北京時間23日晚10點,聯儲局主席鮑威爾在傑克遜霍爾全球央行年會上重磅發聲。會議上,鮑威爾釋放了迄今爲止最爲明確的減息信號,他表示: 政策調整的時機已經到來。減息時機和節奏將取決於後續數據、前景變化和風險平衡。

北京時間23日晚10點,聯儲局主席鮑威爾在傑克遜霍爾全球央行年會上重磅發聲。

會議上,鮑威爾釋放了迄今爲止最爲明確的減息信號,他表示: 政策調整的時機已經到來。減息時機和節奏將取決於後續數據、前景變化和風險平衡。

他認爲,目前的政策利率水平爲聯儲局提供了充足的空間來應對可能面臨的任何風險,包括勞動力市場狀況進一步惡化的風險。「通脹的上行風險已經減弱,就業的下行風險則有所增加。聯儲局關注雙重使命各自所面臨的風險。」

他認爲,目前的政策利率水平爲聯儲局提供了充足的空間來應對可能面臨的任何風險,包括勞動力市場狀況進一步惡化的風險。「通脹的上行風險已經減弱,就業的下行風險則有所增加。聯儲局關注雙重使命各自所面臨的風險。」

以下爲講話全文(中英對照):

Four and a half years after COVID-19's arrival, the worst of the pandemic-related economic distortions are fading. Inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized. And the balance of the risks to our two mandates has changed. Our objective has been to restore price stability while maintaining a strong labor market, avoiding the sharp increases in unemployment that characterized earlier disinflationary episodes when inflation expectations were less well anchored. While the task is not complete, we have made a good deal of progress toward that outcome.

在新冠病毒到來四年半後,與疫情相關的最嚴重的經濟扭曲正在消退。通貨膨脹已明顯下降。勞動力市場不再過熱,現在的狀況也不如疫情前那麼緊俏。供給限制已經正常化。我們兩項任務的風險平衡已經發生了變化。我們的目標是恢復價格穩定的同時保持強勁的勞動力市場,避免失業率急劇上升,這是通脹預期沒有充分錨定時通常會出現的早期去通脹特徵。我們已經朝着這個目標取得了很大進展。雖然任務尚未完成,但我們已經朝着這一結果取得了很大進展。

Today, I will begin by addressing the current economic situation and the path ahead for monetary policy. I will then turn to a discussion of economic events since the pandemic arrived, exploring why inflation rose to levels not seen in a generation, and why it has fallen so much while unemployment has remained low.

今天,我將首先討論當前的經濟形勢和貨幣政策的未來路徑。然後,我將轉向對疫情以來經濟事件的討論,探討爲什麼通貨膨脹上升到一代人以來的最高水平,以及爲什麼通脹率下降如此之多,而失業率卻保持在低位。

Near-Term Outlook for Policy 近期政策展望

Let's begin with the current situation and the near-term outlook for policy.

讓我們從當前的形勢和近期政策前景開始。

For much of the past three years, inflation ran well above our 2 percent goal, and labor market conditions were extremely tight. The Federal Open Market Committee's (FOMC) primary focus has been on bringing down inflation, and appropriately so. Prior to this episode, most Americans alive today had not experienced the pain of high inflation for a sustained period. Inflation brought substantial hardship, especially for those least able to meet the higher costs of essentials like food, housing, and transportation. High inflation triggered stress and a sense of unfairness that linger today.

在過去三年的大部分時間裏,通脹率遠高於我們 2% 的目標,勞動力市場狀況極其緊張。聯邦公開市場委員會 (FOMC) 的主要重點是降低通脹率,這是理所當然的。在此之前,當今大多數美國人還沒有經歷過長期高通脹的痛苦。通脹帶來了巨大的困難,尤其是對於那些最無力承擔食品、住房和交通等基本生活必需品高昂成本的人來說。高通脹引發的壓力和不公平感至今仍然存在。

