Looking At Novo Nordisk's Recent Unusual Options Activity

Looking At Novo Nordisk's Recent Unusual Options Activity

High-rolling investors have positioned themselves bearish on Novo Nordisk (NYSE:NVO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in NVO often signals that someone has privileged information.

高投資者們看淡Novo Nordisk(紐交所:NVO),而零售交易者應該注意。\ 通過Benzinga跟蹤公開的選項數據,我們今天注意到這種活動。這些投資者的身份尚不確定,但是在NVO中發生如此重大的變動通常意味着某些人具有特權資訊。

Today, Benzinga's options scanner spotted 9 options trades for Novo Nordisk. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現諾和諾德有9筆期權交易。這並不是一個典型的模式。

The sentiment among these major traders is split, with 33% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $25,200, and 8 calls, totaling $430,150.

這些主要交易者的情緒分歧,33%看漲,55%看跌。我們確定的所有期權中,有一個看跌期權,金額爲$25,200,還有8個看漲期權,總額爲$430,150。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $145.0 for Novo Nordisk over the last 3 months.

考慮到合約的成交量和持倉量,似乎大戶在過去3個月內將諾和諾德的價格範圍設定在$100.0到$145.0之間。

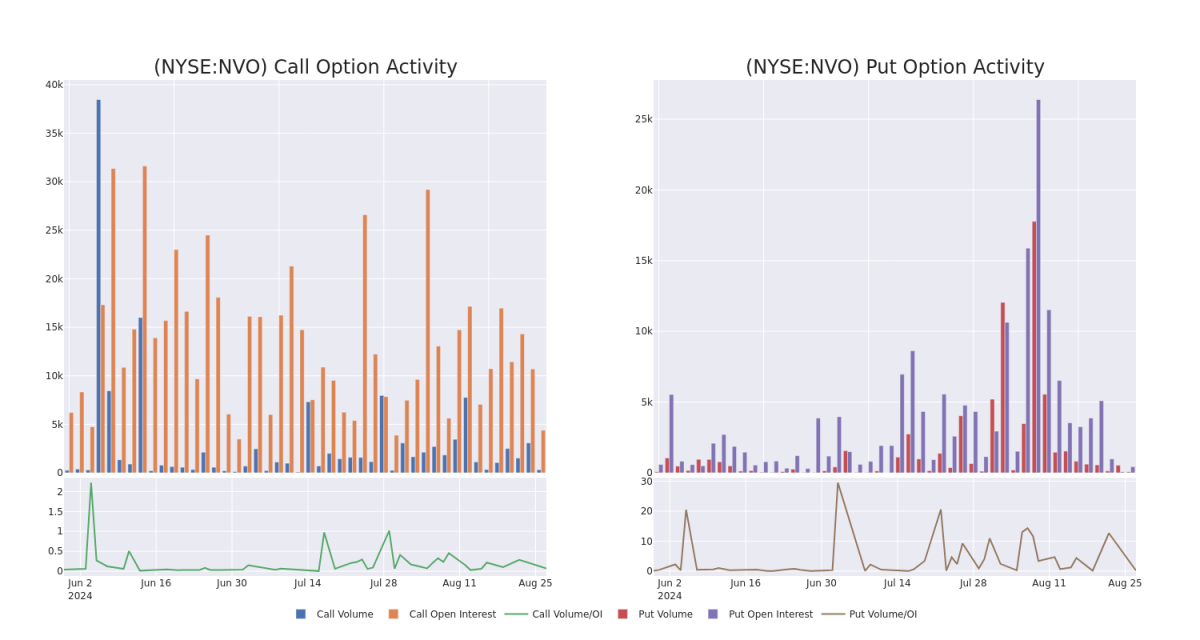

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $100.0 to $145.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的戰略步驟。這些指標揭示了特定行權價處諾和諾德期權的流動性和投資者興趣。即將到來的數據可視化了過去30天內諾和諾德的成交量和持倉量的波動,包括看漲期權和看跌期權,其行權價範圍爲$100.0到$145.0之間的大宗交易。

