Bank of America Options Trading: A Deep Dive Into Market Sentiment

Bank of America Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on Bank of America.

資金充裕的鯨魚明顯看淡美國銀行股票。

Looking at options history for Bank of America (NYSE:BAC) we detected 28 trades.

查看美國銀行(紐交所:BAC)的期權歷史,我們發現了28筆交易。

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 60% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,39%的投資者帶着看好的預期開啓了交易,而60%的投資者帶着看淡的預期。

From the overall spotted trades, 13 are puts, for a total amount of $836,213 and 15, calls, for a total amount of $1,026,632.

在所有的交易中,共有13筆看跌期權,總額爲$836,213,有15筆看漲期權,總額爲$1,026,632。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $65.0 for Bank of America, spanning the last three months.

經過對交易量和持倉量的評估,可以明顯看出,主要市場動能集中在美國銀行的價格區間爲$30.0至$65.0之間,跨過這三個月的時間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

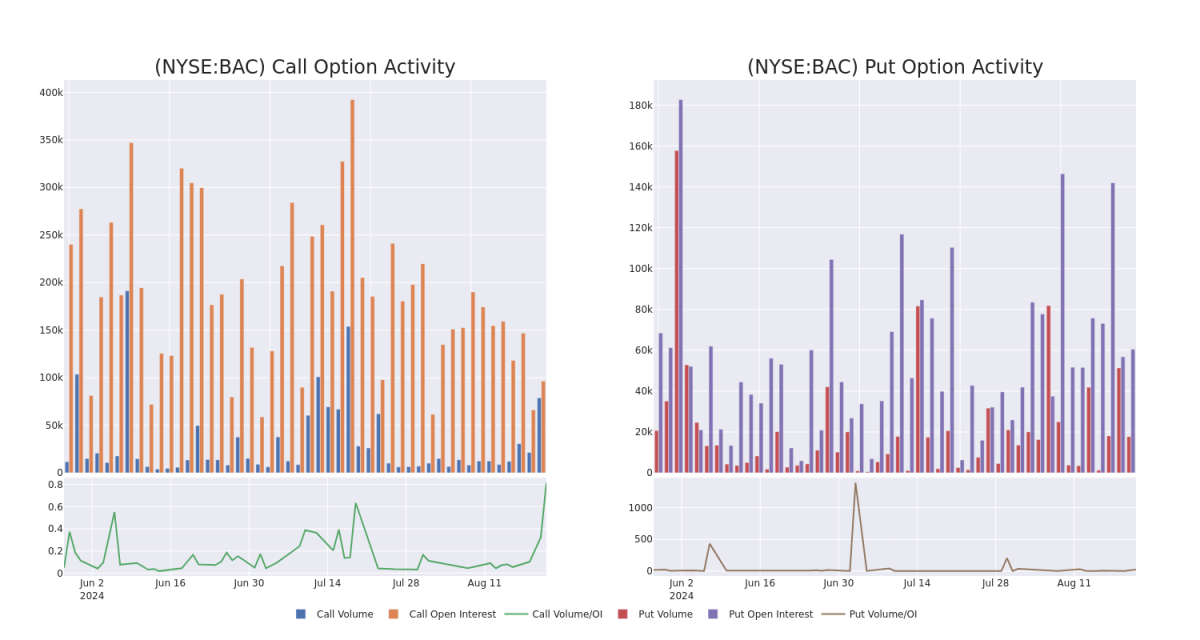

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Bank of America's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Bank of America's substantial trades, within a strike price spectrum from $30.0 to $65.0 over the preceding 30 days.

評估成交量和持倉量是期權交易中的一項戰略步驟。這些指標可以揭示美國銀行指定行權價格的期權的流動性和投資者興趣。接下來的數據可視化了過去30天內美國銀行的成交量和持倉量的波動,涵蓋了從$30.0到$65.0的行權價格範圍,與美國銀行的大規模交易相關的看漲和看跌期權均有所涉及。

Bank of America Call and Put Volume: 30-Day Overview

美國銀行看漲和看跌期權成交量:30天概述

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | CALL | SWEEP | BEARISH | 09/20/24 | $0.42 | $0.41 | $0.41 | $41.00 | $287.7K | 32.5K | 7.2K |

| BAC | PUT | SWEEP | BEARISH | 09/19/25 | $6.85 | $6.7 | $6.85 | $45.00 | $187.7K | 30 | 300 |

| BAC | PUT | SWEEP | BEARISH | 03/21/25 | $5.25 | $5.15 | $5.25 | $44.00 | $157.5K | 0 | 300 |

| BAC | CALL | TRADE | BEARISH | 09/20/24 | $0.42 | $0.4 | $0.4 | $41.00 | $120.0K | 32.5K | 10.2K |

| BAC | CALL | TRADE | BULLISH | 09/20/24 | $1.6 | $1.55 | $1.6 | $39.00 | $104.0K | 15.4K | 1.2K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | 看漲 | SWEEP | 看淡 | 09/20/24 | $0.42 | $0.41 | $0.41 | 41.00美元 | $104.0K | 15.4K | 7,200 |

| BAC | 看跌 | SWEEP | 看淡 | 09/19/25 | $6.85 | $6.7 | $6.85 | $45.00 | $187.7千美元 | 30 | 300 |

| BAC | 看跌 | SWEEP | 看淡 | 03/21/25 | $5.25 | $5.15 | $5.25 | $44.00 | $157.5K | 0 | 300 |

| BAC | 看漲 | 交易 | 看淡 | 09/20/24 | $0.42 | $0.4 | $0.4 | 41.00美元 | $120.0K | 15.4K | 10.2K |

| BAC | 看漲 | 交易 | 看好 | 09/20/24 | $1.6 | $1.55 | $1.6 | $39.00 | 104,000美元 | 15.4K | 1.2K |

About Bank of America

關於美國銀行

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America's consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company's Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

美國銀行是美國最大的金融機構之一,擁有超過$3萬億的資產。它分爲四個主要部門:消費銀行、全球財富和投資管理、全球銀行和全球市場。美國銀行面向消費者的業務包括其分行網絡和存款業務、零售貸款產品、信用和借記卡以及小企業服務。公司的美林業務提供經紀和财富管理服務,其私人銀行也是如此。批發業務包括投資銀行、公司和商業房地產貸款以及資本市場業務。美國銀行在多個國家開展業務,但主要是以美國爲重點。

After a thorough review of the options trading surrounding Bank of America, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Bank of America

美國銀行的現市場地位

- With a volume of 22,817,771, the price of BAC is up 0.25% at $39.34.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 53 days.

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一個收益預計在53天后發佈。

What Analysts Are Saying About Bank of America

分析師對美國銀行的評價

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $49.0.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Bank of America, which currently sits at a price target of $49.

- Morgan Stanley的一位分析師決定保持其對美國銀行的增重評級,目前的價格目標爲$49。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在回報。精明的交易者通過不斷教育自己、調整策略、監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro實時警報了解最新的紐交所銀行股票期權交易。

From the overall spotted trades, 13 are puts, for a total amount of $836,213 and 15, calls, for a total amount of $1,026,632.

From the overall spotted trades, 13 are puts, for a total amount of $836,213 and 15, calls, for a total amount of $1,026,632.