This Is What Whales Are Betting On Verizon Communications

This Is What Whales Are Betting On Verizon Communications

Whales with a lot of money to spend have taken a noticeably bearish stance on Verizon Communications.

有大量資金的鯨魚對Verizon通信採取了明顯的看淡立場。

Looking at options history for Verizon Communications (NYSE:VZ) we detected 9 trades.

查看Verizon Communications (紐交所:VZ) 期權歷史,我們檢測到了9筆交易。

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 55% with bearish.

如果我們考慮每筆交易的具體細節,那麼可以準確地說,22%的投資者持有看漲期權,55%持有看跌期權。

From the overall spotted trades, 2 are puts, for a total amount of $293,840 and 7, calls, for a total amount of $401,890.

從所有發現的交易中,有2筆看跌,總金額爲$293,840,而有7筆看漲,總金額爲$401,890。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $47.0 for Verizon Communications over the recent three months.

根據交易活動,顯然大量投資者瞄準了Verizon Communications 近3個月的價格區間,從$30.0到$47.0。

Insights into Volume & Open Interest

成交量和持倉量分析

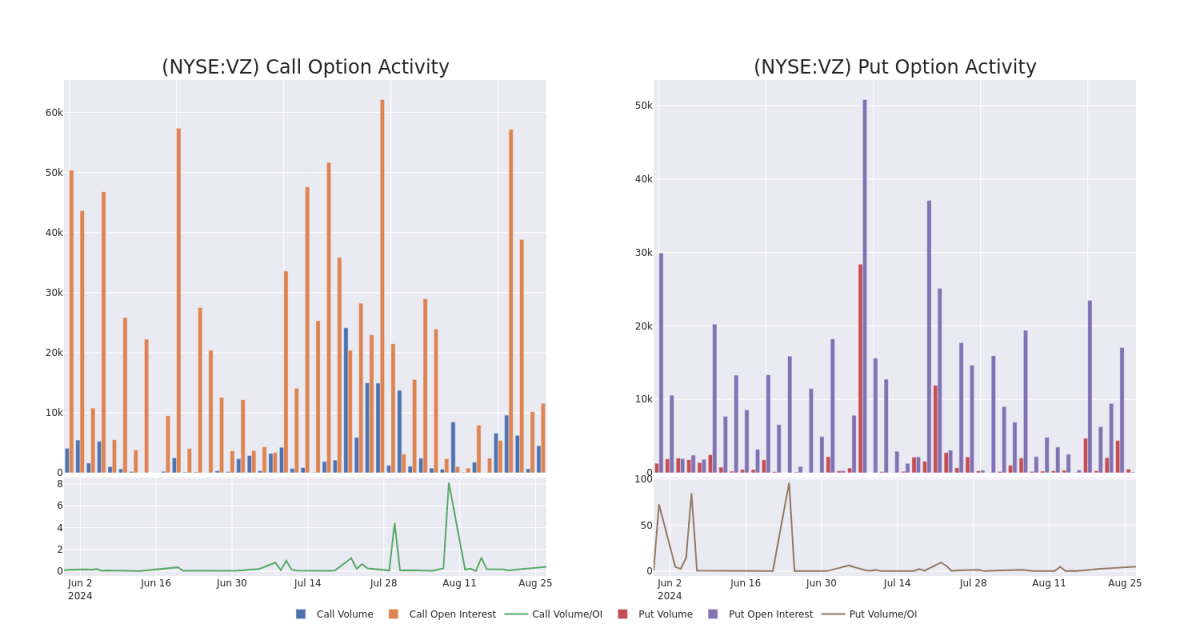

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Verizon Communications's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Verizon Communications's whale trades within a strike price range from $30.0 to $47.0 in the last 30 days.

觀察成交量和未平倉合約在交易期權時是一個強大的舉措。這些數據可以幫助您跟蹤Verizon Communications在特定行權價上期權的流動性和興趣。下面,我們可以分別觀察過去30天內,所有落在$30.0到$47.0行權價範圍內的Verizon Communications的看漲和看跌期權的成交量和未平倉合約的變化。

Verizon Communications Call and Put Volume: 30-Day Overview

Verizon Communications看漲和看跌期權成交量:30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | PUT | SWEEP | BEARISH | 12/20/24 | $5.9 | $5.8 | $5.9 | $47.00 | $175.8K | 104 | 1 |

| VZ | PUT | SWEEP | BEARISH | 12/20/24 | $5.9 | $5.8 | $5.9 | $47.00 | $118.0K | 104 | 499 |

| VZ | CALL | TRADE | BEARISH | 09/20/24 | $0.26 | $0.25 | $0.25 | $42.50 | $102.5K | 2.3K | 4.1K |

| VZ | CALL | SWEEP | BULLISH | 04/17/25 | $7.05 | $6.95 | $7.05 | $35.00 | $81.0K | 1 | 213 |

| VZ | CALL | SWEEP | BULLISH | 04/17/25 | $7.05 | $6.95 | $7.05 | $35.00 | $68.3K | 1 | 98 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| verizon | 看跌 | SWEEP | 看淡 | 12/20/24 | $5.9 | $5.8 | $5.9 | $47.00 | $175.8K | 104 | 1 |

| verizon | 看跌 | SWEEP | 看淡 | 12/20/24 | $5.9 | $5.8 | $5.9 | $47.00 | $118.0K | 104 | 499 |

| verizon | 看漲 | 交易 | 看淡 | 09/20/24 | $0.26 | $0.25 | $0.25 | $42.50 | $102.5千美元 | 2.3K | 4.1K |

| verizon | 看漲 | SWEEP | 看好 | 04/17/25 | $7.05 | $6.95 | $7.05 | 35.00美元 | $81.0K | 1 | 213 |

| verizon | 看漲 | SWEEP | 看好 | 04/17/25 | $7.05 | $6.95 | $7.05 | 35.00美元 | $68.3K | 1 | 98 |

About Verizon Communications

關於Verizon通信

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

無線服務佔Verizon Communications總服務收入的約70%,幾乎佔其營業收入的全部。該公司通過其覆蓋全國的網絡爲約9300萬後付費電話客戶和2100萬預付費電話客戶(收購了Tracfone後)提供服務,使其成爲美國最大的無線運營商。固定線路電信運營包括在東北部的本地網絡,覆蓋約2900萬家庭和企業,爲約800萬寬帶客戶提供服務。Verizon還向全國企業客戶提供電信服務,通常使用其自己和其他運營商的網絡的組合。

Verizon Communications's Current Market Status

- With a volume of 2,240,846, the price of VZ is down -0.07% at $41.46.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 56 days.

- RSI指標暗示該股票可能要超買了。

- 下一次盈利預計將在56天內發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Verizon Communications with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也可能帶來更高的利潤。精明的交易者通過持續教育、策略性的交易調整、利用各種因子和保持對市場動態的關注來減輕這些風險。通過Benzinga Pro獲取Verizon通信的最新期權交易情報,獲得實時提醒。

From the overall spotted trades, 2 are puts, for a total amount of $293,840 and 7, calls, for a total amount of $401,890.

From the overall spotted trades, 2 are puts, for a total amount of $293,840 and 7, calls, for a total amount of $401,890.