Unpacking the Latest Options Trading Trends in ARM Holdings

Unpacking the Latest Options Trading Trends in ARM Holdings

Investors with a lot of money to spend have taken a bullish stance on ARM Holdings (NASDAQ:ARM).

有大量資金的投資者對ARM Holdings(納斯達克:ARM)持樂觀態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ARM, it often means somebody knows something is about to happen.

無論這些投資者是機構還是富裕個人,我們並不知道。但是當ARM發生這麼大的事情時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 54 uncommon options trades for ARM Holdings.

今天,Benzinga的選項掃描器發現了54個ARm Holdings的不尋常的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 55% bullish and 40%, bearish.

這些大資金交易者的總體情緒在55%看漲和40%看淡之間分歧。

Out of all of the special options we uncovered, 21 are puts, for a total amount of $1,321,268, and 33 are calls, for a total amount of $1,776,441.

在我們發現的所有特殊期權中,有21個看跌期權,總金額爲1,321,268美元,有33個看漲期權,總金額爲1,776,441美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $200.0 for ARM Holdings during the past quarter.

分析這些合同的成交量和未平倉合約,似乎大戶在過去的季度裏一直密切關注ARM Holdings在60.0美元至200.0美元的價格區間。

Insights into Volume & Open Interest

成交量和持倉量分析

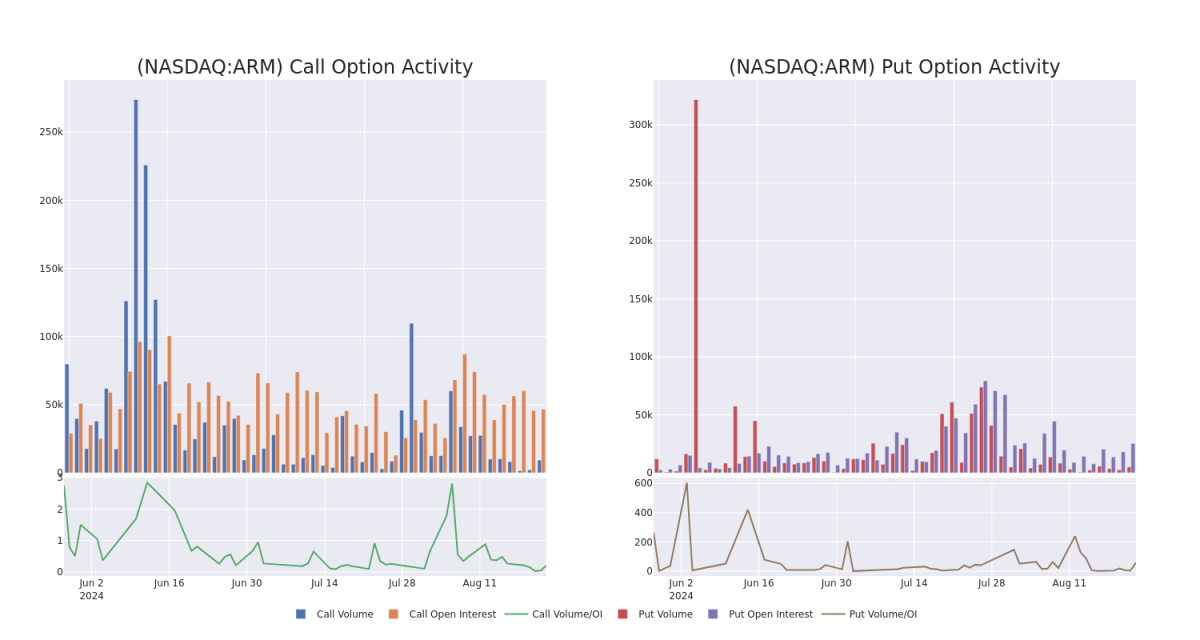

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ARM Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ARM Holdings's significant trades, within a strike price range of $60.0 to $200.0, over the past month.

檢查成交量和持倉量對股票研究至關重要。這些信息對於評估ARm Holdings在某些行權價格下的期權流動性和興趣水平至關重要。以下是過去一個月內ARm Holdings的看漲和看跌期權在60.0至200.0美元行權價範圍內的成交量和持倉量趨勢的快照。

ARM Holdings Option Activity Analysis: Last 30 Days

ARm Holdings期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | TRADE | BULLISH | 11/15/24 | $17.7 | $17.35 | $17.6 | $135.00 | $422.4K | 401 | 38 |

| ARM | PUT | TRADE | BEARISH | 03/21/25 | $4.5 | $4.3 | $4.5 | $85.00 | $135.0K | 796 | 912 |

| ARM | PUT | TRADE | BULLISH | 01/17/25 | $5.65 | $5.5 | $5.55 | $100.00 | $133.2K | 7.6K | 243 |

| ARM | PUT | TRADE | BEARISH | 01/17/25 | $26.15 | $25.9 | $26.15 | $145.00 | $125.5K | 1.0K | 49 |

| ARM | PUT | SWEEP | BULLISH | 11/15/24 | $15.85 | $15.8 | $15.8 | $135.00 | $94.8K | 1.8K | 67 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | 看漲 | 交易 | 看好 | 11/15/24 | $17.7 | $17.35 | $17.6 | $135.00 | RSI indicators show the stock to be is currently neutral between overbought and oversold. | 401 | 38 |

| ARM | 看跌 | 交易 | 看淡 | 03/21/25 | $4.5 | $4.3 | $4.5 | $85.00 | $135.0K | 796 | 912 |

| ARM | 看跌 | 交易 | 看好 | 01/17/25 | $5.65 | $5.5 | $5.55 | $100.00。 | 7.6K | 243 | |

| ARM | 看跌 | 交易 | 看淡 | 01/17/25 | $26.15 | $25.9 | $26.15 | $145.00 | 125.5千美元 | 1.0K | 49 |

| ARM | 看跌 | SWEEP | 看好 | 11/15/24 | $15.85 | $15.8 | $15.8 | $135.00 | $94.8K | 1.8K | 67 |

About ARM Holdings

關於ARM控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM體系結構(IP)的所有者和開發者,該體系結構在全球99%的智能手機CPU核心中使用,在其他電池供電設備(如可穿戴設備、平板電腦或傳感器)中也佔有很高的市場份額。Arm根據用戶的需求提供不同類型的許可證,客戶如蘋果或高通購買體系結構許可證,這使他們可以修改體系結構並添加/刪除指令以使芯片更符合其特定需求。其他客戶直接從Arm購買現成的設計。現成的和架構客戶每出貨一顆芯片,就會支付一定的版稅。

After a thorough review of the options trading surrounding ARM Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of ARM Holdings

ARM Holdings當前的持倉

- Trading volume stands at 6,145,870, with ARM's price up by 4.83%, positioned at $135.99.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 84 days.

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 盈利公告將於84天內發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子和關注市場動態來減輕這些風險。使用Benzinga Pro進行實時提醒,了解ARM Holdings的最新期權交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ARM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ARM, it often means somebody knows something is about to happen.