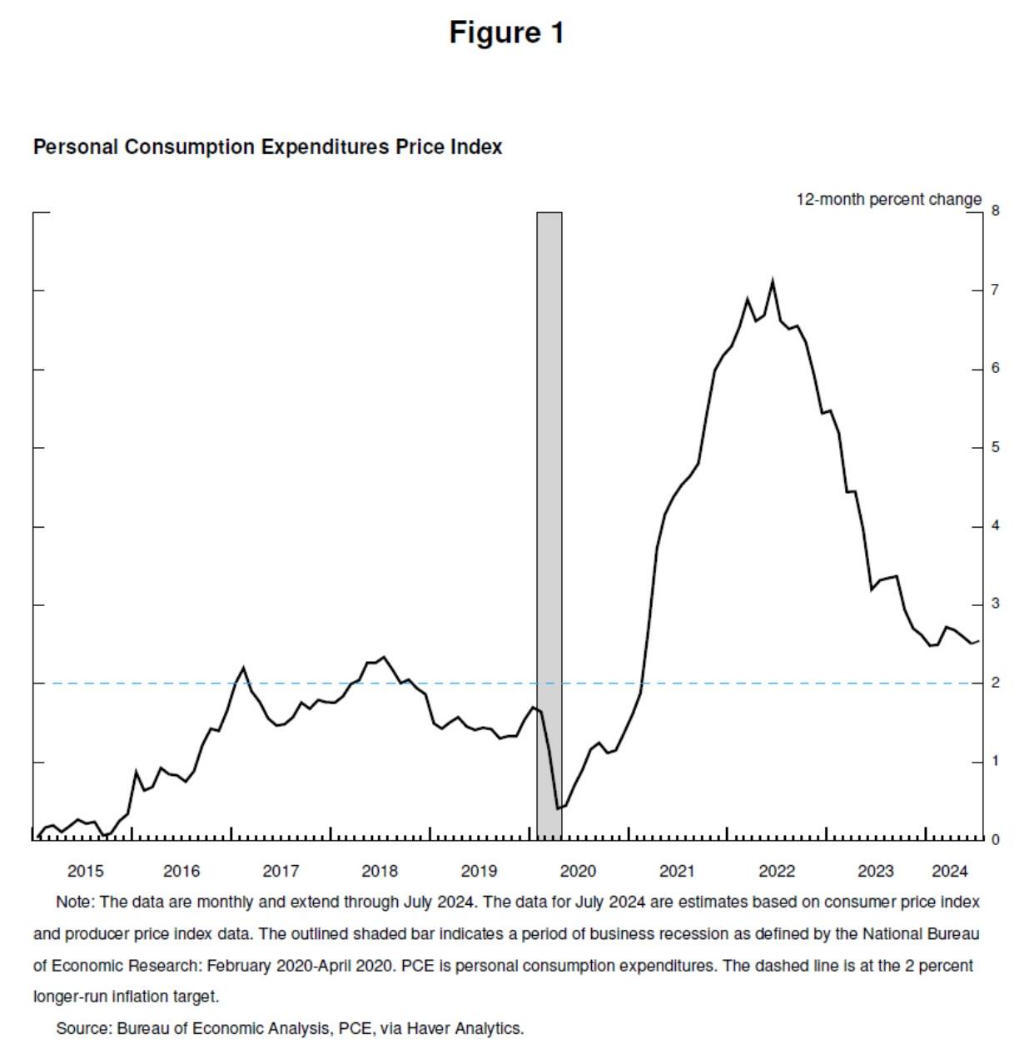

Our restrictive monetary policy helped restore balance between aggregate supply and demand, easing inflationary pressures and ensuring that inflation expectations remained well anchored. Inflation is now much closer to our objective, with prices having risen 2.5 percent over the past 12 months (figure 1) . After a pause earlier this year, progress toward our 2 percent objective has resumed. My confidence has grown that inflation is on a sustainable path back to 2 percent.

我們的限制性貨幣政策有助於恢復總供需平衡,緩解通脹壓力,並確保通脹預期保持良好錨定。通貨膨脹現在更接近我們的目標,物價在過去12個月中上漲了2.5%(圖1)。繼年初有所凝滯之後,我們朝着2%的目標又取得了進展。我越來越有信心,通脹率正沿着可持續的道路回到2%。

Turning to employment, in the years just prior to the pandemic, we saw the significant benefits to society that can come from a long period of strong labor market conditions: low unemployment, high participation, historically low racial employment gaps, and, with inflation low and stable, healthy real wage gains that were increasingly concentrated among those with lower incomes.