Novo Nordisk Option Volume And Open Interest Over Last 30 Days

Novo Nordisk過去30天的期權成交量和未平倉合約

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | TRADE | BEARISH | 01/17/25 | $38.8 | $38.5 | $38.5 | $100.00 | $77.0K | 1.3K | 20 |

| NVO | CALL | SWEEP | BEARISH | 11/15/24 | $7.15 | $7.05 | $7.05 | $140.00 | $70.5K | 673 | 17 |

| NVO | CALL | TRADE | BULLISH | 01/16/26 | $32.3 | $30.95 | $31.8 | $120.00 | $63.6K | 507 | 20 |

| NVO | CALL | SWEEP | NEUTRAL | 10/18/24 | $3.05 | $2.83 | $2.91 | $145.00 | $59.6K | 400 | 208 |

| NVO | CALL | TRADE | BULLISH | 01/16/26 | $29.0 | $28.2 | $29.0 | $125.00 | $58.0K | 588 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | 看漲 | 交易 | 看淡 | 01/17/25 | $38.8 | $38.5 | $38.5 | $100.00。 | $77.0K | 1.3K | 20 |

| NVO | 看漲 | SWEEP | 看淡 | 11/15/24 | $7.15 | $7.05 | $7.05 | $140.00 | $70.5K | 673 | 17 |

| NVO | 看漲 | 交易 | 看好 | 01/16/26 | $32.3 | $30.95 | $31.8 | $120.00 | $63.6K | 507 | 20 |

| NVO | 看漲 | SWEEP | 中立 | 10/18/24 | $3.05 | 2.83美元 | $2.91 | $145.00 | $59.6K | 400 | 208 |

| NVO | 看漲 | 交易 | 看好 | 01/16/26 | $29.0 | $28.2 | $29.0 | $125.00 | $58.0K | 588 | 0 |

About Novo Nordisk

諾和諾德是一家領先的全球醫療保健公司,致力於研發創新藥品,幫助患糖尿病的患者過上更長壽、更健康的生活,這一傳統已有100多年。這種傳統爲我們提供了經驗和能力,使我們能夠推動變革,幫助人們戰勝其他嚴重的慢性疾病,如肥胖症、罕見的血液和內分泌紊亂。我們始終堅信,持久的成功公式是保持專注,長遠思考,並以財務、社會和環境負責任的方式做生意。諾和諾德在新澤西州設有美國總部,在7個州加上華盛頓特區擁有商業、生產和研究設施,在全國約有8000名員工。有關更多信息,訪問novonordisk-us.com,Facebook、Instagram和X。

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

作爲全球治療糖尿病品牌市場三分之一的領先者,丹麥的Novo Nordisk公司是世界上提供糖尿病護理產品的主要製造商和市場推廣者。該公司製造和銷售各種人體和現代胰島素、GLP-1療法等可注射糖尿病治療藥物、口服降糖藥以及肥胖症治療藥物。Novo Nordisk還有一個生物製藥部門(約佔營收的10%),專門從事血友病和其他疾病的蛋白質療法。

Novo Nordisk's Current Market Status

Novo Nordisk的當前市場狀況

- With a volume of 1,618,827, the price of NVO is down -1.05% at $133.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 65 days.

- RSI指標暗示該股票可能要超買了。

- 下一季度業績將在65天內發佈。

Professional Analyst Ratings for Novo Nordisk

挪威諾德斯克的專業分析師評級

In the last month, 3 experts released ratings on this stock with an average target price of $160.0.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Novo Nordisk, targeting a price of $160.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $160.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $160.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續的教育,策略性的交易調整,利用各種因子以及保持對市場動態的關注來減輕這些風險。通過Benzinga Pro及時了解Novo Nordisk的最新期權交易,獲得實時提醒。