Mapletree Logistics Trust Chairman Increases Interest at S$1.31 per Unit

Mapletree Logistics Trust Chairman Increases Interest at S$1.31 per Unit

Institutions were net sellers of Singapore stocks over the five trading sessions to Aug 1, with S$115 million of net institutional outflow, following the similar pace of S$95 million of net outflow for the preceding five sessions to Jul 26.

從8月1日起的五個交易會話中,機構成爲新加坡股票的淨賣方,淨機構流出額爲1.15億新元,與7月26日前五個交易會話的淨流出額9.5億新元相近。

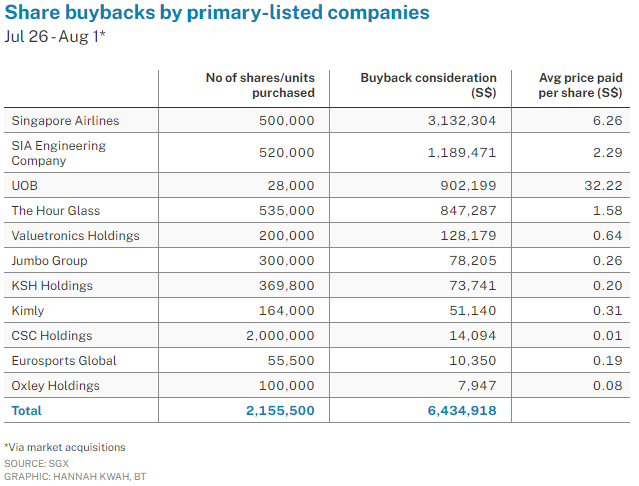

The five sessions to Aug 1 also saw 11 primary-listed companies conduct buybacks with a total consideration of S$6.4 million.

到8月1日爲止的五個交易日,有11家主板上市公司進行回購,總回購金額爲640萬新元。

Singapore Airlines (SIA) led the buyback consideration tally for the five sessions, acquiring 500,000 shares at an average price of S$6.26 per share. This was the first buyback conducted on the current buyback mandate, after the previous mandate saw one million shares acquired between Mar 8 and Apr 15.

新加坡航空公司(SIA)在五個交易日中領跑回購金額,以平均每股6.26新元的價格收購了50萬股。這是在當前回購授權下進行的第一次回購,此前回購授權在3月8日至4月15日期間收購了100萬股。

The company noted that for those one million shares, the highest and lowest price paid was S$6.44 and S$6.35 per share, respectively, and the total consideration paid for all purchases was S$6,405,469, excluding fees and taxes.

該公司指出,對於這100萬股股票,最高價和最低價分別爲每股6.44新元和每股6.35新元,所有購買的總金額爲6,405,469新元(不含費用和稅金)。

Prior to these acquisitions, SIA had last bought back its shares on the open market in September 2016. SIA's management maintains that it is committed to enhancing shareholder value, with share buybacks being one of the strategic methods employed. Additionally, the share repurchase programme is in place to efficiently manage and mitigate any potential dilution effects related to employee share schemes.

在進行這些收購之前,新加坡航空公司最後一次在開放市場上回購其股票是在2016年9月。SIA管理層表示,致力於提升股東價值,回購股份是所採用的戰略方法之一。此外,回購計劃的目的是有效管理和減輕與員工股權計劃相關的任何潛在稀釋效應。

Digital Core REIT Management also acquired units of Digital Core Real Estate Investment Trust (REIT) over each of the five sessions.

Digital Core REIt Management在五個交易會話中還購買了Digital Core房地產投資信託(REIT)的單位。

Leading the net institutional outflow over the five sessions were SIA, Yangzijiang Shipbuilding (Holdings), DBS, Keppel, UOB, Mapletree Logistics Trust (MLT), Frencken Group, City Developments Ltd, Raffles Medical Group and Hongkong Land Holdings.

在過去的五個交易會話中,新加坡航空公司,揚子江船舶(控股),大華銀行,吉寶,大華產業信託,福根集團,城市發展有限公司,萊佛士醫療集團和香港置地控股股份有限公司主導了淨機構流出。

Meanwhile, Singtel, Singapore Exchange, CapitaLand Integrated Commercial Trust, CapitaLand Ascendas REIT, Keppel DC REIT, Seatrium, Venture Corp, Suntec REIT, Wilmar International and Jardine Cycle & Carriage led the net institutional inflow.

