Powell's Rate Cut Signal Triggers Small-Cap Rally, Gold Makes Record Highs, Dollar Tumbles: 7 ETFs On The Move

Powell's Rate Cut Signal Triggers Small-Cap Rally, Gold Makes Record Highs, Dollar Tumbles: 7 ETFs On The Move

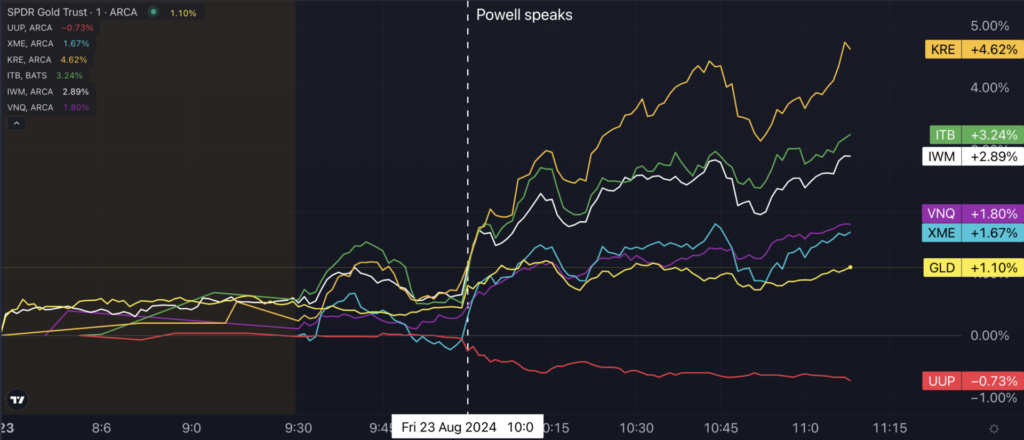

Jerome Powell's interest rate remarks Friday ignited a rally in stocks, bonds, and commodities, while the U.S. dollar plunged as traders solidified their bets on rate cuts.

傑羅姆·鮑威爾(Jerome Powell)週五關於利率的講話引發了股票、債券和商品的上漲,而美元因交易者對減息押注堅定而暴跌。

Financial markets responded positively to Fed Chair Jerome Powell's remarks at the Jackson Hole symposium, where he said the '"time has come for policy to adjust."

金融市場對聯儲局主席傑羅姆·鮑威爾在傑克遜霍爾研討會上的講話做出了積極反應,他表示""到了政策調整的時刻""。

The Fed chair said he is more confident the economy is on a sustainable path back to the 2% inflation target, allowing the Fed to finally shift its focus to labor market conditions.

聯儲局主席表示,他更有信心經濟正朝着可持續的2%通脹目標的道路上邁進,從而讓聯儲局終於將焦點轉向勞動力市場狀況。

"We do not seek or welcome further cooling in labor market conditions," he said, adding the Fed has "ample room to respond" by adjusting its policy should further weakening in labor market conditions occur.

他說:「我們不追求或歡迎勞動力市場狀況進一步降溫」,並補充說聯儲局在勞動力市場狀況進一步惡化時有""足夠的回應空間"",可以通過調整政策來應對。

7 Key ETFs React To Powell's Jackson Hole Speech

7個關鍵etf對鮑威爾的傑克遜霍爾講話做出反應

A greenback gauge, as tracked by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP), tumbled by 0.7% at 11 a.m. ET., extending its weekly decline to 1.4% — the worst performance it has recorded this year.

由於預期利率下降和美元走弱,隨着講話結束,黃金價格飆升到每盎司2530美元的歷史新高,而Invesco Db USD Index Bullish Fund ETF (NYSE:UUP)的美元指數也下跌了0.7%,連續第二週下跌1.4%,是今年表現最差的一週。

Driven by expectations of lower interest rates and a weakening dollar, gold prices surged to a new all-time high of $2,530 per ounce following the speech, with the SPDR Gold Trust (NYSE:GLD) climbing by 1.1%.

受到利率下降和美元走弱的預期推動,黃金價格飆升到每盎司2530美元的歷史新高,而SPDR Gold Trust (NYSE:GLD)的黃金ETF上漲了1.1%。

Wall Street initially rallied before paring back some gains as traders assess the economic outlook.

華爾街最初出現了一波漲勢,但在交易者評估經濟前景後又回調了一些漲幅。

Small caps, instead, substantially outperformed large-cap indices. The iShares Russell 2000 ETF (NYSE:IWM) soared 2.9%, on track for its strongest session since July 16.

相反,小盤股大幅跑贏大盤指數。ishares羅素2000指數etf-vanguard(紐交所:IWM)飆升2.9%,創下自7月16日以來最強勢的一天。

Within sectors, real estate stocks rallied, with the Vanguard Real Estate ETF (NYSE:VNQ) up 1.8%, hitting the highest levels since September 2022.

在行業中,房地產股走強,不動產信託指數etf-vanguard(紐交所:VNQ)上漲1.8%,達到2022年9月以來的最高水平。

Interest-rate sensitive industries saw significant gains following Powell's remarks, with homebuilders, regional banks and miners leading the market.

在鮑威爾的講話後,對利率敏感的行業出現了大幅漲幅,房地產開發商、區域型銀行和礦業公司引領市場。

The SPDR S&P Regional Banking ETF (NYSE:KRE) jumped 4.6%, while the iShares U.S. Home Construction ETF (NYSE:ITB) climbed 3.2%, and the SPDR S&P Metals & Mining ETF (NYSE:XME) advanced 1.7%.

SPDR標普區域銀行etf(紐交所:KRE)大漲4.6%,ishares美國住宅建築etf(紐交所:ITB)上漲3.2%,而spdr標普金屬與礦業etf(紐交所:XME)上漲1.7%。

Don't miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference Oct. 9-10 at the Chicago Marriott Downtown Magnificent Mile.

不要錯過在芝加哥萬豪華翔亞洲酒店舉辦的小市值投資者大會(10月9日-10日)在動盪的市場中佔據主導地位的機會。

- Financial Crime Weekly: Health Care Provider To Pay $3.85M For Medicare Scheme, Co-Conspirators To Pay $70M For Vitol Bribery Scheme

- 金融犯罪每週動態:醫療保健服務提供商因醫療欺詐方案支付385萬美元,共謀者因Vitol賄賂方案支付7000萬美元。

Jerome Powell and Wall Street illustration. Photo: Federalreserve/Flickr Photo: Bylolo/Unsplash

傑羅姆·鮑威爾和華爾街插圖。照片:Federalreserve/Flickr 照片:Bylolo/Unsplash