Is Lennar (NYSE:LEN) Using Too Much Debt?

Is Lennar (NYSE:LEN) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Lennar Corporation (NYSE:LEN) does have debt on its balance sheet. But is this debt a concern to shareholders?

傳奇基金經理李錄(受到查理·芒格的支持)曾說:「最大的投資風險不是價格的波動性,而是你是否會遭受資本永久損失。」因此,聰明錢知道債務是評估公司風險時非常重要的因素,因爲債務通常與破產有關。我們注意到藍納股份公司(紐交所:LEN)的資產負債表上確實有債務。但這債務是否會讓股東感到擔憂呢?

What Risk Does Debt Bring?

債務帶來了什麼風險?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

通常情況下,債務只有在公司無法輕鬆償還時才會成爲真正的問題,無論是通過籌集資本還是憑藉自身現金流。最終,如果公司無法履行償還債務的法律義務,股東可能會什麼也得不到。然而,更常見(但仍然昂貴)的情況是,公司必須以低廉的股價稀釋股東權益,以控制債務。當然,有很多公司使用債務來資助增長,沒有任何負面後果。在考慮公司使用債務時,我們首先看現金和債務的結合。

What Is Lennar's Net Debt?

藍納的淨債務是多少?

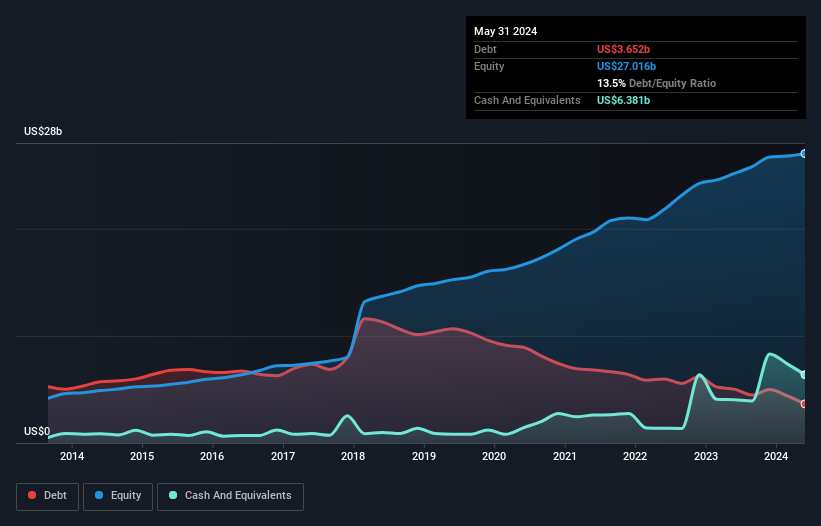

As you can see below, Lennar had US$3.65b of debt at May 2024, down from US$5.03b a year prior. However, it does have US$6.38b in cash offsetting this, leading to net cash of US$2.73b.

正如您在下面所看到的,截至2024年5月,藍納的債務爲36.5億美元,較一年前的50.3億美元下降。然而,其現金爲63.8億美元,抵消了這筆債務,從而形成淨現金爲27.3億美元。

A Look At Lennar's Liabilities

透視Lennar的負債

The latest balance sheet data shows that Lennar had liabilities of US$2.66b due within a year, and liabilities of US$8.99b falling due after that. On the other hand, it had cash of US$6.38b and US$984.6m worth of receivables due within a year. So it has liabilities totalling US$4.29b more than its cash and near-term receivables, combined.

最新的資產負債表數據顯示,Lennar有US$26.6億的一年內到期負債,以及US$89.9億的到期日在此後的負債。而其現金爲US$63.8億,一年內到期應收款爲US$98460萬。因此,其負債總額超過現金和近期應收款的US$42.9億。

Since publicly traded Lennar shares are worth a very impressive total of US$50.4b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Lennar boasts net cash, so it's fair to say it does not have a heavy debt load!

由於Lennar公開交易的股票總值爲US$504億,所以這個負債水平似乎不會是一個重大威脅。但是有足夠的負債,我們當然建議股東繼續關注資產負債表的情況。儘管有顯著的負債,Lennar擁有淨現金,因此可以說它沒有沉重的債務負擔!

On the other hand, Lennar saw its EBIT drop by 4.6% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Lennar can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

另一方面,Lennar在過去十二個月中,EBIT減少了4.6%。如果收益繼續以這個速度下降,公司可能會越來越難以管理其債務負擔。毫無疑問,我們從資產負債表上了解最多的是債務情況。但最終,企業未來的盈利能力將決定Lennar是否能夠逐漸加強其資產負債表。因此,如果你關注未來,可以查看這份顯示分析師盈利預測的免費報告。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Lennar has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Lennar produced sturdy free cash flow equating to 60% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

但是,我們最後考慮的也很重要,因爲公司不能用紙質利潤償還債務;它需要實實在在的現金。儘管Lennar的資產負債表上有淨現金,但仍值得關注其將利息和稅前利潤(EBIT)轉化爲自由現金流的能力,以幫助我們了解其現金餘額的增長(或減少)速度。在過去的三年中,Lennar產生了強勁的自由現金流,相當於其EBIT的60%,與我們的預期相符。這筆實實在在的現金意味着它可以在需要時減少債務。

Summing Up

總之

We could understand if investors are concerned about Lennar's liabilities, but we can be reassured by the fact it has has net cash of US$2.73b. So we are not troubled with Lennar's debt use. We'd be motivated to research the stock further if we found out that Lennar insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

我們可以理解投資者擔心Lennar的負債情況,但是我們可以通過它淨現金27.3億美元的事實來放心。所以我們對Lennar的債務使用沒有困擾。如果我們發現Lennar內部人士最近買入股票,我們會有動力進一步研究這隻股票。如果你也有這樣的想法,那麼你很幸運,因爲今天我們會免費分享我們的報告內部交易列表。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

當然,如果您是那種喜歡購買沒有債務負擔的股票的投資者,那麼不要猶豫,立即發現我們獨家的淨現金增長股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

The latest balance sheet data shows that Lennar had liabilities of US$2.66b due within a year, and liabilities of US$8.99b falling due after that. On the other hand, it had cash of US$6.38b and US$984.6m worth of receivables due within a year. So it has liabilities totalling US$4.29b more than its cash and near-term receivables, combined.

The latest balance sheet data shows that Lennar had liabilities of US$2.66b due within a year, and liabilities of US$8.99b falling due after that. On the other hand, it had cash of US$6.38b and US$984.6m worth of receivables due within a year. So it has liabilities totalling US$4.29b more than its cash and near-term receivables, combined.