談到就業,在疫情爆發前的幾年裏,我們看到了長期強勁的勞動力市場狀況給社會帶來的重大利益:低失業率、高參與率、歷史性的低種族就業差距,以及通貨膨脹率低而穩定、實際工資增長健康且越來越集中在低收入人群中。

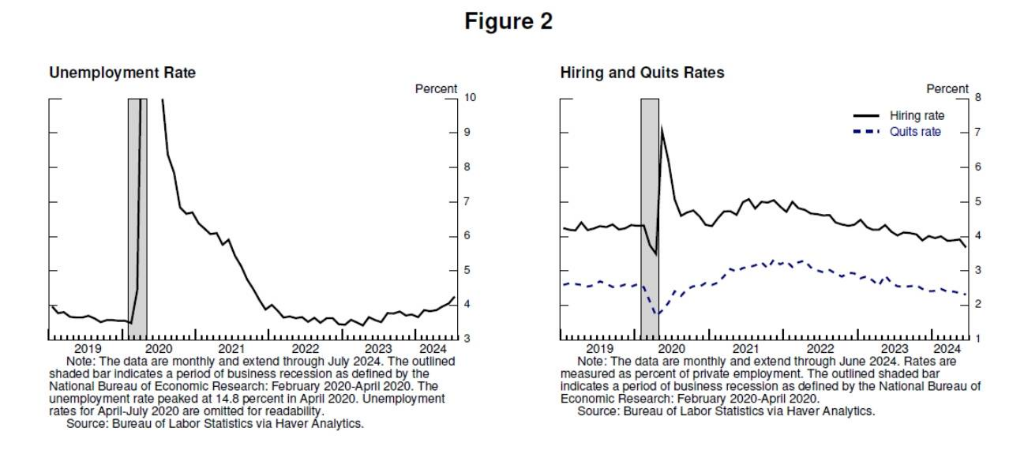

Today, the labor market has cooled considerably from its formerly overheated state. The unemployment rate began to rise over a year ago and is now at 4.3 percent—still low by historical standards, but almost a full percentage point above its level in early 2023 (figure 2). Most of that increase has come over the past six months. So far, rising unemployment has not been the result of elevated layoffs, as is typically the case in an economic downturn. Rather, the increase mainly reflects a substantial increase in the supply of workers and a slowdown from the previously frantic pace of hiring. Even so, the cooling in labor market conditions is unmistakable. Job gains remain solid but have slowed this year. Job vacancies have fallen, and the ratio of vacancies to unemployment has returned to its pre-pandemic range. The hiring and quits rates are now below the levels that prevailed in 2018 and 2019. Nominal wage gains have moderated. All told, labor market conditions are now less tight than just before the pandemic in 2019—a year when inflation ran below 2 percent. It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.

如今,勞動力市場已從之前的過熱狀態大幅降溫。失業率在一年多前開始上升,目前爲4.3%,以歷史標準衡量仍然較低,但比2023年初的水平高出將近整整一個百分點(圖2)。其中大部分上升是在過去六個月中實現的。到目前爲止,失業率上升並不是裁員增加的結果,而裁員是經濟衰退時期的典型情況。相反,這一增長主要反映了工人供給的大幅增加以及之前瘋狂的招聘速度有所放緩。即便如此,勞動力市場狀況的降溫是毋庸置疑的。就業增長保持穩健,但今年有所放緩。職位空缺下降,職位空缺與失業的比率已回到疫情前的水平。招聘率和離職率現在低於 2018年和2019年的水平。名義工資增長有所放緩。總而言之,現在的勞動力市場狀況不如2019年疫情之前那麼緊張,那一年的通脹率低於2%。勞動力市場似乎不太可能在短期內成爲通脹壓力上升的根源。我們不尋求或歡迎勞動力市場狀況進一步降溫。

Overall, the economy continues to grow at a solid pace. But the inflation and labor market data show an evolving situation. The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate.

