Market Mover | Shares of Temu Parent PDD Slump 26% After Q2 Financial Results

Market Mover | Shares of Temu Parent PDD Slump 26% After Q2 Financial Results

August 26, 2024 - Shares of the Temu parent company $PDD Holdings (PDD.US)$ slumped 26.10% to $103.37 in early trading on Monday.

2024 年 8 月 26 日-Temu 母公司的股份 $拼多多 (PDD.US)$ 週一早盤,下跌26.10%,至103.37美元。

Today, the company reported its Q2 unaudited financial results that fell short of expectations. The China-based online retailer reported revenue below analysts' estimates, and management indicated that revenue growth pressures are expected to continue due to heightened competition and other challenges.

今天,該公司公佈的第二季度未經審計的財務業績低於預期。這家總部位於中國的在線零售商報告的收入低於分析師的預期,管理層表示,由於競爭加劇和其他挑戰,預計收入增長壓力將持續下去。

Highlights for Q2 earnings

第二季度收益亮點

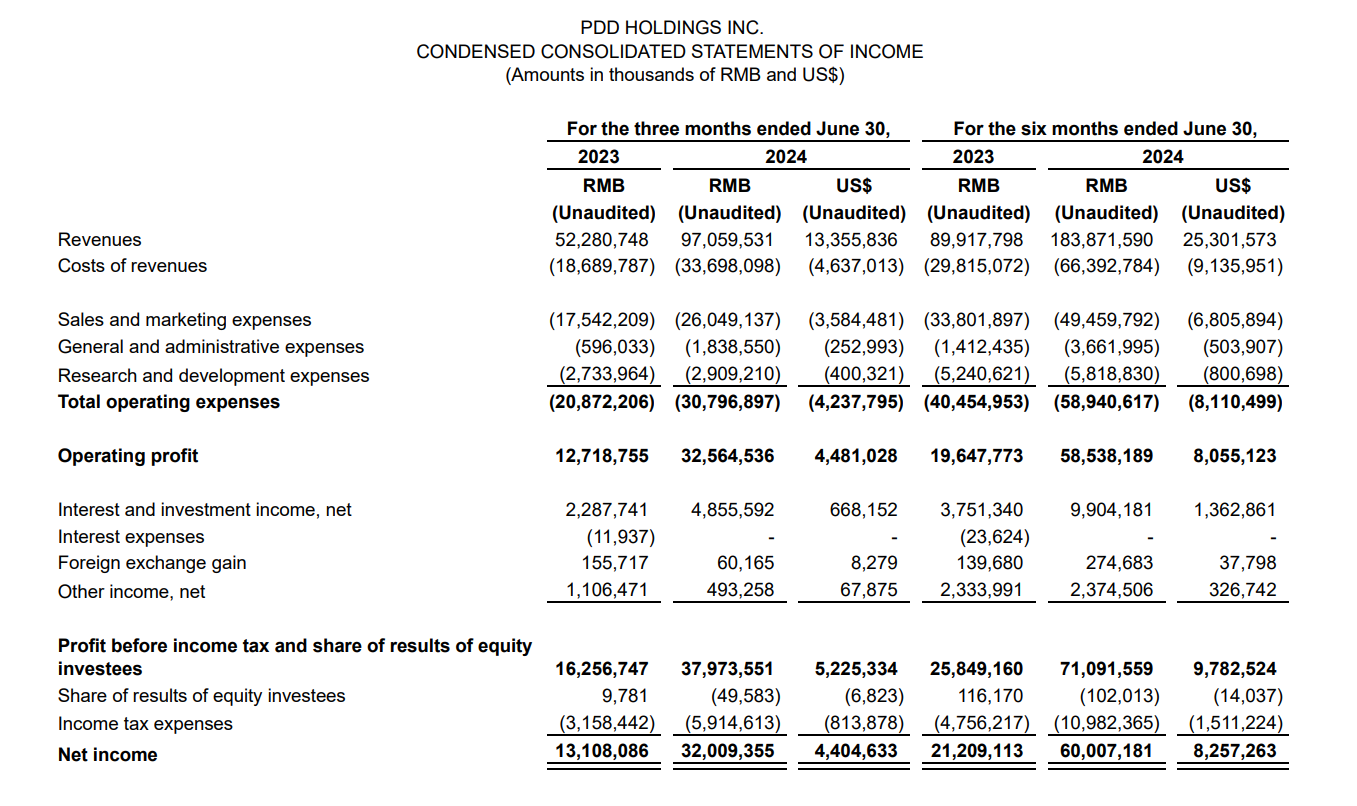

Q2 total revenue of RMB97,059.5 million (US$13,355.8 million), an increase of 86% from RMB52,280.7 million in the same period last year, but falling short of the market expectation of RMB99,985 million.

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.

Q2 non-GAAP net income attributable to ordinary shareholders of RMB34,432.1 million (US$4,738.0 million), an increase of 125% from RMB15,269.4 million in the same quarter of 2023.

In this quarter, revenues from online marketing services and others of RMB49,115.9 million (US$6,758.6 million); and revenues from transaction services of RMB47,943.7 million (US$6,597.3 million).

Non-GAAP diluted earnings per ADS were RMB23.24 (US$3.20).

Additionally, cash, cash equivalents and short-term investments were RMB284.9 billion (US$39.2 billion) as of June 30, 2024, compared with RMB217.2 billion as of December 31, 2023.

第二季度總收入爲人民幣9705950萬元(合133.558億美元),較去年同期的人民幣5228070萬元增長了86%,但未達到市場預期的人民幣9998500萬元。

第二季度歸屬於普通股股東的淨收益爲人民幣3200940萬元(合44.046億美元),較去年同期的人民幣131081.0萬元增長了144%。

第二季度歸屬於普通股股東的非公認會計准則淨收益爲人民幣3443210萬元(合47.38億美元),較2023年同期的人民幣1526940萬元增長了125%。

在本季度,來自在線營銷服務和其他服務的收入爲人民幣4911590萬元(合67.586億美元);交易服務收入爲人民幣4794370萬元(合65.973億美元)。

每股ADS的非公認會計准則攤薄收益爲人民幣23.24元(合3.20美元)。

此外,截至2024年6月30日,現金、現金等價物和短期投資爲人民幣2849元(合392億美元),而截至2023年12月31日爲人民幣2172元。

Chairman and Co-Chief Executive Officer of PDD Holdings, Mr. Lei Chen said:

PDD Holdings董事長兼聯席首席執行官陳雷先生表示:

“While encouraged by the solid progress we made in the past few quarters, we see many challenges ahead, We are committed to transitioning toward high-quality development and fostering sustainable ecosystem. We will invest heavily in the platform’s trust and safety, support high-quality merchants, and relentlessly improve the merchant ecosystem. We are prepared to accept short-term sacrifices and potential decline in profitability.”

「儘管我們對過去幾個季度取得的穩步進展感到鼓舞,但我們看到了許多挑戰,但我們致力於向高質量發展過渡並培育可持續的生態系統。我們將大力投資於平台的信任和安全,支持高質量的商家,並不斷改善商戶生態系統。我們準備接受短期的犧牲和潛在的盈利能力下降。」

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.