Do Shanghai Stonehill Technology's (SZSE:002195) Earnings Warrant Your Attention?

Do Shanghai Stonehill Technology's (SZSE:002195) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

即使這些故事沒有任何收入,更不用說利潤了,投資者們經常被發現「發現下一個大事件」的想法所引導。有時,這些故事會矇蔽投資者的頭腦,導致他們基於情感而非基本面的好公司來投資。儘管一家資本充足的公司可能會多年承受損失,但它最終需要創造利潤,否則投資者將離開,該公司將被淘汰。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Shanghai Stonehill Technology (SZSE:002195). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

儘管處於科技股藍天投資的時代,許多投資者仍然採用更傳統的策略;像買入像巖山科技(SZSE:002195)這樣的盈利公司的股票。在投資時盈利並不是唯一應考慮的指標,但值得認識到那些能夠持續產生盈利的企業。

Shanghai Stonehill Technology's Improving Profits

巖山科技的利潤增長

In the last three years Shanghai Stonehill Technology's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Shanghai Stonehill Technology's EPS soared from CN¥0.039 to CN¥0.053, over the last year. That's a commendable gain of 39%.

在過去三年裏,巖山科技的每股收益大幅增長;以至於用這些數據來推斷長期預期有點心懷不軌。因此,將焦點放在最近的增長率上更有意義。令股東高興的是,巖山科技的每股收益從CN¥0.039上升到CN¥0.053,過去一年中。這是可觀的增長達39%。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, revenue is down and so are margins. That will not make it easy to grow profits, to say the least.

銷售額的增長是可持續增長的重要指標,再加上高的利潤率,這是公司在市場上保持競爭優勢的好方法。不幸的是,收入下降了,利潤率也下降了。這將使利潤增長變得更加困難,這是毋庸置疑的。

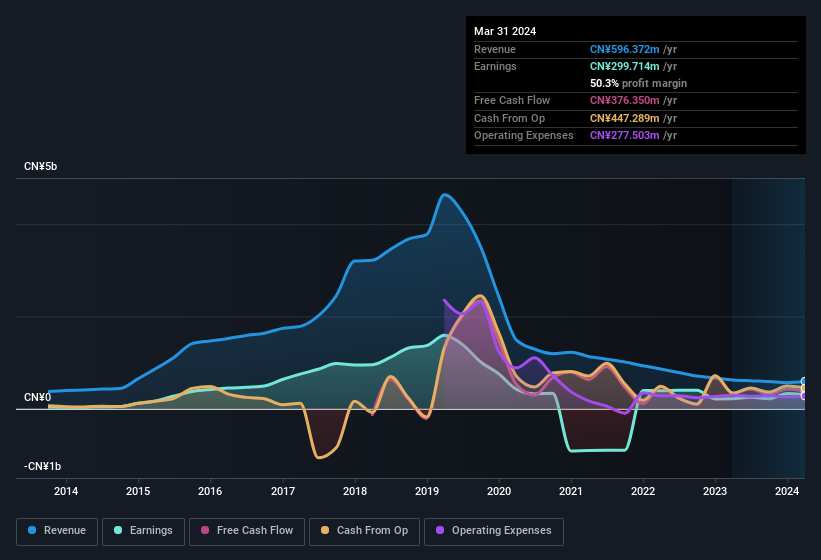

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

您可以查看下圖中企業的營收和收益增長趨勢。要查看實際數字,請單擊圖表。

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Shanghai Stonehill Technology's balance sheet strength, before getting too excited.

雖然看到盈利增長總是好的,但是在過於興奮之前,你應該記住資產負債表薄弱可能會帶來麻煩。所以在興奮之前,先查看一下巖山科技的資產負債表狀況。

Are Shanghai Stonehill Technology Insiders Aligned With All Shareholders?

巖山科技內部人與所有股東是否一致?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Shanghai Stonehill Technology shares worth a considerable sum. To be specific, they have CN¥210m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 1.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

看到公司領導人把自己的錢拿出來,所謂的把錢投入到業務中,是令人欣慰的,因爲它增加了經營者與真正所有人之間的利益契合。股東們會高興地發現內部人擁有價值相當可觀的巖山科技股份。具體來說,他們擁有2.1億人民幣的股份,這份相當大的投資應該有助於推動公司的長期價值。儘管只佔公司的1.6%,但這筆投資的價值足夠表明內部人在這個創業公司上責任重大。

Is Shanghai Stonehill Technology Worth Keeping An Eye On?

巖山科技值得關注嗎?

For growth investors, Shanghai Stonehill Technology's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Even so, be aware that Shanghai Stonehill Technology is showing 1 warning sign in our investment analysis , you should know about...

對於增長投資者來說,巖山科技的直接收益增長率就像夜晚的指引。憑藉這樣的每股收益增長率,不足爲奇,看到公司高層通過持續持有大量投資來表達對公司的信心。快速的增長和充滿信心的內部人應該足以需要進一步研究,所以看起來這是一個值得關注的好股票。儘管如此,要知道,巖山科技在我們的投資分析中顯示了一個警示信號,你應該了解一下...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

雖然不選取增長收益和缺少內部人買入的股票可能會產生效果,但是對於重視這些關鍵指標的投資者,這裏是一份精心挑選的具有巨大增長潛力和內部人信心的CN公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)