總體而言,經濟繼續以穩健的速度增長。但通貨膨脹和勞動力市場數據顯示,情況正在不斷變化。通脹的上行風險已經減弱。就業的下行風險也有所增加。正如我們在上一次FOMC中強調的那樣,我們關注雙重任務中的兩方面風險。

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

現在是政策調整的時候了。前進的方向是明確的,減息的時機和步伐將取決於即將到來的數據、不斷變化的前景以及風險的平衡。

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

我們將盡一切努力支持強勁的勞動力市場,同時在價格穩定方面力求進一步進展。隨着政策約束的適當收斂,我們有充分的理由認爲,經濟將回到2%的通脹率,同時保持強勁的勞動力市場。我們目前的政策利率水平爲我們提供了充足的空間來應對可能面臨的任何風險,包括勞動力市場狀況不受歡迎的進一步疲軟的風險。

The Rise and Fall of Inflation 通脹的起落

Let's now turn to the questions of why inflation rose, and why it has fallen so significantly even as unemployment has remained low. There is a growing body of research on these questions, and this is a good time for this discussion. It is, of course, too soon to make definitive assessments. This period will be analyzed and debated long after we are gone.

現在讓我們來談談爲什麼通貨膨脹會上升,爲什麼在失業率保持低位的情況下通貨膨脹卻大幅下降。關於這些問題的研究越來越多,現在是討論的好時機。當然,現在做出明確的評估還爲時過早。在我們離開後很長一段時間,人們仍將對這段時期進行分析和辯論。

The arrival of the COVID-19 pandemic led quickly to shutdowns in economies around the world. It was a time of radical uncertainty and severe downside risks. As so often happens in times of crisis, Americans adapted and innovated. Governments responded with extraordinary force, especially in the U.S. Congress unanimously passed the CARES Act. At the Fed, we used our powers to an unprecedented extent to stabilize the financial system and help stave off an economic depression.

新冠疫情的爆發迅速導致全球經濟停擺。這是一個充滿不確定性和嚴重下行風險的時期。正如危機時期經常發生的那樣,美國人適應並創新。各國政府做出了非凡的回應,尤其是美國國會一致通過了《關懷法案》。在聯儲局,我們以前所未有的程度運用我們的權力來穩定金融體系並幫助避免經濟蕭條。

After a historically deep but brief recession, in mid-2020 the economy began to grow again. As the risks of a severe, extended downturn receded, and as the economy reopened, we faced the risk of replaying the painfully slow recovery that followed the Global Financial Crisis.

在經歷了歷史上令人深刻但短暫的衰退之後,2020年年中,經濟再次開始增長。隨着嚴重偏向下行的風險消退,以及經濟重新開放,我們依然面臨着風險,可能會再次經歷像全球金融危機之後那樣緩慢復甦的痛苦。

Congress delivered substantial additional fiscal support in late 2020 and again in early 2021. Spending recovered strongly in the first half of 2021. The ongoing pandemic shaped the pattern of the recovery. Lingering concerns over COVID weighed on spending on in-person services. But pent-up demand, stimulative policies, pandemic changes in work and leisure practices, and the additional savings associated with constrained services spending all contributed to a historic surge in consumer spending on goods.

國會在 2020 年底和 2021 年初提供了大量額外的財政支持。2021 年上半年,支出強勁復甦。持續的疫情影響了復甦的模式。對新冠疫情的持續擔憂拖累了面對面服務的支出。但被壓抑的需求、刺激政策、疫情導致的工作和休閒習慣的變化,以及與服務支出受限相關的額外儲蓄,都促使消費者在商品上的支出出現歷史性激增。

The pandemic also wreaked havoc on supply conditions. Eight million people left the workforce at its onset, and the size of the labor force was still 4 million below its pre-pandemic level in early 2021. The labor force would not return to its pre-pandemic trend until mid-2023 (figure 3). Supply chains were snarled by a combination of lost workers, disrupted international trade linkages, and tectonic shifts in the composition and level of demand (figure 4). Clearly, this was nothing like the slow recovery after the Global Financial Crisis.

