Market Whales and Their Recent Bets on AMZN Options

Market Whales and Their Recent Bets on AMZN Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Amazon.com.

擁有大量資金的鯨魚們對亞馬遜.com採取了明顯的看好態度。

Looking at options history for Amazon.com (NASDAQ:AMZN) we detected 12 trades.

查看亞馬遜.com(納斯達克:AMZN)的期權歷史,我們發現了12筆交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 33% with bearish.

如果考慮每筆交易的具體情況,可以準確地說,50%的投資者持有看好期望,33%持有看跌期望。

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.

在所有被發現的交易中,有7筆看跌期權,總金額爲$245,612,有5筆看漲期權,總金額爲$317,267。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $180.0 for Amazon.com, spanning the last three months.

在評估交易量和持倉量之後,顯然主要市場推動者正在關注亞馬遜.com的價格區間,該區間跨過了最近三個月,介於$100.0和$180.0之間。

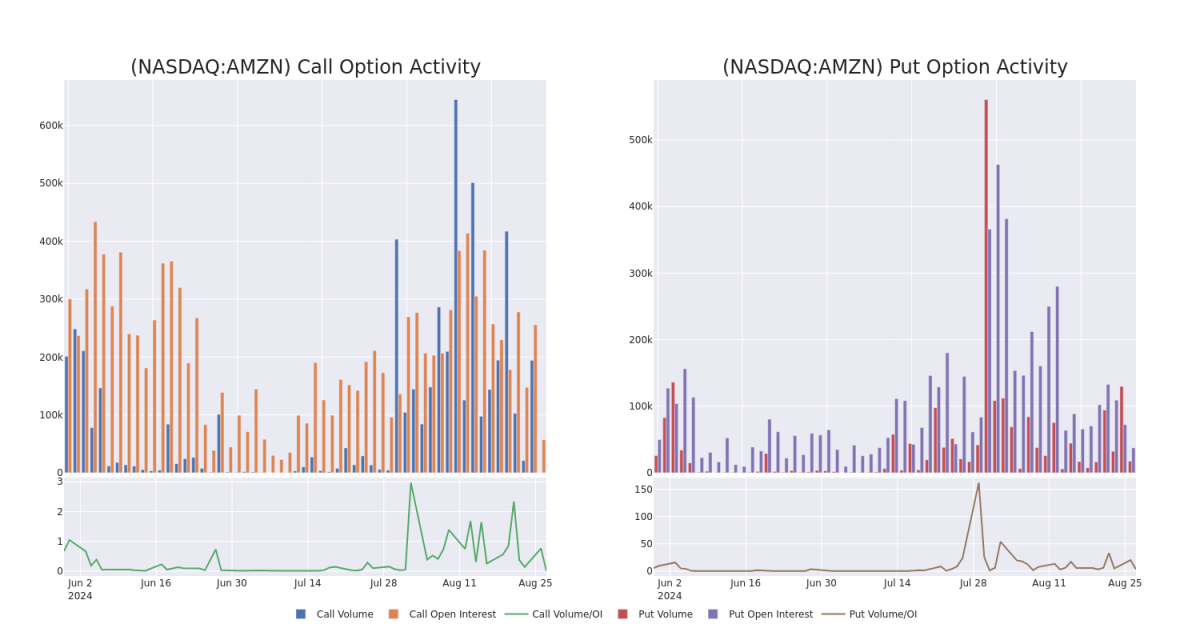

Volume & Open Interest Trends

成交量和未平倉量趨勢

In terms of liquidity and interest, the mean open interest for Amazon.com options trades today is 10517.33 with a total volume of 17,597.00.

就流動性和興趣而言,今天亞馬遜.com期權交易的平均持倉量爲10517.33,總成交量爲17,597.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Amazon.com's big money trades within a strike price range of $100.0 to $180.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內亞馬遜公司的大手交易的買入看漲和看跌期權的成交量和未平倉量在100.0美元到180.0美元的行權價格區間內的發展。

Amazon.com Option Volume And Open Interest Over Last 30 Days

亞馬遜公司期權成交量和未平倉合約過去30天內的情況

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | TRADE | NEUTRAL | 12/19/25 | $82.45 | $80.45 | $81.42 | $100.00 | $162.8K | 5.2K | 20 |

| AMZN | PUT | SWEEP | BULLISH | 08/30/24 | $3.2 | $3.15 | $3.15 | $175.00 | $63.0K | 8.8K | 2.0K |

| AMZN | CALL | SWEEP | BULLISH | 02/21/25 | $14.55 | $14.4 | $14.52 | $180.00 | $49.3K | 1.1K | 45 |

| AMZN | PUT | TRADE | BULLISH | 01/17/25 | $9.65 | $9.45 | $9.53 | $170.00 | $38.1K | 16.3K | 0 |

| AMZN | CALL | TRADE | BULLISH | 09/13/24 | $7.3 | $7.15 | $7.3 | $170.00 | $37.2K | 1.1K | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | 看漲 | 交易 | 中立 | 2025年12月19日 | $14.55 | $14.4 | 14.52美元 | $100.00。 | $162.8K | 5.2K | 20 |

| AMZN | 看跌 | SWEEP | 看好 | 08/30/2024 | $3.2 | $3.15 | $3.15 | $175.00 | $63.0K | 8.8K | 2.0K |

| AMZN | 看漲 | SWEEP | 看好 | 02/21/25 | $14.55 | 14.4美元 | 180.00美元 | $49.3K | 1.1千 | 45 | |

| AMZN | 看跌 | 交易 | 看好 | 01/17/25 | $9.65 | 9.45 | $9.53 | $170.00 | $38.1K | 16.3K | 0 |

| AMZN | 看漲 | 交易 | 看好 | 09/13/24 | $7.3 | $7.15 | $7.3 | $170.00 | $37.2千美元 | 1.1千 | 0 |

About Amazon.com

關於亞馬遜.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

亞馬遜是領先的在線零售商和第三方賣家市場。與零售相關的營業收入約佔總收入的75%,其次是亞馬遜Web Services的雲計算、存儲、數據庫和其他服務(15%)、廣告服務(5%至10%)以及其他收入。國際業務佔亞馬遜非AWS銷售的25%至30%,主要在德國、英國和日本。

After a thorough review of the options trading surrounding Amazon.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Amazon.com Standing Right Now?

亞馬遜.com現在的地位如何?

- Trading volume stands at 748,840, with AMZN's price down by -0.61%, positioned at $174.43.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 58 days.

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

Professional Analyst Ratings for Amazon.com

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $220.8.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $225.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $215.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Amazon.com, targeting a price of $224.

- An analyst from Roth MKM persists with their Buy rating on Amazon.com, maintaining a target price of $215.

- An analyst from Jefferies has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $225.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amazon.com options trades with real-time alerts from Benzinga Pro.

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.