REIT Watch - S-Reits Score Lower in Transparency Overall but Five See Marked Improvement

REIT Watch - S-Reits Score Lower in Transparency Overall but Five See Marked Improvement

In this year's Singapore Governance and Transparency Index (SGTI) 2024 rankings, the overall scores for Singapore real estate investment trusts (S-Reits) and business trusts declined to 86.6 points from 89.3 last year.

在今年的新加坡治理與透明度指數(SGTI)2024年排名中,新加坡房地產投資信託基金(S-Reits)和商業信託的總分從去年的89.3降至86.6點。

Nearly two-thirds of the 38 S-Reits with rankings decreased year-on-year in overall scores. This year's assessment had mean penalty points for poor disclosure practices, such as earnings restatements, drop by three points to 1.8 points – the lowest since the SGTI 2020 rankings.

在38家排名靠前的S-Reits中,有近三分之二的總體得分同比下降。今年的評估顯示,對不良披露做法(例如收益重報)的懲罰分數下降了三個百分點至1.8點,這是自2020年SGTI排名以來的最低水平。

For the general category, the overall score of 69.3 points was lower than 74.8 last year. The decline in SGTI scores this year was largely due to a revision in the current assessment round, which includes more indicators assessing sustainability reporting such as materiality and sustainability governance. The ESG and Stakeholders pillar had its weightage double to 20 per cent.

在普通類別中,總分爲69.3分,低於去年的74.8分。今年SGTI分數的下降主要是由於對本輪評估進行了修訂,其中包括更多評估可持續發展報告的指標,例如重要性和可持續性治理。ESG和利益相關者支柱的權重翻了一番,達到20%。

Findings by the SGTI highlighted that S-Reits recorded strongest performance in shareholder rights; accountability and audit; and disclosure and transparency. S-Reits also commonly identified climate change as a material issue.

SGTI的調查結果突出表明,S-Reits在股東權利、問責制和審計以及披露和透明度方面表現最爲強勁。S-Reits通常還將氣候變化視爲重大問題。

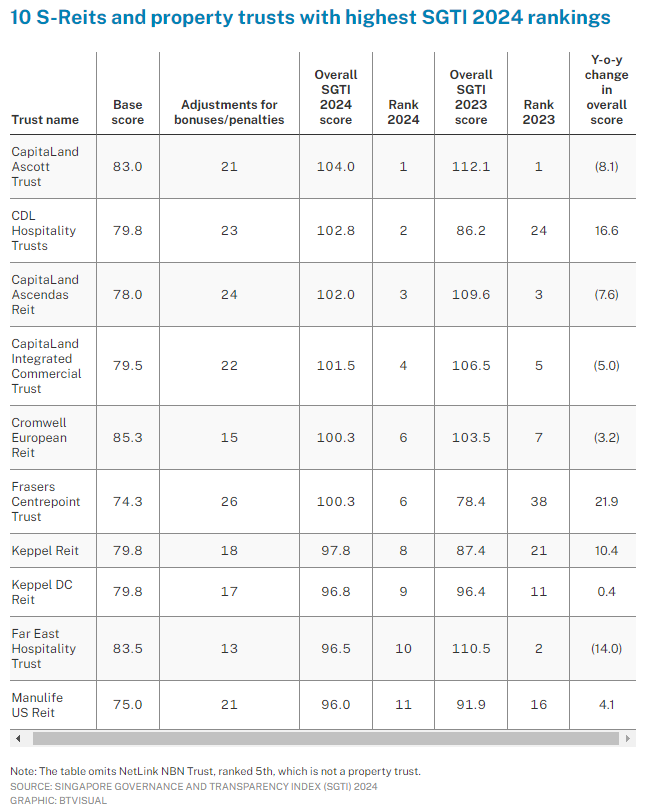

In the Reits and Business Trusts category, CapitaLand Ascott Trust (Clas) and CapitaLand Ascendas Reit (Clar) maintained their first and third positions respectively. Clas retained its top position for the fourth consecutive year at 104 points, while Clar remained at third place for the second year at 102 points. CDL Hospitality Trusts (CDLHT) was in second place at 102.8 points, climbing 22 places with a year-on-year (yoy) improvement of 16.6 points.