疫情還對供給端造成了嚴重破壞。疫情開始時有 800 萬人離開了勞動力市場,勞動力數量仍比 2021 年初疫情前的水平低 400 萬人。勞動力直到2023年年中才恢復到疫情前的趨勢(圖3)。 工人流失、國際貿易聯繫中斷以及需求水平以及組成的結構性變化等因素使供應鏈陷入困境(圖4)。顯然,這與全球金融危機後的緩慢復甦完全不同。

Enter inflation. After running below target through 2020, inflation spiked in March and April 2021. The initial burst of inflation was concentrated rather than broad based, with extremely large price increases for goods in short supply, such as motor vehicles. My colleagues and I judged at the outset that these pandemic-related factors would not be persistent and, thus, that the sudden rise in inflation was likely to pass through fairly quickly without the need for a monetary policy response—in short, that the inflation would be transitory. Standard thinking has long been that, as long as inflation expectations remain well anchored, it can be appropriate for central banks to look through a temporary rise in inflation.

通貨膨脹開始顯現。在 2020 年全年低於目標水平後,通貨膨脹在 2021 年 3 月和 4 月飆升。最初的通貨膨脹爆發是集中的,而不是廣泛的,汽車等短缺商品的價格大幅上漲。我和我的同事一開始就判斷,這些與疫情相關的因素不會持續,因此,通貨膨脹的突然上升很可能很快就會過去,而不需要貨幣政策應對——簡而言之,通貨膨脹將是暫時的。長期以來的標準思維是,只要通脹預期保持良好穩定,央行就可以忽略通脹的暫時上升。

The good ship Transitory was a crowded one, with most mainstream analysts and advanced-economy central bankers on board. The common expectation was that supply conditions would improve reasonably quickly, that the rapid recovery in demand would run its course, and that demand would rotate back from goods to services, bringing inflation down.

「暫時性」這艘好船擠滿了人,大多數主流分析師和發達經濟體央行行長都支持這一觀點。他們普遍預期供應狀況將迅速改善,需求的快速復甦將順其自然,需求將從商品轉向服務,從而降低通脹率。

For a time, the data were consistent with the transitory hypothesis. Monthly readings for core inflation declined every month from April to September 2021, although progress came slower than expected (figure 5). The case began to weaken around midyear, as was reflected in our communications. Beginning in October, the data turned hard against the transitory hypothesis.9 Inflation rose and broadened out from goods into services. It became clear that the high inflation was not transitory, and that it would require a strong policy response if inflation expectations were to remain well anchored. We recognized that and pivoted beginning in November. Financial conditions began to tighten. After phasing out our asset purchases, we lifted off in March 2022.

一段時間內,數據與暫時性假設相一致。2021 年 4 月至 9 月,核心通脹的月度讀數每月都在下降,儘管進展慢於預期(圖 5)。正如我們的溝通所反映的那樣,這種情況在年中左右開始減弱。從 10 月開始,數據變得與暫時性假設背道而馳。9 通脹上升,並從商品擴展到服務。很明顯,高通脹不是暫時的,如果要保持通脹預期的良好穩定,就需要強有力的政策應對。我們意識到了這一點,並從 11 月開始轉變。金融狀況開始收緊。在逐步取消資產購買後,我們於 2022 年 3 月開始加息。

By early 2022, headline inflation exceeded 6 percent, with core inflation above 5 percent. New supply shocks appeared. Russia's invasion of Ukraine led to a sharp increase in energy and commodity prices. The improvements in supply conditions and rotation in demand from goods to services were taking much longer than expected, in part due to further COVID waves in the U.S.

到2022年初,總體通脹超過6%,核心通脹超過5%。新的供給衝擊出現。俄烏衝突導致能源和大宗商品價格大幅上漲。供給狀況的改善和需求從商品轉向服務的時間比預期的要長得多,部分原因是美國新一輪的新冠浪潮。

High rates of inflation were a global phenomenon, reflecting common experiences: rapid increases in the demand for goods, strained supply chains, tight labor markets, and sharp hikes in commodity prices.12 The global nature of inflation was unlike any period since the 1970s. Back then, high inflation became entrenched—an outcome we were utterly committed to avoiding.

高通脹率是一種全球現象,反映了共同的經歷:商品需求迅速增加、供應鏈緊張、勞動力市場緊張以及大宗商品價格大幅上漲。全球通脹的本質不同於上世紀70年代以來的任何時期。那時,高通脹已經根深蒂固——這是我們盡全力避免的結果。

By mid-2022, the labor market was extremely tight, with employment increasing by over 6-1/2 million from the middle of 2021. This increase in labor demand was met, in part, by workers rejoining the labor force as health concerns began to fade. But labor supply remained constrained, and, in the summer of 2022, labor force participation remained well below pre-pandemic levels. There were nearly twice as many job openings as unemployed persons from March 2022 through the end of the year, signaling a severe labor shortage (figure 6).Inflation peaked at 7.1 percent in June 2022.

