Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

Investors with a lot of money to spend have taken a bullish stance on GameStop (NYSE:GME).

有大量資金可以花的投資者對GameStop(紐約證券交易所代碼:GME)採取了看漲立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 GME 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 8 options trades for GameStop.

今天,Benzinga的期權掃描儀發現了GameStop的8筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 50% bullish and 25%, bearish.

這些大資金交易者的整體情緒介於50%的看漲和25%的看跌之間。

Out of all of the options we uncovered, there was 1 put, for a total amount of $41,060, and 7, calls, for a total amount of $294,615.

在我們發現的所有期權中,有1個看跌期權,總額爲41,060美元,還有7個看漲期權,總額爲294,615美元。

Expected Price Movements

預期的價格走勢

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $125.0 for GameStop during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注GameStop在過去一個季度的價格範圍從15.0美元到125.0美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

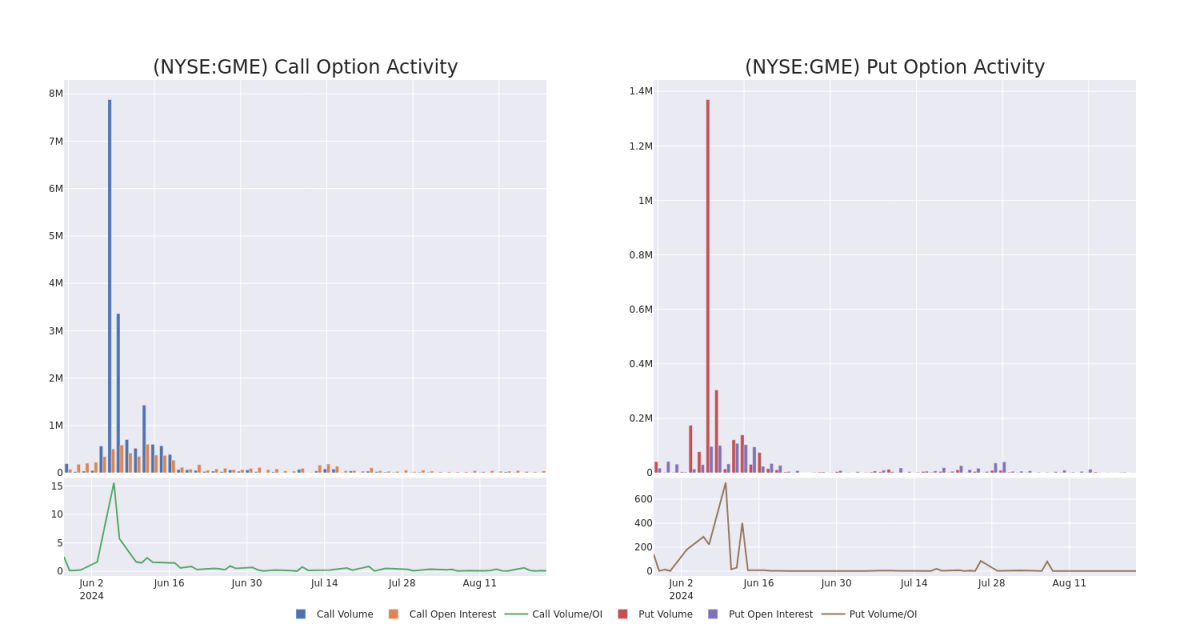

In today's trading context, the average open interest for options of GameStop stands at 6022.43, with a total volume reaching 3,259.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in GameStop, situated within the strike price corridor from $15.0 to $125.0, throughout the last 30 days.

在當今的交易背景下,GameStop期權的平均未平倉合約爲6022.43,總交易量達到3,259.00。隨附的圖表描繪了過去30天GameStop高價值交易的看漲期權和看跌期權交易量以及未平倉合約的變化,行使價走勢從15.0美元到125.0美元不等。

GameStop Call and Put Volume: 30-Day Overview

GameStop 看漲和看跌交易量:30 天概述

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | NEUTRAL | 08/23/24 | $1.48 | $1.26 | $1.39 | $21.00 | $83.5K | 1.1K | 853 |

| GME | CALL | TRADE | NEUTRAL | 10/18/24 | $7.9 | $7.35 | $7.63 | $15.00 | $57.2K | 2.0K | 75 |

| GME | PUT | TRADE | BEARISH | 01/17/25 | $102.9 | $102.05 | $102.65 | $125.00 | $41.0K | 548 | 6 |

| GME | CALL | SWEEP | BULLISH | 09/06/24 | $1.0 | $0.98 | $1.0 | $22.50 | $39.9K | 928 | 285 |

| GME | CALL | SWEEP | BEARISH | 08/23/24 | $1.48 | $1.26 | $1.37 | $21.00 | $30.1K | 1.1K | 241 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 打電話 | 掃 | 中立 | 08/23/24 | 1.48 美元 | 1.26 美元 | 1.39 美元 | 21.00 美元 | 83.5 萬美元 | 1.1K | 853 |

| GME | 打電話 | 貿易 | 中立 | 10/18/24 | 7.9 美元 | 7.35 美元 | 7.63 美元 | 15.00 美元 | 57.2 萬美元 | 2.0K | 75 |

| GME | 放 | 貿易 | 粗魯的 | 01/17/25 | 102.9 美元 | 102.05 美元 | 102.65 美元 | 125.00 美元 | 41.0 萬美元 | 548 | 6 |

| GME | 打電話 | 掃 | 看漲 | 09/06/24 | 1.0 美元 | 0.98 美元 | 1.0 美元 | 22.50 | 39.9 萬美元 | 928 | 285 |

| GME | 打電話 | 掃 | 粗魯的 | 08/23/24 | 1.48 美元 | 1.26 美元 | 1.37 美元 | 21.00 美元 | 30.1K | 1.1K | 241 |

About GameStop

關於 GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp 是一家美國多渠道視頻遊戲、消費電子產品和服務零售商。該公司在歐洲、加拿大、澳大利亞和美國開展業務。GameStop主要通過GameStop、EB Games和Micromania商店以及國際電子商務網站銷售新的和二手的視頻遊戲硬件、實體和數字視頻遊戲軟件以及視頻遊戲配件。大部分銷售來自美國。

Following our analysis of the options activities associated with GameStop, we pivot to a closer look at the company's own performance.

在分析了與GameStop相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

GameStop's Current Market Status

GameStop 的當前市場狀況

- With a trading volume of 1,650,933, the price of GME is up by 0.54%, reaching $22.24.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 12 days from now.

- GME的交易量爲1,650,933美元,上漲了0.54%,達到22.24美元。

- 當前的RSI值表明,該股目前在超買和超賣之間處於中立狀態。

- 下一份收益報告定於即日起12天后發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解最新的GameStop期權交易。