在房地產投資信託和商業信託類別中,凱德置地雅詩閣信託(Clas)和凱德騰飛房地產信託基金(Clar)分別保持了第一和第三位。Clas連續第四年保持最高排名,爲104點,而Clar連續第二年保持第三位,爲102點。CDL酒店信託基金(CDLHT)以102.8點位居第二,上升22位,同比增長16.6點。

In its H1 2024 results, CDLHT recorded 5.9 per cent yoy improvement in net property income and maintained distribution per stapled security at S$0.0251. CDLHT recorded positive yoy revenue per available room across all its markets, except for New Zealand.

在其2024年上半年的業績中,CDLht的淨房地產收入同比增長5.9%,並將每隻合訂證券的分配維持在0.0251新元。除新西蘭外,CDLht在其所有市場的每個可用房間的同比收入均爲正數。

The five S-Reits with the greatest yoy improvement in overall scores: Frasers Centrepoint Trust (+21.9 points), Elite UK Reit (+16.7 points), CDLHT (+16.6 points), Keppel Reit (+10.4 points) and Prime US Reit (+9.8 points).

總體得分同比增幅最大的五家S-REIT:弗雷澤中心點信託(+21.9分)、英國精英房地產投資信託基金(+16.7分)、CDLHT(+16.6分)、吉寶房地產投資信託基金(+10.4分)和Prime美國房地產投資信託基金(+9.8分)。

FCT jumped 32 spots, finishing sixth at 100.3 points. In its 2023 annual report, it started disclosing measurable objectives for implementing its board diversity policy. It also reported that board independence increased to 62.5 per cent in 2023 from 50 per cent in 2022.

FcT上升了32位,以100.3分排名第六。在其 2023 年年度報告中,它開始披露實施董事會多元化政策的可衡量目標。它還報告稱,董事會獨立性從2022年的50%提高到2023年的62.5%。

In green initiatives, FCT – together with Frasers Property and the SP Group – will roll out Singapore's largest solarisation installation for six of its retail malls by end 2024. This initiative targets to generate about S$179,000 in energy savings and a reduction in about 293 tonnes of carbon emissions yearly.

在綠色舉措方面,FcT與弗雷澤地產和SP集團一道,將在2024年底之前爲其六個零售購物中心推出新加坡最大的太陽能發電裝置。該計劃的目標是每年節省約179,000新元的能源,減少約293噸的碳排放。

Cromwell European Reit (Cromwell E-Reit), tied with FCT at sixth place, moved up a rank this year and recorded the highest base score in trusts category.

克倫威爾歐洲房地產投資信託基金(Cromwell E-Reit)與FcT並列第六,今年排名上升,創下信託類別中最高的基本分數。

In its H1 2024 results, Cromwell E-Reit reported that 82 per cent of its office assets are now BREEAM or LEED certified, up from 65 per cent half a year ago, and above its 40 per cent criteria for its sustainability-linked loans.

克倫威爾E-Reit在其2024年上半年的業績中報告稱,其82%的辦公資產現已通過BreeAM或LEED認證,高於半年前的65%,高於其40%的可持續發展相關貸款標準。

For more research and information on Singapore's REIT sector, visit sgx.com/research-education/sectors for the monthly SREITs & Property Trusts Chartbook.

有關新加坡房地產投資信託基金行業的更多研究和信息,請訪問sgx.com/research-education/sectors,獲取每月的房地產投資信託基金和房地產信託基金圖表。

REIT Watch is a regular column on The Business Times, read the original version.

房地產投資信託基金觀察是《商業時報》的定期專欄文章,請閱讀原始版本。

Enjoying this read?

喜歡這本書嗎?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱新加坡交易所 My Gateway 時事通訊,了解最新的市場新聞、行業表現、新產品發佈更新以及新加坡交易所上市公司的研究報告。

- 隨時關注我們的新加坡證券交易所投資電報頻道的最新動態。

Findings by the SGTI highlighted that S-Reits recorded strongest performance in shareholder rights; accountability and audit; and disclosure and transparency. S-Reits also commonly identified climate change as a material issue.

Findings by the SGTI highlighted that S-Reits recorded strongest performance in shareholder rights; accountability and audit; and disclosure and transparency. S-Reits also commonly identified climate change as a material issue.