2022年年中,勞動力市場極度緊張,就業人數比2021年年中增加了650萬以上。勞動力需求的增加在一定程度上是通過工人重新加入勞動力市場來實現的,因爲人們對健康的擔憂開始消退。但勞動力供給仍然受到限制,2022年夏天的勞動力參與率仍遠低於疫情前的水平。從2022年3月到年底,職位空缺數幾乎是失業人數的兩倍,表明勞動力嚴重短缺(圖6)。通脹在2022年6月達到7.1%的峯值。

At this podium two years ago, I discussed the possibility that addressing inflation could bring some pain in the form of higher unemployment and slower growth. Some argued that getting inflation under control would require a recession and a lengthy period of high unemployment. I expressed our unconditional commitment to fully restoring price stability and to keeping at it until the job is done.

兩年前,我曾在這個講臺上討論過,解決通貨膨脹問題可能會帶來失業率上升和經濟增長放緩等一些痛苦。有人認爲,控制通貨膨脹需要經濟衰退和長期的高失業率。我表達了我們無條件的承諾,即全面恢復價格穩定,並堅持下去,直到任務完成。

The FOMC did not flinch from carrying out our responsibilities, and our actions forcefully demonstrated our commitment to restoring price stability. We raised our policy rate by 425 basis points in 2022 and another 100 basis points in 2023. We have held our policy rate at its current restrictive level since July 2023 (figure 7).

FOMC在履行責任方面沒有退縮,我們的行動有力地表明瞭我們對恢復價格穩定的決心。我們在2022年將政策利率上調了425bp,並在2023年再次上調 100bp。自2023年7月以來,我們一直將政策利率維持在目前的限制性水平(圖7)。

The summer of 2022 proved to be the peak of inflation. The 4-1/2 percentage point decline in inflation from its peak two years ago has occurred in a context of low unemployment—a welcome and historically unusual result.

通脹在2022 年夏季達到峯值。在低失業率的背景下,通脹從兩年前的峯值下降了4.5%,這是一個可喜且歷史罕見的結果。

How did inflation fall without a sharp rise in unemployment above its estimated natural rate?

如何達到通脹下降而失業率沒有急劇上升到超過估計的自然失業率的?

Pandemic-related distortions to supply and demand, as well as severe shocks to energy and commodity markets, were important drivers of high inflation, and their reversal has been a key part of the story of its decline. The unwinding of these factors took much longer than expected but ultimately played a large role in the subsequent disinflation. Our restrictive monetary policy contributed to a moderation in aggregate demand, which combined with improvements in aggregate supply to reduce inflationary pressures while allowing growth to continue at a healthy pace. As labor demand also moderated, the historically high level of vacancies relative to unemployment has normalized primarily through a decline in vacancies, without sizable and disruptive layoffs, bringing the labor market to a state where it is no longer a source of inflationary pressures.

疫情相關的供需扭曲以及對能源和大宗商品市場的嚴重衝擊,是高通脹的重要驅動因素,而它們的逆轉是通脹下降的關鍵部分。這些因素的消除花費的時間比預期要長得多,但最終在隨後的去通脹中發揮了重要作用。限制性貨幣政策導致總需求放緩,這與總供給的改善相結合,減輕了通脹壓力,同時繼續保持良性增長。隨着勞動力需求也有所放緩,職位空缺率/失業率已經從歷史高位恢復正常,主要是通過職位空缺的下降,而非大規模和破壞性的裁員,使得勞動力市場不再是通脹壓力的來源。

A word on the critical importance of inflation expectations. Standard economic models have long reflected the view that inflation will return to its objective when product and labor markets are balanced—without the need for economic slack—so long as inflation expectations are anchored at our objective. That's what the models said, but the stability of longer-run inflation expectations since the 2000s had not been tested by a persistent burst of high inflation. It was far from assured that the inflation anchor would hold. Concerns over de-anchoring contributed to the view that disinflation would require slack in the economy and specifically in the labor market. An important takeaway from recent experience is that anchored inflation expectations, reinforced by vigorous central bank actions, can facilitate disinflation without the need for slack.