與新電信、新加坡交易所、凱德商業信託、凱德安達斯REIt、吉寶數據中心房地產信託、海庭、創業公司、新達產業信託、金寶國際和怡和車行實現淨機構流入領先。

Singtel also booked the most net institutional inflow in the 2024 year to Aug 1, followed by UOB, OCBC, ST Engineering and Yangzijiang Shipbuilding.

新電信在2024年截至8月1日的淨機構流入中也位居榜首,其次是大華銀行、華僑銀行、新科工程和揚子江造船。

The five trading sessions saw 70 director interests and substantial shareholdings filed for close to 40 primary-listed stocks. Directors or chief executive officers filed nine acquisitions and no disposals, while substantial shareholders filed four acquisitions and three disposals.

在這五個交易日中,有70位董事以及實質性股東報告了將近40家主板上市股票的利益。董事或首席執行官進行了九次收購和沒有處分,而實質性股東進行了四次收購和三次處分。

Mapletree Logistics Trust

豐樹物流信託

On Jul 30, MLT Management non-executive chairman and director Lee Chong Kwee acquired 134,000 units of the REIT at S$1.31 per unit. This increased his direct interest in MLT to 200,000 units.

7月30日,豐樹物流信託管理非執行主席和董事李忠貴以每單位1.31新元收購了13.4萬單位的REIt。這增加了他對豐樹物流信託的直接利益至20萬單位。

Lee holds a position on the board of directors at Mapletree Investments, serves as the chairman of its transaction review committee, and is a member of its executive resource and compensation committee. His past roles include being the Asia-Pacific CEO of Exel (Singapore), non-executive chairman of Jurong Port and corporate adviser to Temasek.

李在豐樹投資的董事會擔任職務,擔任其交易審查委員會主席,並是其執行資源和薪酬委員會成員。他過去的職務包括擔任Exel(新加坡)亞太區首席執行官、裕廊港非執行主席以及淡馬錫的公司顧問。

After MLT's financial results for the first quarter of FY2025 (ended Jun 30) were reported on Jul 24, its price-to-book ratio reverted to below one standard deviation of the 12-month mean.

在豐樹物流信託2025財年第一季度(截至6月30日)的財務結果於7月24日報告後,其市淨率回歸到12個月均值一倍標準差以下。

For Q1 FY2025, the manager highlighted that MLT's proactive capital management and geographically diverse portfolio helped cushion the impact of higher borrowing costs, regional currency depreciation and China's economic challenges.

對於2025財年第一季度,管理層強調豐樹物流信託積極的資本管理和地理多樣化投資組合幫助抵消了借貸成本上升、地區貨幣貶值和中國經濟面臨的挑戰。

This saw MLT's Q1 FY2025 gross revenue marginally decrease by 0.3 per cent from the year before to S$181.7 million. Higher borrowing costs, which rose 9.4 per cent to S$38.5 million, and a lower divestment gain reduced distributable income to unitholders by 7.4 per cent from Q1 FY2024 to S$103.7 million.

這導致MLT的2025財年第一季度總收入邊際下降了0.3%,從去年的S$18170萬降至。較高的借款成本上升了9.4%,達到S$3850萬,較低的剝離收益使可分配收入較第一季度FY2024減少了7.4%,降至S$10370萬。

The manager also highlighted that the quarter delivered a strong operational performance, with 95.7 per cent occupancy and 2.6 per cent positive rental reversions. MLT has continued to pursue portfolio rejuvenation, completing acquisitions in Malaysia and Vietnam, and announcing or finalising more than S$44 million in divestments across Malaysia, Singapore, and China during the quarter.

經理還強調,該季度交付了強勁的運營業績,佔用率達到95.7%,租金回升率爲2.6%。MLt繼續追求組合更新,完成了在馬來西亞和越南的收購,並在該季度宣佈或最終確定了超過S$4400萬在馬來西亞、新加坡和中國的剝離交易。

As at Jun 30, 2024, MLT's portfolio of logistics real estate and real estate-related assets comprised 188 properties in Singapore, Australia, China, Hong Kong, India, Japan, Malaysia, South Korea and Vietnam, with assets under management of S$13.4 billion.

