls, for a total amount of $947,215.

根據總體已發現的交易情況,有2筆看跌交易,總金額爲122,803美元,以及9筆看漲交易,總金額爲947,215美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $37.5 to $115.0 for Vertiv Hldgs over the recent three months.

根據交易活動,顯然一些重要的投資者正瞄準Vertiv Hldgs的股價區間,範圍從37.5美元到115.0美元,在最近三個月內。

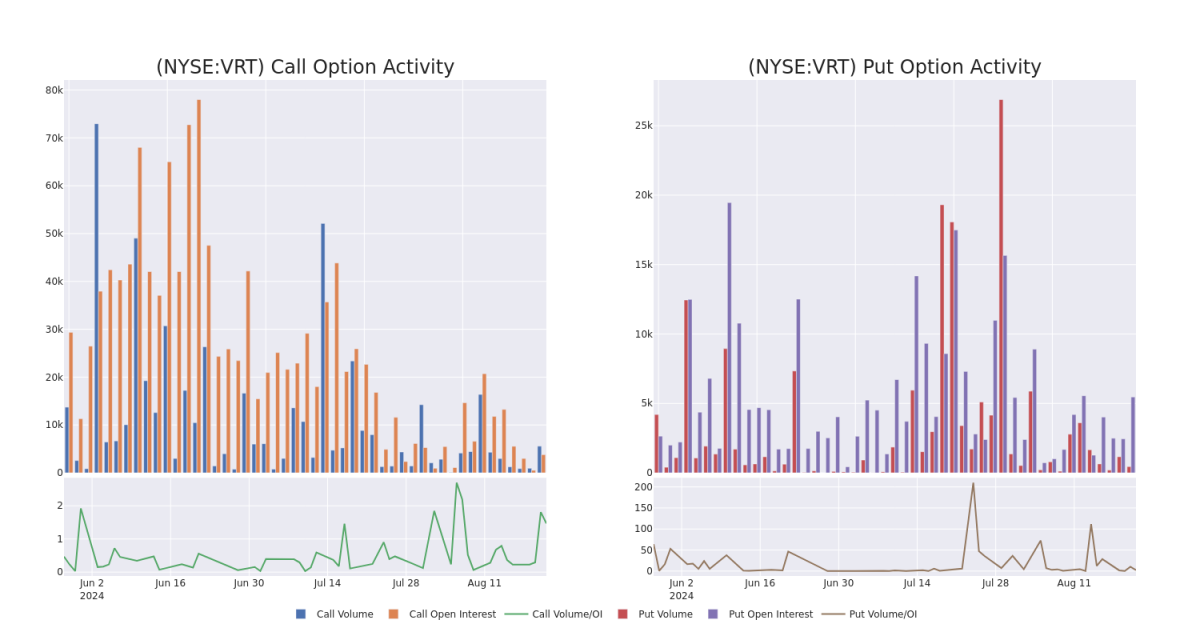

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In today's trading context, the average open interest for options of Vertiv Hldgs stands at 1028.44, with a total volume reaching 6,017.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vertiv Hldgs, situated within the strike price corridor from $37.5 to $115.0, throughout the last 30 days.

在今日的交易環境中,Vertiv Hldgs的期權平均持倉量爲1028.44,總成交量達到6017.00。附帶的圖表描繪了過去30天內Vertiv Hldgs中高價值交易的看漲和看跌期權成交量和持倉量的發展情況,這些交易位於37.5美元至115.0美元的行權價格走廊內。

Vertiv Hldgs Call and Put Volume: 30-Day Overview

Vertiv Hldgs看漲期權和看跌期權成交量:30天總覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | SWEEP | BULLISH | 09/20/24 | $3.3 | $3.2 | $3.3 | $82.00 | $330.1K | 26 | 1.0K |

| VRT | CALL | SWEEP | BULLISH | 01/17/25 | $15.8 | $15.6 | $15.8 | $70.00 | $186.4K | 2.8K | 119 |

| VRT | CALL | SWEEP | BULLISH | 07/18/25 | $25.0 | $24.8 | $25.0 | $62.50 | $152.5K | 27 | 62 |

| VRT | CALL | SWEEP | NEUTRAL | 11/15/24 | $41.1 | $39.3 | $40.29 | $37.50 | $96.2K | 0 | 24 |

| VRT | PUT | SWEEP | BEARISH | 11/15/24 | $3.8 | $3.7 | $3.8 | $65.00 | $87.8K | 5.3K | 231 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 看漲 | SWEEP | 看好 | 09/20/24 | $3.3 | $3.2 | $3.3 | 82.00美元 | $87.8K | 26 | 1.0K |

| VRT | 看漲 | SWEEP | 看好 | 01/17/25 | $15.8 | $15.6 | $15.8 | 70.00美元 | TD Cowen的分析師決定維持對Vertiv Hldgs的買入評級,目前的價格目標爲93美元。 | 2.8K | 119 |

| VRT | 看漲 | SWEEP | 看好 | 07/18/25 | $25.0 | $24.8 | $25.0 | $62.50 | 152,500美元 | 27 | 62 |

| VRT | 看漲 | SWEEP | 中立 | 11/15/24 | $41.1 | $39.3 | $40.29 | $37.50 | $96.2K | 0 | 24 |

| VRT | 看跌 | SWEEP | 看淡 | 11/15/24 | $3.8 | $3.7 | $3.8 | $65.00 | $87.8K | 5.3K | 231 |

About Vertiv Hldgs

關於Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co整合了硬件、軟件、分析和持續服務,確保客戶的關鍵應用程序連續運行、最佳表現並隨着業務需求而增長。該公司通過一系列從雲到網絡邊緣的電力、冷卻和IT基礎設施解決數據中心、通信網絡和商業及工業設施面臨的挑戰。其服務包括關鍵電力、熱管理、機櫃和外殼、監控和管理以及其他服務。其三個業務板塊包括美洲、亞太和歐洲、中東和非洲。

Following our analysis of the options activities associated with Vertiv Hldgs, we pivot to a closer look at the company's own performance.

在對Vertiv Hldgs的期權活動進行分析之後,我們轉而更近距離地觀察該公司的表現。

Where Is Vertiv Hldgs Standing Right Now?

Vertiv Hldgs目前處於什麼狀態?

- Currently trading with a volume of 3,195,509, the VRT's price is up by 0.46%, now at $78.35.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 62 days.

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計發佈收益爲62天。

Professional Analyst Ratings for Vertiv Hldgs

Vertiv Hldgs的專業分析師評級

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $98.5.

- An analyst from TD Cowen has decided to maintain their Buy rating on Vertiv Hldgs, which currently sits at a price target of $93.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Vertiv Hldgs, which currently sits at a price target of $104.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Vertiv Hldgs, which currently sits at a price target of $105.

- Showing optimism, an analyst from Mizuho upgrades its rating to Outperform with a revised price target of $92.

- 高盛的一位分析師決定維持對Vertiv Hldgs的買入評級,目前目標價爲104美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。