關於通脹預期的重要性。長期以來,標準經濟模型一直反映出這樣一種觀點,即只要通脹預期錨定在我們的目標上,當產品和勞動力市場達到平衡時,通脹就會回到其目標,而不會帶來經濟鬆弛。模型是這麼說的,但自2000年代以來長期通脹預期的穩定性並沒有經受過持續高通脹的考驗。通脹能否持續錨定還遠不能得以保障。對脫錨的擔憂促成了一種觀點,即去通脹將需要經濟(尤其是勞動力市場)的鬆弛。從最近的經驗中得出的一個重要結論是,錨定的通脹預期,加上央行的有力行動,可以促進去通脹,經濟鬆弛並不是必須的。

This narrative attributes much of the increase in inflation to an extraordinary collision between overheated and temporarily distorted demand and constrained supply. While researchers differ in their approaches and, to some extent, in their conclusions, a consensus seems to be emerging, which I see as attributing most of the rise in inflation to this collision.All told, the healing from pandemic distortions, our efforts to moderate aggregate demand, and the anchoring of expectations have worked together to put inflation on what increasingly appears to be a sustainable path to our 2 percent objective.

這種說法將通脹上升主要歸咎於(經濟)過熱以及暫時扭曲的需求與受限的供給之間的非凡碰撞。儘管研究人員在方法上各不相同,在某種程度上他們的結論上也各不相同,但似乎正在形成一種共識,在我看來就是通脹上升的大部分原因應歸咎於這場碰撞。總而言之,我們從疫情的扭曲中恢復了過來,我們爲緩和總需求所做的努力結合對預期的錨定,共同使通脹走上了一條日益實現2%目標的可持續道路。

Disinflation while preserving labor market strength is only possible with anchored inflation expectations, which reflect the public's confidence that the central bank will bring about 2 percent inflation over time. That confidence has been built over decades and reinforced by our actions.

只有在錨定通脹預期的情況下才有可能在保持勞動力市場強勁的同時實現去通脹,這反映了公衆有信心央行將逐漸達到2%左右的通脹目標。這種信心是過去幾十年來建立起來的,並且通過我們的行動得以加強。

That is my assessment of events. Your mileage may vary.

這是我對事件的評估。可能因人而異。

Conclusion 結論

Let me wrap up by emphasizing that the pandemic economy has proved to be unlike any other, and that there remains much to be learned from this extraordinary period. Our Statement on Longer-Run Goals and Monetary Policy Strategy emphasizes our commitment to reviewing our principles and making appropriate adjustments through a thorough public review every five years. As we begin this process later this year, we will be open to criticism and new ideas, while preserving the strengths of our framework. The limits of our knowledge—so clearly evident during the pandemic—demand humility and a questioning spirit focused on learning lessons from the past and applying them flexibly to our current challenges.

最後,我想強調的是,事實證明,疫情經濟與其他任何經濟都不同,從這一特殊時期中我們仍有許多東西需要學習。我們的《長期目標和貨幣政策戰略聲明》強調,我們致力於每五年通過一次全面的公開審查來審查我們的原則並做出適當調整。當我們在今年晚些時候開始這一進程時,我們將對批評和新想法持開放態度,同時保持我們框架的優勢。我們知識的侷限性——在疫情期間顯而易見——要求我們保持謙遜和質疑精神,專注於從過去吸取教訓並靈活地將其應用於我們當前的挑戰。

注:鮑威爾講話稿原文詳見聯儲局官網,華爾街見聞略有刪節。

他认为,目前的政策利率水平为美联储提供了充足的空间来应对可能面临的任何风险,包括劳动力市场状况进一步恶化的风险。“通胀的上行风险已经减弱,就业的下行风险则有所增加。美联储关注双重使命各自所面临的风险。”

他认为,目前的政策利率水平为美联储提供了充足的空间来应对可能面临的任何风险,包括劳动力市场状况进一步恶化的风险。“通胀的上行风险已经减弱,就业的下行风险则有所增加。美联储关注双重使命各自所面临的风险。”