Decoding Gilead Sciences's Options Activity: What's the Big Picture?

Decoding Gilead Sciences's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Gilead Sciences. Our analysis of options history for Gilead Sciences (NASDAQ:GILD) revealed 10 unusual trades.

金融巨頭在吉利德科學上進行了明顯的看淡操作。我們對吉利德科學(納斯達克:GILD)的期權歷史進行分析,發現了10筆異常交易。

Delving into the details, we found 20% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $310,182, and 2 were calls, valued at $112,717.

深入了解細節後,我們發現20%的交易員看好,而50%的交易員顯示看淡傾向。我們發現所有交易中,有8筆看跌期權交易,價值爲310,182美元;而有2筆看漲期權交易,價值爲112,717美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $79.0 for Gilead Sciences, spanning the last three months.

在評估交易量和持倉量後,顯然主要的市場推動者將吉利德科學的價格區間集中在60.0美元到79.0美元之間,跨越過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

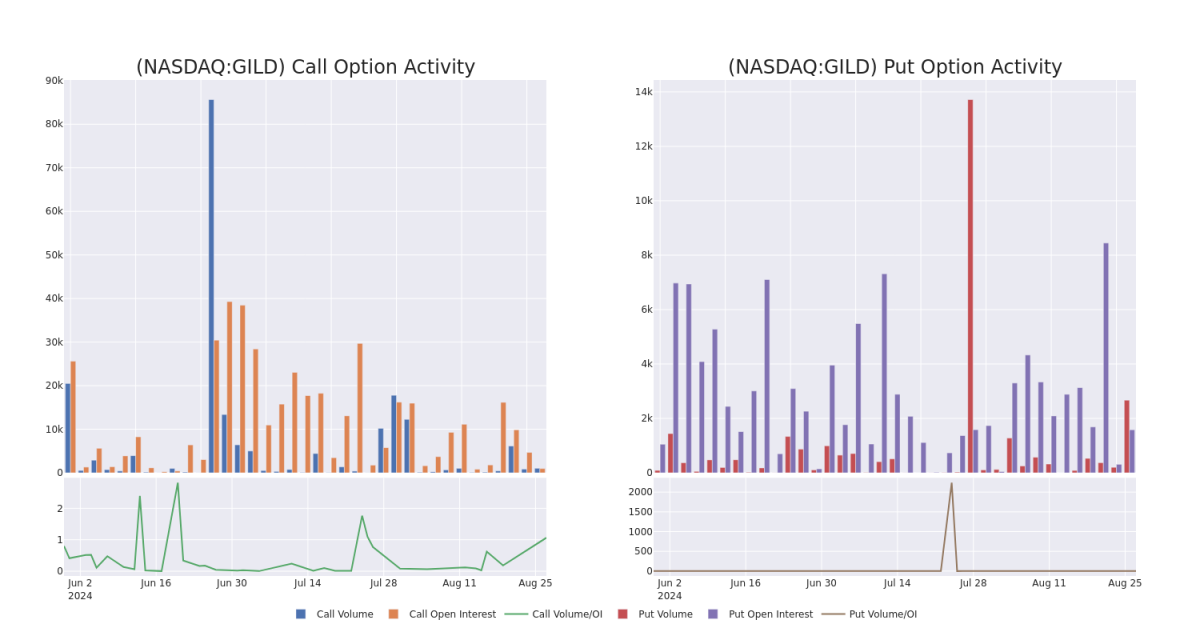

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Gilead Sciences's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Gilead Sciences's whale trades within a strike price range from $60.0 to $79.0 in the last 30 days.

在交易期權時,查看成交量和持倉量是一個強有力的舉措。這些數據可以幫助您跟蹤吉利德科學在特定行權價的期權的流動性和興趣。下面,我們可以觀察過去30天內,吉利德科學所有鯨魚交易的看漲期權和看跌期權的成交量和持倉量的演變,行權價範圍爲60.0美元到79.0美元。

Gilead Sciences Call and Put Volume: 30-Day Overview

Gilead Sciences 看漲和看跌期權成交量:30 天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | TRADE | NEUTRAL | 09/20/24 | $0.73 | $0.65 | $0.69 | $79.00 | $69.0K | 86 | 1.0K |

| GILD | PUT | SWEEP | BEARISH | 01/16/26 | $5.8 | $4.8 | $5.72 | $70.00 | $59.6K | 1.2K | 500 |

| GILD | PUT | SWEEP | BEARISH | 01/16/26 | $5.8 | $5.6 | $5.73 | $70.00 | $44.7K | 1.2K | 370 |

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $17.5 | $17.4 | $17.46 | $60.00 | $43.7K | 889 | 25 |

| GILD | PUT | SWEEP | NEUTRAL | 01/16/26 | $6.0 | $5.65 | $5.75 | $70.00 | $40.2K | 1.2K | 640 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | 看漲 | 交易 | 中立 | 09/20/24 | 0.73美元 | $0.65 | $0.69 | 79.00美元 | $69.0K | 86 | 1.0K |

| GILD | 看跌 | SWEEP | 看淡 | 01/16/26 | $5.8 | $4.8 | 70.00美元 | $59.6K | 1.2K | 500 | |

| GILD | 看跌 | SWEEP | 看淡 | 01/16/26 | $5.8 | $5.6 | $5.73 | 70.00美元 | $44.7K | 1.2K | 370 |

| GILD | 看漲 | SWEEP | 看好 | 01/17/25 | $17.5 | $17.4 | $60.00 | $43.7千美元 | 889 | 25 | |

| GILD | 看跌 | SWEEP | 中立 | 01/16/26 | $6.0 | $5.65 | $5.75 | 70.00美元 | $40.2K | 1.2K | 640 |

About Gilead Sciences

關於吉利德科學

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

吉利德科學開發和營銷治療危及生命的傳染病,其核心組合主要關注HIV和乙型和C型肝炎。吉利德收購Pharmasset帶來了對乙型肝炎藥物Sovaldi的所有權,該藥物也是較新的聯合方案的一部分,仍然是標準治療。吉利德還通過收購在腫瘤學市場上擴大了其存在,由CAR-t細胞療法Yescarta/Tecartus(來自Kite)和乳腺和膀胱癌療法Trodelvy(來自Immunomedics)領導。

In light of the recent options history for Gilead Sciences, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到吉利德科學最近的期權歷史,現在應該關注該公司的表現。我們旨在探索其當前的業績。

Gilead Sciences's Current Market Status

吉利德科學的當前市場狀況

- Currently trading with a volume of 1,387,168, the GILD's price is down by -0.05%, now at $76.92.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 70 days.

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計在70天內發佈收益。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Gilead Sciences options trades with real-time alerts from Benzinga Pro.

期權交易存在較高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多種因子並密切關注市場動態來管理這些風險。隨時通過Benzinga Pro獲得有關吉利德科學期權交易的實時提醒,以保持了解最新情況。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Gilead Sciences's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Gilead Sciences's whale trades within a strike price range from $60.0 to $79.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Gilead Sciences's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Gilead Sciences's whale trades within a strike price range from $60.0 to $79.0 in the last 30 days.