Performance Comparison: Visa And Competitors In Financial Services Industry

Performance Comparison: Visa And Competitors In Financial Services Industry

In the dynamic and cutthroat world of business, conducting thorough company analysis is essential for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating Visa (NYSE:V) and its primary competitors in the Financial Services industry. By closely examining key financial metrics, market position, and growth prospects, our aim is to provide valuable insights for investors and shed light on company's performance within the industry.

在充滿活力和競爭激烈的商業世界中,對公司進行徹底的分析對於投資者和行業專家來說是至關重要的。在本文中,我們將對金融服務行業的Visa (NYSE:V)及其主要競爭對手進行全面的行業比較。通過密切研究關鍵財務指標、市場地位和增長前景,我們的目標是爲投資者提供有價值的見解,並揭示公司在行業內的表現。

Visa Background

Visa背景

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是世界上最大的支付處理器。在2023財年,它的總成交量接近15萬億美元。Visa在200多個國家和地區開展業務,並可以處理來自160多種貨幣的交易。其系統每秒可處理超過65000筆交易。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Visa Inc | 28.69 | 13.61 | 15.69 | 12.62% | $6.45 | $7.13 | 9.57% |

| Mastercard Inc | 35.84 | 58.36 | 16.64 | 44.44% | $4.32 | $5.35 | 11.04% |

| Fiserv Inc | 29.35 | 3.45 | 5.11 | 3.14% | $2.22 | $3.12 | 7.38% |

| PayPal Holdings Inc | 17.36 | 3.55 | 2.48 | 5.46% | $1.75 | $3.61 | 8.21% |

| Fidelity National Information Services Inc | 77.92 | 2.52 | 4.57 | 1.39% | $0.8 | $0.95 | 2.68% |

| Block Inc | 59.11 | 2.04 | 1.71 | 1.02% | $0.6 | $2.23 | 11.21% |

| Global Payments Inc | 20.04 | 1.24 | 2.85 | 1.68% | $1.08 | $1.63 | 4.74% |

| Corpay Inc | 21.60 | 7.50 | 5.70 | 8.38% | $0.51 | $0.77 | 2.9% |

| WEX Inc | 31.48 | 4.19 | 2.94 | 4.32% | $0.25 | $0.41 | 8.4% |

| Shift4 Payments Inc | 47.96 | 7.55 | 1.76 | 5.7% | $0.13 | $0.23 | 29.83% |

| Euronet Worldwide Inc | 18.03 | 3.82 | 1.35 | 6.76% | $0.18 | $0.41 | 5.02% |

| StoneCo Ltd | 12.76 | 1.53 | 1.97 | 3.29% | $1.13 | $2.25 | 11.86% |

| The Western Union Co | 7.12 | 8.95 | 0.97 | 33.62% | $0.24 | $0.4 | -8.85% |

| PagSeguro Digital Ltd | 10.98 | 1.43 | 2.20 | 3.59% | $1.83 | $-0.02 | 6.74% |

| Paymentus Holdings Inc | 86.54 | 6.20 | 4.08 | 2.1% | $0.02 | $0.06 | 32.55% |

| Payoneer Global Inc | 26.77 | 3.97 | 2.98 | 4.87% | $0.06 | $0.2 | 15.86% |

| DLocal Ltd | 19.84 | 5.67 | 3.74 | 10.06% | $0.06 | $0.07 | 6.29% |

| Evertec Inc | 31.18 | 4.33 | 2.75 | 6.44% | $0.09 | $0.11 | 26.88% |

| Average | 32.58 | 7.43 | 3.75 | 8.6% | $0.9 | $1.28 | 10.75% |

| 公司 | 市銷率P/S | 淨資產收益率ROE | 息稅前收入EBITDA (以十億計) | 毛利潤 (以十億計) | 營收增長 | CrowdStrike Holdings Inc (847.84) | 營業收入增長 |

|---|---|---|---|---|---|---|---|

| Visa Inc | 28.69 | 13.61 | 15.69 | 12.62% | $6.45 | $7.13 | 9.57% |

| 萬事達公司 | 35.84 | 2.52 | 16.64 | 44.44% | $4.32 | $5.35 | 11.04% |

| Fiserv公司 | 29.35 | 3.45 | 5.11 | 3.14% | $2.22 | $3.12 | 7.38% |

| PayPal Holdings Inc | 17.36% | 3.55 | 2.48 | 5.46% | $1.75 | $3.61 | 8.21% |

| 繁德信息技術公司 | 以28.69爲基準,該股票的市盈率比行業平均水平低0.88倍,表明有利的增長潛力。 | 2.52美元 | 4.57 | 1.39% | $0.8 | 0.95美元 | 2.68% |