截至2024年6月30日,MLT的物流房地產和與房地產相關的資產組合包括新加坡、澳洲、中國、香港、印度、日本、馬來西亞、韓國和越南的188個物業,管理資產達到S$134億。

Lee also maintained in June that MLT would focus on advancing its portfolio rejuvenation strategy through accretive acquisitions, asset enhancements and selective divestments in FY2025.

Lee也在六月份表示,MLt將專注於通過具有增值效應的收購、資產增值和有選擇性的剝離,在FY2025推進其組合更新策略。

On Jul 22, Ng Kiat stepped down as CEO and executive director of the manager of MLT and was succeeded by Jean Kam. Kam has significantly contributed to MLT's growth and portfolio strategy for 17 years, holding key positions such as general manager of Singapore, head of asset management and head of investment. Ng served as CEO of the manager for 12 years and has transferred to Mapletree Investments. During her tenure as CEO of the manager, MLT delivered unitholders an annualised total return of 8.6 per cent.

7月22日,吳潔辭去了MLt主管的首席執行官和執行董事一職,由金 祖贏(Jean Kam)接替。Kam在MLT的增長和資產策略方面做出了重大貢獻,擔任重要職務長達17年,如新加坡總經理、資產管理負責人和投資主管。吳潔擔任管理層首席執行官12年,並已調任至豐樹投資。在擔任該管理層首席執行官期間,MLt爲持有人提供了年化總回報率達8.6%。

Raffles Medical Group

萊佛士醫療集團

On Jul 31, Raffles Medical executive and non-independent director Sarah Lu acquired 250,000 shares of the group at an average price of S$0.95 per share. Acquired through S&D Holdings, this increased her deemed interest in the company from 3.38 per cent to 3.4 per cent.

7月31日,萊佛士醫療執行董事兼非獨立董事陸氏以平均S$0.95每股的價格收購了該集團的25萬股。通過S&D Holdings收購,使她在公司中的被視爲利益從3.38%增至3.4%。

Dr Lu was first appointed a director of Raffles Medical in February 2018, at which time she maintained a 3.24 per cent deemed interest in the company. Dr Lu is also the daughter of executive chairman and non-independent director Loo Choon Yong.

陸博士於2018年2月首次被任命爲萊佛士醫療的董事,當時她在公司中持有3.24%的被視爲利益。陸博士也是執行主席兼非獨立董事盧春榮的女兒。

On Jul 29, Raffles Medical reported a revenue of S$365.7 million and net profit of S$30.6 million for the first half of FY2024 (ended Jun 30). These figures represent a 1.4 per cent decrease in revenue and a 48.8 per cent decrease in net profit compared with the corresponding period in the previous year, attributed to the phasing out of Covid-19 activities.

2024財年上半年(截至6月30日),萊佛士醫療報告營業收入爲S$36570萬,淨利潤爲S$3060萬。與去年同期相比,營業收入下降1.4%,淨利潤下降48.8%,歸因於新冠疫情活動逐步消退。

Baker Technology

巴克科技

Baker Technology (Baker Tech), with its subsidiaries, is a key player in marine offshore equipment and services, catering to oil, gas and renewable sectors. It specialises in designing, constructing and operating offshore units and vessels, as well as creating essential offshore equipment such as cranes, winches and wind-turbine gear. The group also provides engineering, project management and quality-supervision services.

巴克科技(Baker Tech)及其子公司是海洋海工裝備和服務領域的關鍵參與者,爲石油、燃氣和可再生能源行業提供服務。它專注於設計、建造和運營海工裝備、船舶,以及製造起重機、絞車和風力渦輪齒輪等重要的海工裝備。該集團還提供工程、項目管理和質量監督服務。

In an industry outlook earlier in the year, Baker Tech chairman Wong Meng Yeng maintained that strong balance sheets are prompting oil companies to revisit their exploration and production investments, leading to significant capital plans.

今年早些時候,在業界展望中,巴克科技董事長黃明榮表示,強勁的資產負債表促使石油公司重新審視勘探和生產投資,從而推動了重大資本計劃。

He noted that Petronas, for example, had over 45 upstream projects and decommissioning plans in the pipeline. Wong maintained that the activity is expected to increase demand for offshore support, including rigs and vessels; and with a recent shortage of new builds, the group maintained that 2024 is poised for higher charter hire and vessel valuations.

