Philip Morris Intl Options Trading: A Deep Dive Into Market Sentiment

Philip Morris Intl Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Philip Morris Intl. Our analysis of options history for Philip Morris Intl (NYSE:PM) revealed 29 unusual trades.

巨頭對菲利普莫里斯國際展開了明顯的看好動作。我們對菲利普莫里斯國際(紐交所:PM)期權歷史進行分析後發現了29筆異常交易。

Delving into the details, we found 62% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 21 were puts, with a value of $1,041,519, and 8 were calls, valued at $480,870.

深入細節,我們發現62%的交易者持有看好態度,而37%顯示出看淡傾向。在我們發現的所有交易中,有21筆看跌期權交易,價值1041519美元,8筆看漲期權交易,價值480870美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $130.0 for Philip Morris Intl over the last 3 months.

考慮到這些合約的成交量和持倉量,過去3個月來,大型投資者已經將目標價區間鎖定在菲利普莫里斯國際的100.0至130.0之間。

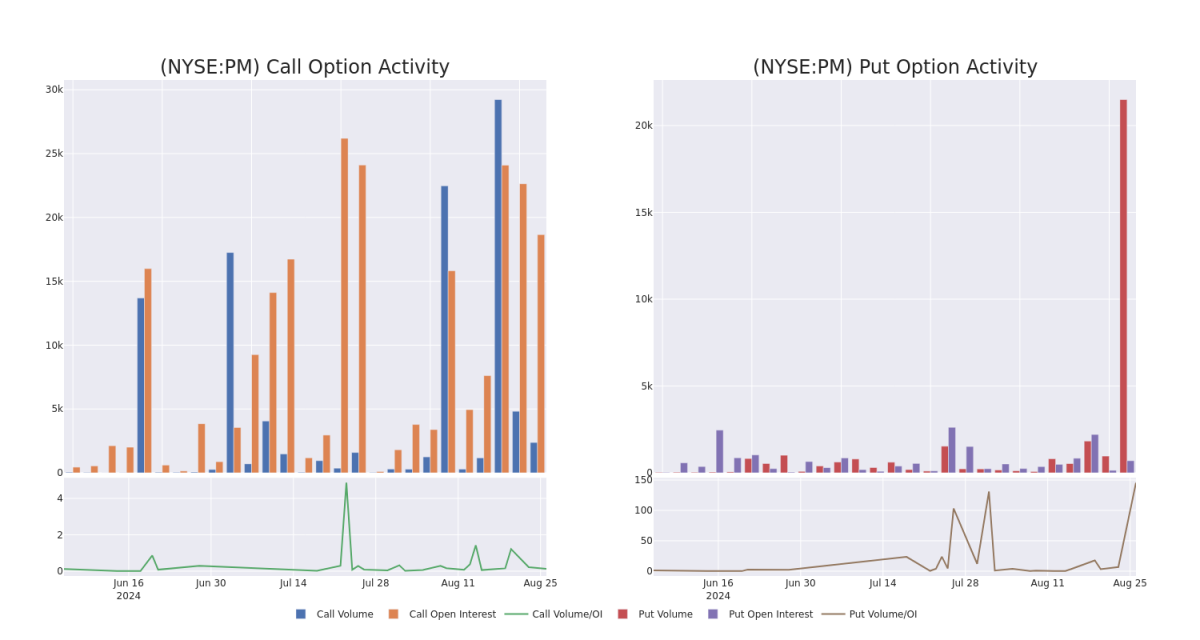

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Philip Morris Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Philip Morris Intl's substantial trades, within a strike price spectrum from $100.0 to $130.0 over the preceding 30 days.

評估成交量和持倉量是期權交易中的戰略步驟。這些指標揭示了投資者對於指定行權價格下菲利普莫里斯國際期權的流動性和興趣。即將公佈的數據可視化展示了在過去30天內,菲利普莫里斯國際的看漲和看跌期權成交量和持倉量的波動,與行權價範圍從100.0至130.0美元之間的大宗交易有關。

Philip Morris Intl Call and Put Volume: 30-Day Overview

菲利普莫里斯國際看漲和看跌期權成交量:30天總覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PM | CALL | TRADE | BULLISH | 09/20/24 | $7.2 | $6.6 | $7.15 | $115.00 | $107.2K | 1.4K | 155 |

| PM | PUT | TRADE | BEARISH | 08/30/24 | $0.25 | $0.2 | $0.25 | $119.00 | $95.1K | 143 | 6.4K |

| PM | CALL | TRADE | BEARISH | 12/20/24 | $22.1 | $22.0 | $22.0 | $100.00 | $88.0K | 699 | 40 |

| PM | PUT | SWEEP | BULLISH | 10/18/24 | $5.9 | $5.7 | $5.7 | $125.00 | $72.9K | 2 | 0 |

| PM | CALL | TRADE | BEARISH | 03/21/25 | $5.3 | $5.2 | $5.2 | $125.00 | $68.6K | 6.3K | 530 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 菲利普莫里斯 | 看漲 | 交易 | 看好 | 09/20/24 | $7.2 | 6.6 | $7.15 | $115.00 | $107.2K | 1.4千 | 155 |

| 菲利普莫里斯 | 看跌 | 交易 | 看淡 | 08/30/2024 | $0.25 | $0.2 | $0.25 | $119.00 | $95.1K | 143 | 6.4千 |

| 菲利普莫里斯 | 看漲 | 交易 | 看淡 | 12/20/24 | $22.1 | $22.0 | $22.0 | $100.00。 | $88.0千美元 | 699 | 40 |

| 菲利普莫里斯 | 看跌 | SWEEP | 看好 | 10/18/24 | $5.9 | $5.7 | $5.7 | $125.00 | $72.9K | 2 | 0 |

| 菲利普莫里斯 | 看漲 | 交易 | 看淡 | 03/21/25 | $5.3 | $5.2 | $5.2 | $125.00 | $68.6K | 6.3K | 530 |

About Philip Morris Intl

關於菲利普莫里斯國際

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

菲利普莫里斯國際是奧馳亞在2008年創立的國際運營部門,銷售捲菸和降危風險產品,包括加熱棒、電子煙和口服尼古丁產品,主要在美國以外地區銷售。憑藉對瑞典瑞士Match的收購,後者是美國和斯堪的納維亞地區傳統口腔菸草產品和尼古丁袋的主要生產商,PMI不僅擺脫了可吸菸的產品,而且進入了美國市場以銷售其iQOS加熱棒。

Having examined the options trading patterns of Philip Morris Intl, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Philip Morris Intl's Current Market Status

- Trading volume stands at 1,810,769, with PM's price down by -0.5%, positioned at $119.55.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 52 days.

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 將在52天內公佈收益聲明。

Professional Analyst Ratings for Philip Morris Intl

1 market experts have recently issued ratings for this stock, with a consensus target price of $130.0.

- An analyst from Barclays persists with their Overweight rating on Philip Morris Intl, maintaining a target price of $130.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Philip Morris Intl with Benzinga Pro for real-time alerts.

進行期權交易涉及更大的風險,但也有可能獲得更高的利潤。聰明的交易者通過持續教育、策略性交易調整、利用各種因子和保持對市場動態的關注來減輕這些風險。通過Benzinga Pro了解菲利普莫里斯國際的最新期權交易,獲得實時提醒。