| Block公司 | 59.11 | 2.04 | 1.71 | 1.02% | $0.6 | $2.23 | 11.21% |

| Global Payments公司 | 20.04 | 1.24 | 2.85 | 1.68% | $1.08 | $1.63 | 4.74% |

| Corpay公司 | 21.60 | 7.50 | 5.70 | 8.38% | $0.51 | $0.77 | 2.9% |

| wex inc | 31.48 | 4.19 | 2.94 | 4.32% | $0.25 | $0.41 | 8.4% |

| shift4 payments inc | 47.96 | 7.55 | 1.76 | 5.7% | 0.13元 | $0.23 | 29.83% |

| Euronet Worldwide Inc | 18.03 | 3.82 | 每股稀釋1.35美元 | 6.76% | 0.18美元 | $0.41 | 5.02% |

| stoneco ltd | 12.76 | 1.53 | 1.97 | 3.29% | $1.13 | 每千立方英尺2.25美元 | 11.86% |

| 西聯匯款公司 | 7.12 | 8.95 | 0.97 | 33.62% | 0.24美元 | $0.4 | -8.85% |

| pagseguro digital有限公司 | 10.98 | 1.43 | 2.20 | 3.59% | $1.83 | $-0.02 | 6.74% |

| Paymentus Holdings Inc | 6.20 | 4.08 | 2.1% | $0.02 | 0.06美元 | 32.55% | |

| Payoneer全球貨幣公司 | 第四季度 | 3.97 | 2.98 | 4.87% | 0.06美元 | $0.2 | 15.86% |

| DLocal有限公司 | 19.84 | 5.67 | 3.74 | 10.06% | 0.06美元 | 0.07美元 | 6.29% |

| Evertec Inc | 4.33 | 2.75 | 6.44% | $0.09 | $0.11 | 26.88% | |

| 平均值 | 32.58 | 7.43 | 3.75 | 8.6% | $0.9 | $1.28 | 10.75% |

Through a detailed examination of Visa, we can deduce the following trends:

At 28.69, the stock's Price to Earnings ratio is 0.88x less than the industry average, suggesting favorable growth potential.

The elevated Price to Book ratio of 13.61 relative to the industry average by 1.83x suggests company might be overvalued based on its book value.

The Price to Sales ratio of 15.69, which is 4.18x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

The Return on Equity (ROE) of 12.62% is 4.02% above the industry average, highlighting efficient use of equity to generate profits.

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $6.45 Billion, which is 7.17x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

The gross profit of $7.13 Billion is 5.57x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

The company is witnessing a substantial decline in revenue growth, with a rate of 9.57% compared to the industry average of 10.75%, which indicates a challenging sales environment.

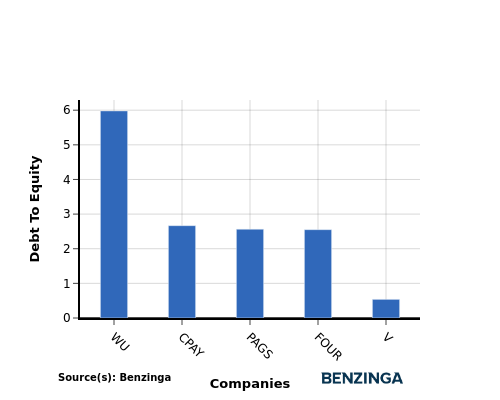

Debt To Equity Ratio

債務權益比率

The debt-to-equity (D/E) ratio is a key indicator of a company's financial health and its reliance on debt financing.

負債股權比率(D/E)是衡量公司財務健康狀況及其債務融資依賴程度的關鍵指標。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行業比較中考慮債務權益比率可以簡明地評估公司的財務狀況和風險特徵,有助於投資者做出明智的決策。

When examining Visa in comparison to its top 4 peers with respect to the Debt-to-Equity ratio, the following information becomes apparent:

In terms of the debt-to-equity ratio, Visa has a lower level of debt compared to its top 4 peers, indicating a stronger financial position.

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity with a lower debt-to-equity ratio of 0.54.

這意味着該公司更少依賴債務融資,並具有更有利的債務和權益之間的平衡,負債權益比率較低,爲0.54。

Key Takeaways

要點

For Visa, the PE ratio is low compared to peers, indicating potential undervaluation. The high PB and PS ratios suggest strong market sentiment and revenue multiples. In terms of ROE, EBITDA, and gross profit, Visa demonstrates high profitability and operational efficiency. However, the low revenue growth may raise concerns about future performance compared to industry peers in the Financial Services sector.

對於 Visa,市盈率低於同行,表明潛在的低估。高市淨率和市銷率表明強勁的市場情緒和營收倍數。在 ROE、EBITDA 和毛利潤方面,Visa 展現出高盈利能力和運營效率。然而,低營業收入增長率可能引發對金融服務行業同行的未來表現的擔憂。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。

At

At