他指出,例如馬來西亞國家石油公司在建設中的上游項目和退役計劃超過45個。黃明榮表示,活動預計將增加對海工支持,包括鑽井平台和船舶的需求;由於最近新建設備的短缺,該集團表示,2024年租船收入和船舶估值有望提高。

On Jul 29, Baker Tech reported that its H1 FY2024 (ended Jun 30) revenue had increased by S$13 million, or 33 per cent, to S$52.4 million compared with the same period last year. This rise was primarily due to an uptick in charter revenue and spare parts sales, with higher vessel utilisation and contributions from third-party managed vessels.

7月29日,巴克科技報告稱,其2024財年上半年(截至6月30日)的營業收入增加了S$1300萬,增長了33%,達到S$5240萬,與去年同期相比。這一增長主要歸因於租船收入和備件銷售的增加,船舶利用率提高以及第三方管理船舶的貢獻。

Net profit saw a more significant increase to S$13 million in H1 FY2024 from S$1.5 million in the year-ago period, attributed to enhanced chartering activities aligning with the revenue increase, in addition to reduced administrative expenses, notably due to the absence of expected credit loss allowance.

在2024財年上半年,淨利潤從去年同期的S$150萬增至S$1300萬,這歸因於增加的租船活動與營業收入增長相一致,以及由於預期信用損失減少而導致的行政費用減少。

The group also attributed higher foreign exchange gains to its net profit, as the US dollar strengthened against the Singapore dollar by about 3 per cent in H1 FY2024 compared with 1 per cent in the same period in the previous year. Profit attributable to shareholders stood at S$11.9 million for H1 FY2024, increasing from S$4.1 million from the year before.

該集團還將外匯收益增加歸功於其淨利潤,因爲美元對新加坡元的匯率在H1 FY2024中升值約3%,而在上一年同期只有1%。歸屬於股東的利潤爲S$1190萬,較去年同期的S$410萬增加。

For context, in FY2023 and FY2022, the net profit attributable to shareholders came to S$8.3 million and $13.4 million, respectively. The group's cash position stood at S$98.3 million as at Jun 30, up from S$87.5 million at the end of 2023, gradually increasing from S$28.9 million at the end of 2018.

爲了更好理解,值得一提的是,在FY2023和FY2022,歸屬於股東的淨利潤分別爲S$830萬和S$1340萬。該集團的現金持有量截至6月30日爲S$9830萬,較2023年底的S$8750萬逐漸增加,而比2018年底的S$2890萬大幅增加。

Over the past 10 years, Baker Tech's executive director, Benety Chang, has gradually increased his total interest from 48.17 per cent to 55.85 per cent. Dr Chang has had a distinguished tenure at Baker Tech, serving as director and CEO since May 2000. He stepped down as CEO at the end of 2018, but has continued to serve as an executive director.

在過去10年中,巴克科技的執行董事Benety Chang逐漸將其持股比例從48.17%增加到55.85%。自2000年5月以來,Chang博士在巴克科技擔任董事和首席執行官,任期卓著。他在2018年底辭去了首席執行官職務,但繼續擔任執行董事。

As a major shareholder, Dr Chang was re-elected as director in April 2023. Additionally, he holds the position of CEO and executive director at CHO, a subsidiary of Baker Tech. With a wealth of experience in the offshore oil and gas industry, Dr Chang was also a key founding shareholder and CEO of PPL Shipyard until July 2012.

作爲重要的股東,Chang博士於2023年4月連任董事。此外,他還擔任巴克科技子公司CHO的首席執行官和執行董事。Chang博士在海工裝備領域擁有豐富的經驗,他還是PPL Shipyard的主要創始股東和首席執行官,直到2012年7月。

Inside Insights is a weekly column on The Business Times, read the original version.

《商業時報》的「內部視角」(Inside Insights)是每週專欄,閱讀原版。

Enjoying this read?

喜歡這篇文章嗎?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱SGX My Gateway通訊,以獲取最新市場資訊、板塊表現、新產品發佈更新以及新交易所上市公司的研報彙編。

- 通過我們的SGX Invest Telegram頻道保持最新。