Zhejiang Shapuaisi Pharmaceutical Co.,Ltd.'s (SHSE:603168) Market Cap Dropped CN¥372m Last Week; Individual Investors Bore the Brunt

Zhejiang Shapuaisi Pharmaceutical Co.,Ltd.'s (SHSE:603168) Market Cap Dropped CN¥372m Last Week; Individual Investors Bore the Brunt

Key Insights

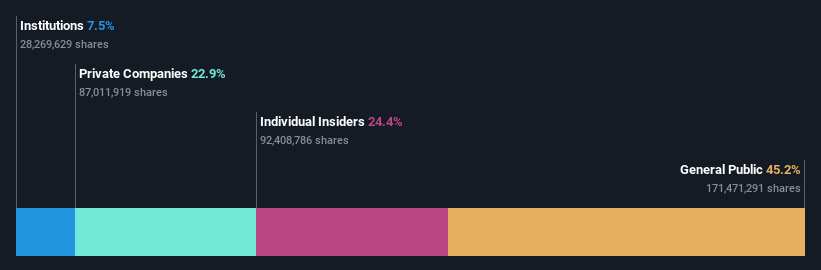

- Significant control over Zhejiang Shapuaisi PharmaceuticalLtd by individual investors implies that the general public has more power to influence management and governance-related decisions

- A total of 6 investors have a majority stake in the company with 51% ownership

- Insiders own 24% of Zhejiang Shapuaisi PharmaceuticalLtd

To get a sense of who is truly in control of Zhejiang Shapuaisi Pharmaceutical Co.,Ltd. (SHSE:603168), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are individual investors with 45% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

While insiders, who own 24% shares weren't spared from last week's CN¥372m market cap drop, individual investors as a group suffered the maximum losses

In the chart below, we zoom in on the different ownership groups of Zhejiang Shapuaisi PharmaceuticalLtd.

What Does The Institutional Ownership Tell Us About Zhejiang Shapuaisi PharmaceuticalLtd?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

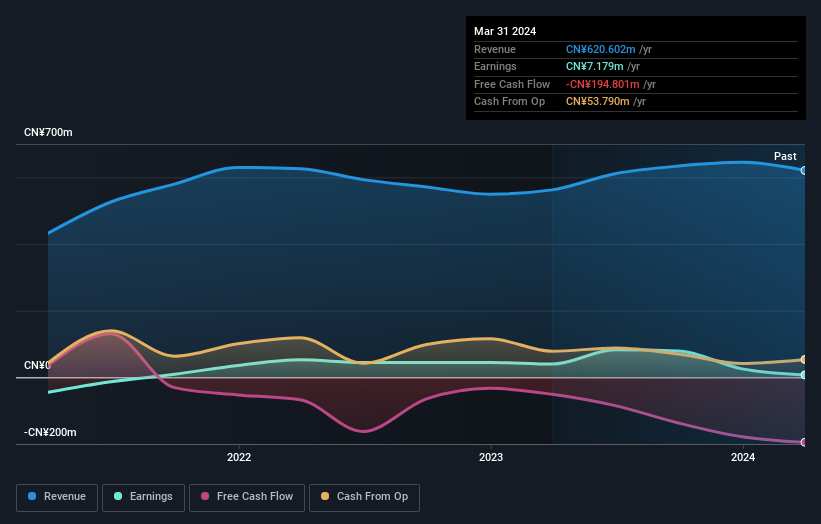

We can see that Zhejiang Shapuaisi PharmaceuticalLtd does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Zhejiang Shapuaisi PharmaceuticalLtd's earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Zhejiang Shapuaisi PharmaceuticalLtd. Looking at our data, we can see that the largest shareholder is Shanghai Yanghe Industrial Co., Ltd. with 21% of shares outstanding. In comparison, the second and third largest shareholders hold about 12% and 9.2% of the stock.

On further inspection, we found that more than half the company's shares are owned by the top 6 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Zhejiang Shapuaisi PharmaceuticalLtd

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Zhejiang Shapuaisi Pharmaceutical Co.,Ltd.. Insiders have a CN¥576m stake in this CN¥2.4b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 45% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Zhejiang Shapuaisi PharmaceuticalLtd. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 23%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Zhejiang Shapuaisi PharmaceuticalLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Zhejiang Shapuaisi PharmaceuticalLtd , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.