DraftKings Unusual Options Activity For August 26

DraftKings Unusual Options Activity For August 26

Financial giants have made a conspicuous bearish move on DraftKings. Our analysis of options history for DraftKings (NASDAQ:DKNG) revealed 11 unusual trades.

金融巨頭對DraftKings採取了明顯的看淡行動。我們對DraftKings(納斯達克:DKNG)的期權歷史進行了分析,發現了11筆異常交易。

Delving into the details, we found 45% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $279,628, and 5 were calls, valued at $349,356.

深入研究細節,我們發現45%的交易者看好,而54%的交易者顯示出看淡的傾向。在我們發現的所有交易中,有6筆看跌期權,價值279,628美元,5筆看漲期權,價值349,356美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $28.0 to $44.0 for DraftKings over the last 3 months.

考慮到這些合約的成交量和持倉量,過去3個月來大鱷們一直將DraftKings的目標價範圍定在28.0至44.0美元之間。

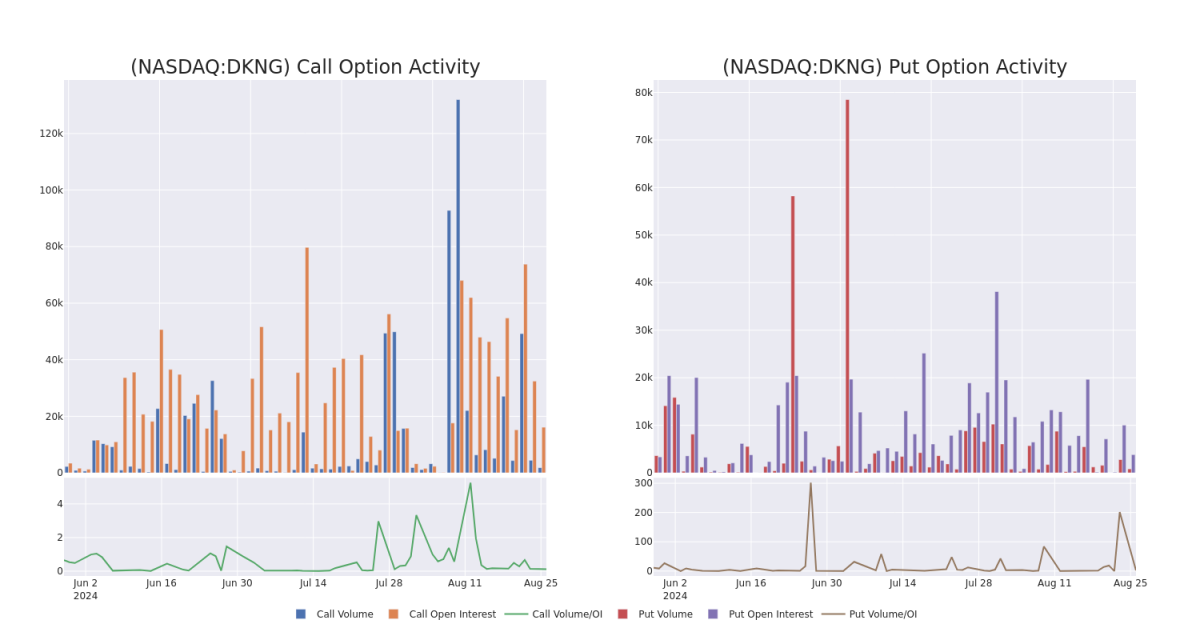

Volume & Open Interest Trends

成交量和未平倉量趨勢

In terms of liquidity and interest, the mean open interest for DraftKings options trades today is 2216.67 with a total volume of 2,646.00.

就流動性和利益而言,今天DraftKings期權交易的平均持倉量爲2216.67,總成交量爲2,646.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for DraftKings's big money trades within a strike price range of $28.0 to $44.0 over the last 30 days.

在下圖中,我們可以追蹤過去30天內,DraftKings的大手交易的看漲和看跌期權的成交量和持倉量的發展情況,一直在28.0至44.0美元的行權價範圍內。

DraftKings 30-Day Option Volume & Interest Snapshot

DraftKings 30天期權成交量和持倉量快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | CALL | TRADE | BEARISH | 09/20/24 | $4.05 | $3.9 | $3.95 | $33.00 | $197.5K | 14.5K | 500 |

| DKNG | PUT | SWEEP | BULLISH | 10/18/24 | $3.3 | $3.2 | $3.2 | $38.00 | $75.5K | 270 | 0 |

| DKNG | PUT | SWEEP | BULLISH | 06/20/25 | $8.0 | $7.9 | $7.9 | $40.00 | $62.4K | 147 | 1 |

| DKNG | CALL | SWEEP | BEARISH | 08/30/24 | $5.3 | $5.2 | $5.2 | $31.00 | $52.0K | 405 | 101 |

| DKNG | CALL | TRADE | BEARISH | 09/06/24 | $8.1 | $8.0 | $8.04 | $28.00 | $48.2K | 62 | 60 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | 看漲 | 交易 | 看淡 | 09/20/24 | $4.05 | $3.9 | $3.95 | $33.00 | $197.5K | 14.5K | 500 |

| DKNG | 看跌 | SWEEP | 看好 | 10/18/24 | $3.3 | $3.2 | $3.2 | $38.00 | $75.5K | 270 | 0 |

| DKNG | 看跌 | SWEEP | 看好 | 06/20/25 | $8.0 | $7.9 | $7.9 | $40.00 | $62.4千美元 | 147 | 1 |

| DKNG | 看漲 | SWEEP | 看淡 | 08/30/2024 | $5.3 | $5.2 | $5.2 | $31.00 | $52000 | 405 | 101 |

| DKNG | 看漲 | 交易 | 看淡 | 09/06/24 | $8.1 | $8.0 | $28.00 | $48.2K | 62 | 60 |

About DraftKings

關於DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online or retail sports betting in 25 states and iGaming in seven states, with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

DraftKings於2012年作爲日常奇妙比賽的創新者開始運營。然後,在2018年的最高法院裁決允許各州合法化在線體育博彩後,該公司擴展到在線體育和賭場博彩領域,在其中競爭的各州的營業收入份額通常排名第二或第三。現在,DraftKings在25個州提供在線或零售體育博彩,7個州提供iGaming,這兩種產品可供加拿大40%的人口使用。該公司還經營基於委託的非同質化代幣市場,並開發和授權在線遊戲產品。

DraftKings's Current Market Status

DraftKings的當前市場狀況

- Trading volume stands at 1,116,443, with DKNG's price down by -1.53%, positioned at $35.81.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 66 days.

- RSI指標顯示該股票可能接近超買。

- 將在66天內公佈收益報告。

What The Experts Say On DraftKings

專家對DraftKings的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $51.8.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $60.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on DraftKings with a target price of $47.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on DraftKings with a target price of $47.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for DraftKings, targeting a price of $50.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on DraftKings, which currently sits at a price target of $55.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DraftKings options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。明智的交易者通過不斷學習、調整策略、監控多個因子並密切關注市場變動來管理這些風險。從Benzinga Pro獲取實時警報,了解最新的DraftKings期權交易。

In terms of liquidity and interest, the mean open interest for DraftKings options trades today is 2216.67 with a total volume of 2,646.00.

In terms of liquidity and interest, the mean open interest for DraftKings options trades today is 2216.67 with a total volume of 2,646.00.