Decoding Adobe's Options Activity: What's the Big Picture?

Decoding Adobe's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Adobe (NASDAQ:ADBE).

有很多錢可供使用的投資者已經對Adobe (納斯達克: ADBE)採取了看好的立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ADBE, it often means somebody knows something is about to happen.

無論這些是機構還是富有的個人,我們都不知道。但是當與ADBE發生如此大的事件時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 28 uncommon options trades for Adobe.

今天,Benzinga的期權掃描器發現了28筆adobe的非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 53% bullish and 32%, bearish.

這些大手交易者的整體情緒在53%看漲和32%看跌之間分歧。

Out of all of the special options we uncovered, 9 are puts, for a total amount of $361,751, and 19 are calls, for a total amount of $1,257,784.

在我們發現的所有特殊期權中,有9個看跌期權,總金額爲361,751美元,有19個看漲期權,總金額爲1,257,784美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $440.0 to $620.0 for Adobe during the past quarter.

分析Adobe合約的成交量和持倉量,似乎在過去的一個季度裏,大戶們一直關注着從440.0美元到620.0美元的價格區間。

Insights into Volume & Open Interest

成交量和持倉量分析

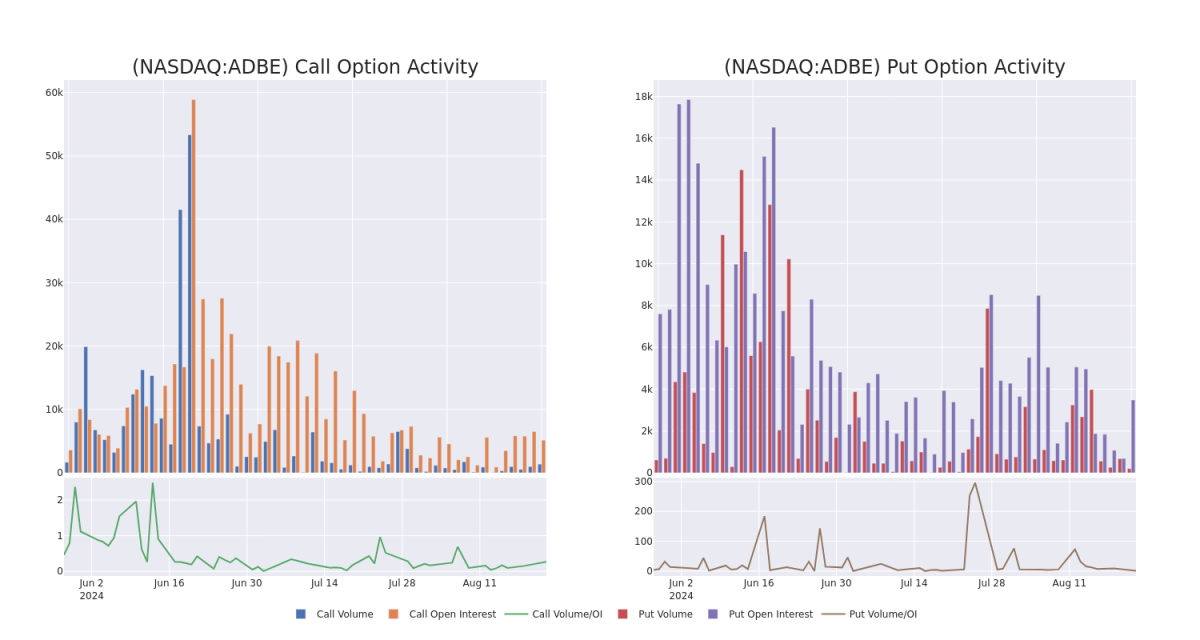

In today's trading context, the average open interest for options of Adobe stands at 345.32, with a total volume reaching 1,519.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Adobe, situated within the strike price corridor from $440.0 to $620.0, throughout the last 30 days.

在今天的交易環境中,Adobe期權的平均持倉量爲345.32,總成交量達到1,519.00。附圖中描述了過去30天內,在440.0美元到620.0美元的行權價走廊內進行的高價交易中,看漲和看跌期權的成交量與持倉量的變化情況。

Adobe Option Activity Analysis: Last 30 Days

Adobe選擇活動分析:最近30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | CALL | SWEEP | BULLISH | 09/13/24 | $10.25 | $10.05 | $10.25 | $600.00 | $205.0K | 65 | 203 |

| ADBE | CALL | TRADE | BULLISH | 09/13/24 | $65.75 | $64.8 | $65.75 | $500.00 | $144.6K | 2 | 0 |

| ADBE | CALL | TRADE | BEARISH | 08/23/24 | $66.35 | $63.9 | $63.9 | $495.00 | $140.5K | 25 | 22 |

| ADBE | CALL | TRADE | BEARISH | 08/30/24 | $2.2 | $2.0 | $2.0 | $585.00 | $119.8K | 301 | 600 |

| ADBE | CALL | TRADE | NEUTRAL | 09/13/24 | $11.55 | $10.2 | $10.75 | $600.00 | $86.0K | 65 | 408 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| adobe | 看漲 | SWEEP | 看好 | 09/13/24 | $10.25 | $10.05 | $10.25 | $600.00 | 205,000美元 | 65 | 203 |

| adobe | 看漲 | 交易 | 看好 | 09/13/24 | $65.75 | $64.8 | $65.75 | $500.00 | 2 | 0 | |

| adobe | 看漲 | 交易 | 看淡 | 08/23/24 | $66.35 | 63.9 | 63.9 | $495.00 | 140.5千美元 | 25 | 22 |

| adobe | 看漲 | 交易 | 看淡 | 08/30/2024 | $2.2 | $2.0 | $2.0 | $585.00 | $119.8K | 301 | 600 |

| adobe | 看漲 | 交易 | 中立 | 09/13/24 | $11.55 | $10.2 | $10.75 | $600.00 | $86.0K | 65 | 408 |

About Adobe

關於Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe 提供內容創作、文檔管理和數字營銷和廣告軟件及服務,爲創意專業人士和營銷人員創建、管理、交付、衡量、優化和參與多種操作系統、設備和媒體的引人入勝的內容。公司有三個板塊:數字媒體內容創作、數字營銷解決方案的數字體驗和出版的傳統產品(營業收入不到 5%)。

In light of the recent options history for Adobe, it's now appropriate to focus on the company itself. We aim to explore its current performance.

針對Adobe最近的期權歷史,現在適當關注該公司本身。我們旨在探討其當前的表現。

Present Market Standing of Adobe

Adobe的現有市場地位

- With a volume of 504,808, the price of ADBE is down -0.21% at $556.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 20 days.

- RSI指標暗示該股票可能要超買了。

- 下一輪盈利預計將在20天內發佈。

Professional Analyst Ratings for Adobe

Adobe的專業分析師評級

1 market experts have recently issued ratings for this stock, with a consensus target price of $600.0.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $600.

- 鑑於擔憂,RBC Capital的一位分析師將其評級下調爲跑贏市場,並將新價格目標定爲600美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Adobe options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地學習、調整策略、監控多個因子並密切關注市場動態來管理這些風險。從Benzinga Pro獲取實時的Adobe 期權交易警報信息,讓您時刻保持了解最新動態。